CSRA WINCHESTER MOB, DST

Location: 38 West Jubal Early Drive, Winchester, Virginia 22601

INVESTMENT COST: $5,074,000

EQUITY RAISE: $5,074,000

- CASH-ON-CASH RETURN: 5.5% Starting

- LEASE: 15-year lease

- STORIES: One

- PARKING: 31 Spaces

Recently built-to-suit for Fresenius, this 9,503-square-foot medical condominium unit is 100 percent leased to Bio-Medical Applications of Virginia. The lease is guaranteed by Fresenius Medical Care Holdings, Inc. (“Fresenius Medical Care Holdings”), a wholly-owned subsidiary of Fresenius Medical Care AG & Co.

West Jubal Early Drive, Winchester, Virginia

Healthcare represents 18 percent of the U.S. gross domestic product, and is expected to increase to nearly 20 percent of GDP by 2021.

INVESTMENT HIGHLIGHTS

- Strong Corporate Parent: Fresenius has posted strong revenues – more than $15.8 million.

- Stabilized Lease Economics: The property is 100 percent leased for 15 years, with three five-year renewal options.

- Triple Net Leases: The tenant is responsible for the payment of taxes, insurance, maintenance and repairs, protecting investor distributions from future inflation.

- Positioned for Stability through Necessary Medical Care: Fresenius provides products and services for people with chronic kidney failure, a disease that affects many worldwide. More than 2.5 million patients regularly undergo dialysis therapy. Fresenius has completed more than 42.7 million dialysis treatments in the Americas alone.

PROPERTY DETAILS

- LEASE: 15-year lease

- STRUCTURE: Triple net lease, expires in November, 2030

- RENEWAL OPTIONS: Three five-year renewal options

- STORIES: One

- PARKING: 31 Spaces

Investing in Medical Real Estate

BY THE NUMBERS: The Increasing Demand for Medical Real Estate

- Approximately 12 million people have obtained coverage under the Affordable Care Act, generating additional need for medical real estate.

- The aging of America has created a demand for more healthcare real estate.

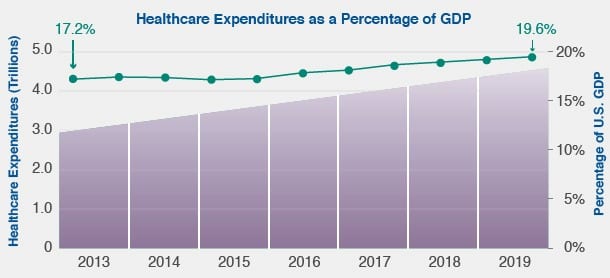

- Healthcare expenditures are expected to increase to $4.8 trillion by 2021, up over 58% from 2012.

- Healthcare represents 18 percent of the U.S. gross domestic product, and is expected to increase to nearly 20 percent of GDP by 2021.

- Between 2008 and 2018, healthcare job growth is projected to increase by nearly 29 percent.

- Advances in technology and research increase life expectancies, producing additional interest in healthcare assets.

FRESENIUS MEDICAL CARE

Fresenius Medical Care Holdings, Inc. is a wholly-owned subsidiary of Fresenius Medical Care AG & Co. KGaA (“Fresenius”). Listed on both the Frankfurt Stock Exchange (FME) and New York Stock Exchange (FMS), Fresenius is the world’s leading provider of products and services for people with chronic kidney failure. The company is primarily engaged in providing kidney dialysis services and clinical laboratory testing manufacturing and distributing products and equipment for kidney dialysis treatment and providing other medical ancillary services.

Dialysis is a vital blood cleansing procedure that substitutes the function of the kidney in case of kidney failure. During 2014, Fresenius cared for more than 283,000 dialysis patients in 3,349 proprietary clinics in over 45 countries worldwide. Fresenius continues to develop its network of clinics – the largest and most international in the world – to accommodate the ever growing number of dialysis patients. The company also operates more than 40 production sites on all continents, making Fresenius the leading provider of dialysis products including dialysis machines, dialyzers and disposable accessories.

ABOUT CAPITAL SQUARE

Capital Square 1031, LLC specializes in the creation and management of real estate investment programs for Section 1031 exchange investors and other investors using the Delaware Statutory Trust structure. Louis J. Rogers, founder and chief executive offi cer of Capital Square, has been involved in the creation and management of more than 100 investment offerings totaling over $3 billion, including DSTs, tenant-in-common offerings, numerous real estate funds, and multiple publicly registered non-traded real estate investment trusts.