CS1031 Tampa Pharma, DST

Location: 4910 Savarese Circle, Tampa, FL 33434

INVESTMENT COST: $8,471,000

EQUITY RAISE: $3,671,000

- FIXED INTEREST RATE: 4.52%

- LOAN TERMS: 10-Year Term

- Current Distribution Rate* 6.00%

Capsugel is an award-winning contract manufacturing and development organization (CMDO). Capsugel provides research and development services for pharmaceutical companies seeking to outsource the development of new drugs.

Savarese Circle, Tampa, FL

The property is 100 percent leased to Xcelience, Inc., a division of Capsugel, an award-winning global contract development and manufacturing organization.

INVESTMENT HIGHLIGHTS

- Strong Tenant: From inception in 2006, original tenant Xcelience grew from one facility with 45 employees to an international contract development and manufacturing organization (CMDO), with 7 facilities and over 200 employees. Strong growth attracted Capsugel, which acquired Xcelience in 2015, with more than 4,000 customers in 100 countries. In July 2017, Capsugel’s continued upward momentum led to its acquisition by Lonza Group, a Swiss pharmaceutical firm with sales of approximately $4.13 billion1.

- Corporate Guaranty: Lonza’s American subsidiary, Lonza America, Inc., guarantees full payment and performance of the lease. Lonza is a leading pharmaceutical firm with a market capitalization of approximately $19 billion2. This new guaranty demonstrates the corporate-parent’s Lonza’s long-term commitment to the facility.

- Stable, Long-Term Lease: There are 10 years remaining on the lease with 2.5% annual increases in the base rental rate, and two 5-year extension options.

- Commitment to Location: Tenant’s representative estimates that Capsugel has spent approximately $6 million in build-out and equipment at the facility. The site is an FDA approved location, which is required to provide CDMO services to clients.

- Favorable Purchase Price: The purchase price of $7,065,000 represents a $435,000 discount to the $7,500,000 appraised market value3.

- Tax-Free State: Florida does not have an income tax. Investors will not pay Florida income taxes.

PROPERTY DETAILS

- Comprised of 45,000 square feet of office space & 26,150 square feet of tech space

- Completely renovated for Capsugel expansion in 2015

- $6 million in approximate tenant improvement and equipment spending at the property since 2015

- 110 surface parking spaces

- LEASE: 12.5-year lease with approximately 10 years remaining

- STRUCTURE: Modified triple net lease

- RENTAL INCREASES: 2.5% annual rent increases

- RENEWAL OPTIONS: Two five-year renewal options

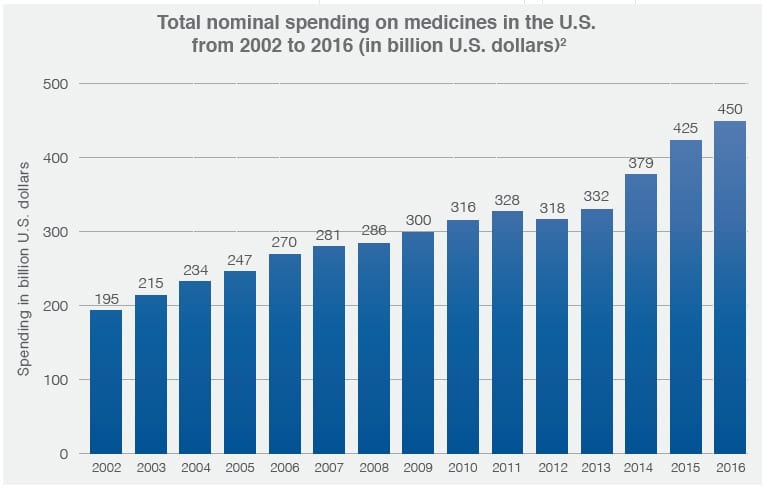

A SNAPSHOT OF THE US PHARMACEUTICAL MARKET

- The United States is responsible for over 45 percent of the global pharmaceutical market, valued at approximately $446 billion in 2016.

- The market for overall biopharmaceutical outsourced development spending is expected to increase from $26 billion in 2016 to $31 billion in 2019

A B O U T CAPSUGEL

Capsugel is an award-winning contract manufacturing and development organization (CMDO). Capsugel provides research and development services for pharmaceutical companies seeking to outsource the development of new drugs. With clients providing initial research, Capsugel completes the process of developing drugs into a marketable FDA approved product. This process involves the research and testing necessary to design the chemical components of a drug in a way that is stable and resistant to stress (temperature, degradation, etc.), and formulating the drug to achieve proper consistency and solubility in a tablet or capsule. Capsugel’s Tampa staff also provides small-scale clinical commercial manufacturing, including packaging of clinical supplies, specialized analytical services, and logistics. Capsugel’s Tampa

executive management team is located at the property.

ABOUT CAPITAL SQUARE

Capital Square 1031, LLC specializes in the creation and management of real estate investment programs for Section 1031 exchange investors and other investors using the Delaware Statutory Trust structure. Louis J. Rogers, founder and chief executive offi cer of Capital Square, has been involved in the creation and management of more than 100 investment offerings totaling over $3 billion, including DSTs, tenant-in-common offerings, numerous real estate funds, and multiple publicly registered non-traded real estate investment trusts.