AEI Net Lease Portfolio V DST

QUALITY PEOPLE. QUALITY PERFORMANCE. SINCE 1970.

Total offering: $24,416,000

Minimum investment: $100,000

- Initial distribution rate: 5.13%

- Liquidate 10 years

- Anticipated exit strategy: Liquidate 10 years

AEI Net Lease Portfolio V DST consists of a portfolio of three single-tenant, net leased properties owned through a Delaware Statutory Trust (DST) structured to be suitable for 1031 exchange or direct investment. This offering is for accredited investors seeking stable, long-term income and tax deferral through a high-quality, fractional real estate investment.

Quality People. Quality Performance. Since 1970.

The properties in this portfolio are located in three separate markets across the United States. Each property is leased to an industry leading corporate tenant under a long-term, full faith and credit net lease. The tenants operate in diverse industries including medical and retail.

Investment Overview

AEI Net Lease Portfolio V DST consists of a portfolio of three single-tenant, net leased properties owned through a Delaware Statutory Trust (DST) structured to be suitable for 1031 exchange or direct investment. This offering is for accredited investors seeking stable, long-term income and tax deferral through a high-quality, fractional real estate investment.

The properties in this portfolio are located in three separate markets across the United States. Each property is leased to an industryleading corporate tenant under a long-term, full faith and credit net lease. The tenants operate in diverse industries including medical and retail.

Investment Strategy

- Debt-free: With no mortgage debt, properties are not subject to the risk of interest rate fluctuations or foreclosure.

- Long Term Net leases: Tenants pay for most or all property expenses, such as: taxes, insurance and maintenance, which helps to create income stability for the property owners.

- Creditworthy tenants: AEI’s leases represent a company-wide obligation of the corporate tenants.

- Rental increases: Rental escalators, when present, can serve to increase income over time.

- Location: Major corporate tenants typically occupy quality commercial locations.

- Diversification: Owning properties in multiple industries and markets can help create a diversified portfolio.

BioLife Plasma Services

About the Tenant:

- BioLife Plasma Services is an industry leader for the collection of high-quality plasma that is processed into life-saving therapies. The company operates numerous stateof- the-art plasma collection facilities throughout the United States and Austria.

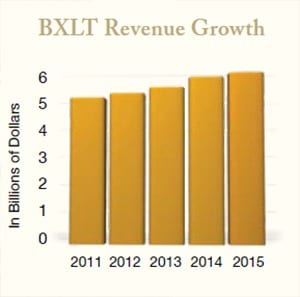

- Baxalta Inc. (NYSE: BXLT, S&P BBB) the parent company of BioLife Plasma Services, is the lease guarantor. Baxalta is a leading biopharmaceutical company that advances innovative therapies in hematology, immunology, and oncology for the treatment of hemophilia, bleeding disorders, immune deficiencies, alpha-1 antitrypsin deficiency, and other chronic diseases. Baxalta’s global net sales totaled $6.15 Billion in 2015, an increase of 3.3% over 2014.

Location:

- Maple Grove, Minnesota is located in the north central portion of Hennepin County, approximately 20 miles northwest of Minneapolis. Ten Fortune 500 companies are headquartered in Hennepin County. The city of Maple Grove is home to more retail than nearly any other city in the state, second only to Bloomington, the home of the Mall of America.

ABOUT AEI

Founded in 1970, AEI is one of America’s oldest sponsors of net lease real estate investment programs and a leader in the TIC- 1031 exchange industry. AEI is a national source of high quality, commercial real estate for property owners engaged in 1031 tax-deferred property exchanges. AEI has specialized in developing, evaluating and purchasing these types of properties for more than 35 years and offers a portfolio of name-brand, net leased commercial retail properties.

Why come to AEI for your TIC or 1031 properties?

Exceptional service. If this is your first 1031 property exchange or TIC purchase, we make every effort to ensure that you fully understand the transaction. Our experienced professionals are available to assist you at each step.

Stability and quality. AEI offers quality, single tenant properties – freestanding real estate occupied by creditworthy corporate tenants under long-term net leases.

Acquisition expertise. AEI has performed institutional-grade due diligence on every property we own. Acquiring property from AEI can reduce this time-consuming, labor-intensive aspect of your property selection process and provide a higher level of expertise than you may be able to provide yourself.

Post-purchase services. After your property purchase is complete, AEI can provide the following services:

- Accounting and distribution of rental income

- Year-end 1099 forms for tax reporting

- Assisting with any management concerns you may have about your property

- Monitoring lease compliance, tax and insurance payments, and property maintenance by the tenant