BR Grand Dominion, DST

23910 WEST INTERSTATE 10, SAN ANTONIO, TEXAS 78257

Offering Purchase Price: $56,898,729

Equity Amount: $23,228,729

- Loan Amount: $33,670,000

- Purchase Price per Unit: $175,534

- Projected Hold Period: Approx. 7-10 Years

- Assumed Debt (0.42620% interest): $143,500

Use creative marketing initiatives incorporating localbusinesses, vendors, sponsorships, and specialized internet search engines;

Implement state-of-the-art computerized revenue management, leasing, and reputation management systems and programs to maximize revenues;

23910 WEST INTERSTATE 10, SAN ANTONIO, TEXAS

Developed in 2015, the Property offers eight contemporary 1, 2, and 3 bedroom floor plans within a 21.3 acre garden-style community resulting in top-of-the-market apartment living in San Antonio.

The Property offers residents three kitchen and bath finish options: Signature (160 units), Signature Plus (112 units) or Executive (48 units) packages, along with a wide array of premium amenities.

Key Investment Considerations

- San Antonio’s population and economy is growing with a low 3.6% unemployment rate driven by a 2.5% job growth rate, one of the highest in the nation. (Source: Bureau of Labor Statistics).

- The Northwest San Antonio submarket is a very high growth area; the Property’s 3-mile radius has experienced 54% population growth from 2010- 2017 which is four times the growth experienced statewide during that time.

- The Property has $1.275 million built-in value creation due to the purchaseprice to appraised value comparison.

- San Antonio was Forbes 8th ranked “Next Big Boom Towns in the U.S.”

- The Property is set in the Texas Hill Country, located in the ominion, an exclusive country club and one of San Antonio’s most affluent areas. The average household income within a one mile radius is $190,732 and the median single-family home price in the immediate area is approximately $640,000.

The Property is located within minutes from San Antonio’s largest employers: NuStar Energy (3.9 miles), Medtronic (4 miles), Acelity (fka Kinetic Concepts Inc.) (8 miles), Valero Energy (6 miles), USAA (9 miles), and South Texas Medical Center (11 miles).

Business Plan

- preserve Investor’s capital investment;

- make monthly distributions from Property cash flow, which may be partially tax-deferred as a result of depreciation and amortization expenses;

- make any necessary improvements and upgrades to the Property to maximize rental rates, thereby potentially creating value;

- institute a nationally recognized third-party property management company and (v) profitably sell the Property within approximately seven to 10 years.

- Use creative marketing initiatives incorporating local businesses, vendors, sponsorship, and specialized internet search engines;

Regional Overview

San Antonio is the county seat for Bexar County, located within the Central-South region of the state of Texas. Currently, the city is 7th largest in the United States.

The Property is located in Northwest San Antonio, Texas, in the central Texas Hill Country, approximately 20 miles from downtown San Antonio.

Economic Overview

San Antonio’s overall economy is expanding at an above-average pace.

Average hourly earnings have risen at more than twice the national rate over the past year. Job growth has averaged approximately 3% annually in the past three years, well above the U.S. rate. This employment growth is being driven by population growth, among other factors. According to the Bureau of Labor Statistics, the job sectors with the highest rate of growth are education and health services, construction, and mining and logging.

Additionally, several fundamentals are in place for further residential construction gains. First, high-wage job additions have been strong over the past couple of years, contributing to gains in household incomes.

Second, population growth has averaged nearly triple the national average for the past five years. Third, affordability is above the Texas average and mortgage rates are still low. Fourth, despite the completion of more than 5,000 rental units in 2016, demand was strong enough to keep rents rising.

Local Overview

The Property is located in the Texas Hill Country, an area of rolling hills in contrast to the plains in east Texas where residents enjoy proximity to nearly 1.8 million square feet of shopping, ample recreation opportunities, and multiple Fortune 500 companies. Specifically, the Property is located in the Dominion, an exclusive country club and one of San Antonio’s most affluent areas. The average household income within a one mile radius is $190,732 and the median single-family home price in the immediate area is approximately $640,000. The Northwest San Antonio submarket is a very high growth area; the Property’s 3-mile radius has experienced 54% population growth from 2010- 2017, four times the growth experienced statewide during that time.

The area immediately along Interstate 10 is generally flat with hills rising quickly beyond the immediate Interstate 10 (“I-10”) corridor. The Property’s neighborhood is suburban with significant development occurring within the area. Land uses are primarily residential with some commercial development along the I-10 corridor. The majority of the vacant land is attributed to either Camp Bullis Military Base or the Friedrich Wilderness Park. Camp Bullis is used for combat and medical training while Friedrich Wilderness Park is approximately 600 acres used for open space and recreation with approximately 10 miles of hiking trails.

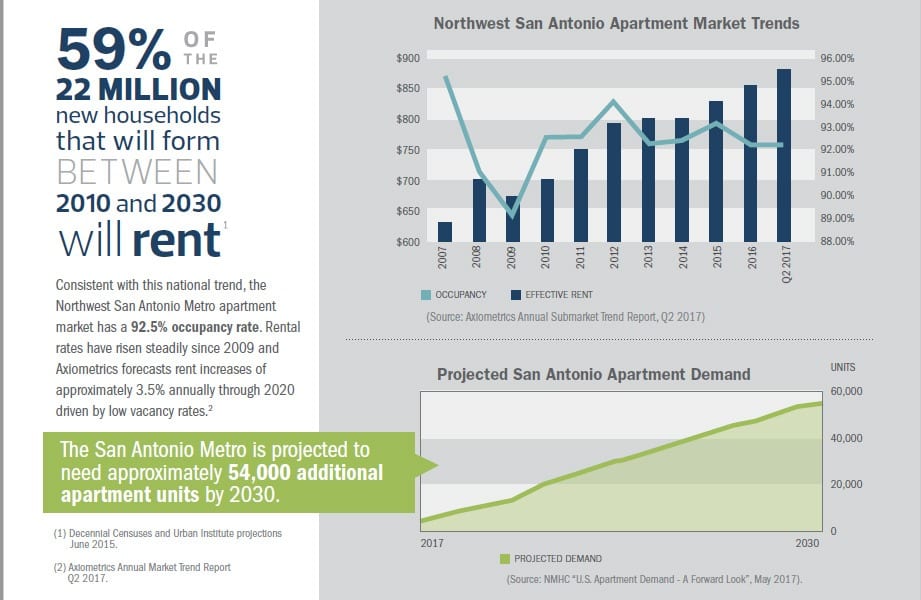

WHY APARTMENTS?

The “Millennial Generation”, at more than 86 million and already exceeding that of the “Baby Boomers” at similar ages, is expected to increase over the next 20 years as immigration (typically of young adults) continues to increase. Although they are only now beginning to live on their own, “Millennials” will likely form even more households than the “Gen-Xers” and even the “Baby Boomers”. In fact, according to a recent study by the National Multifamily Housing Council (NMHC), the nation is projected to add 4.6 million new renter households by 2030.

About Bluerock Value Exchange, LLC

BVEX is a national sponsor of syndicated 1031 exchange offerings with a focus on Class A assets that can deliver stable cash flows and have the potential

for value creation. BVEX is an affiliate of Bluerock Real Estate, L.L.C., a private equity real estate investment firm that sponsors a portfolio currently exceeding

25 million square feet of primarily apartment and office real estate, including approximately $1.1 billion in total property value and over 7.5 million square

feet of property. Bluerock’s senior management team has an average of over 25 years investing experience, has been involved with acquiring over 35 million

square feet of real estate worth approximately $10 billion, and has helped launch leading real estate private and public company platforms.