Lakeside at Arbor Place DST

3000 Highway 5, Douglasville, GA 30135

TOTAL OFFERING PRICE: $14,050,000

Equity Offering Amount : $10,895,000

- Non-Recourse Debt: $14,000,000

- offering loan to value (ltv): 349.91%

- minimum purchase - 1031: $100,000

- minimum purchase – cash: $25,000

Lakeside at Arbor Place is a 246-unit Class B multifamily property with 94%+ average occupancy over the past twelve months and the opportunity to update unit interiors and increase rents by approximately 10% ($80+ per month).

Highway 5, Douglasville, GA

The property has ease of access to I-20 and two large shopping centers, yet sits on a parcel that is secluded from noise and traffic with mature trees surrounding the apartment community and a small lake serving as the property’s focal point.

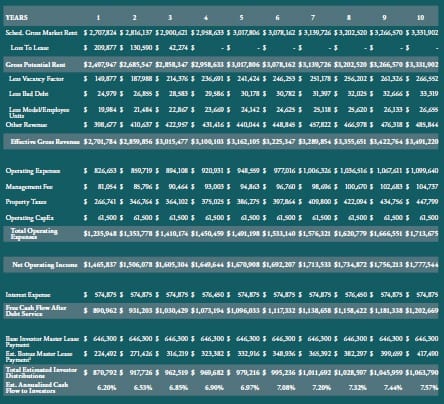

Underwriting Highlights

- Net cash flow projected to average 7.01% over a 10-year hold.

- Offering Loan to Value of 49.91% with a Debt Service Coverage Ratio averaging 2.88x per annum over a 10-year hold.

- Year 1 Net Operating Income conservatively underwritten to have no growth in year 1 of operations when compared to historical financials.

- 10-year annual revenue growth rate underwritten to 3.07% over a 10-year hold, with a 2.0% terminal growth rate starting in Year 5. This assumption is anticipated to be conservative given the intended renovation plan in the initial years of ownership.

- 10-year operating expense growth rate average underwritten to 4.38%, outpacing EGR growth rate by a factor of 33%.

- Nearly $2.3mm of accountable reserves have been funded by lender and by investors to execute on the property upgrades.

- $1.11 million for various capital and construction management expenditures

- $1.15 million for unit interior renovations

- $100,000 for operating reserves

Bonus Master Lease Payments are estimated payments that would be paid to investors if the property produces revenues in excess of annual effective gross revenue benchmarks. There is no guarantee that the property will produce the necessary effective gross revenue to earn bonus rent payments.

Investing in real estate in general, including this offering, involves risk. Please review the Private Placement Memorandum in its entirety, including especially the section that outlines the risks of this offering, before making any investment decision.

property Details

Community Amenities

- Clubhouse

- Fitness Center

- Gated Entrance

- Playground

- Two Tennis Courts

- One Resort-Style Pool

- Picnic Area

- Walking/Biking Trails

- Business Center

- Lake

- Conference Center

Property Summary

- Address 3000 Highway 5, Douglasville, GA 30135

- Year Built 1988 / 1996

- No. of Apartment Buildings 14

- Net Rentable Area (Sq Ft) 239, 329

- Avg. Sq Ft per Unit 973

- Occupancy/Leased 94% / 96%

- Avg. Effective Rents $823

- Avg. Effective Rent/Sq Ft $0.85

- No. of Floors 3 / 4

- Land Area (Acres) 30.47

- Density 12 units / acre

ABOUT Lakeside at Arbor Place DST

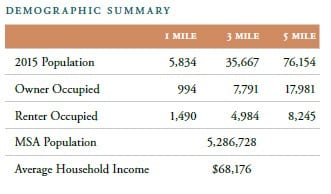

Lakeside at Arbor Place is a 246-unit Class B multifamily property with 94%+ average occupancy over the past twelve months and the opportunity to update unit interiors and increase rents by approximately 10% ($80+ per month). The Property is located approximately 25 miles west of the Atlanta CBD with immediate proximity to Interstate 20.

Forecasted Investor Returns: 6.20% initial investor cash flow and increasing to 7.57% over a 10-year hold. Investors have the ability to participate in additional increased rent should the property outperform underwritten returns.

Unique opportunity: The property was built in 1988 and expanded in 1996. It has been owned by the same family with this transaction representing the first time the property has changed ownership.

Unit Upgrade Potential: Of the total 246 units, 57% of units have never had any renovations, and 22% only had partial renovations. Although the property is well-built and has been well maintained, the prior owners have not maximized the earnings potential available through renovating unit interiors.

Conservative Growth Assumptions: Similar upgrades of apartments within our market have achieved over $100 more in rent per month. Our underwriting forecasts rental increases of $80 per month following renovations.

Submarket: There is limited new supply with no new recent products. This has benefited the apartment submarket with comparable properties averaging 95%+ occupancy.

Location: The property has ease of access to I-20 and two large shopping centers, yet sits on a parcel that is secluded from noise and traffic with mature trees surrounding the apartment community and a small lake serving as the property’s focal point.

ABOUT Exchange Right

ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 and 1033 investors. Our goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. We target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

ExchangeRight launched its 1031-exchangeable DST multifamily platform in 2015 targeting Class B apartments with stable income and value-added upside potential. Our multifamily offerings feature strong cash flow, high debt coverage ratios, conservative underwriting, long-term fixed-rate financing, and the potential to enhance return with value-added strategies.

ExchangeRight also raises limited preferred equity capital that allows accredited investors to participate in the cash flow and profits of our 1031 platform. This preferred equity is used alongside ExchangeRight’s capital to invest in the acquisition and inventorying of individual net-leased assets prior to their being structured in DST portfolios for offering to exchange investors. These preferred equity funds can provide investors with enhanced liquidity and short-term returns, and exit options with each DST portfolio disposition.