Mira Bella and San Martin Apartments DST

Stable multi family property in houston with upside potential available for 1031 exchange

TOTAL OFFERING PRICE: $21,380,000

Equity Offering Amount : $9,950,000

- Non-Recourse Debt: $11,430,000

- offering loan to value (ltv): 53.46%

- minimum purchase – 1031:$100,000

- minimum purchase – cash: $25,000

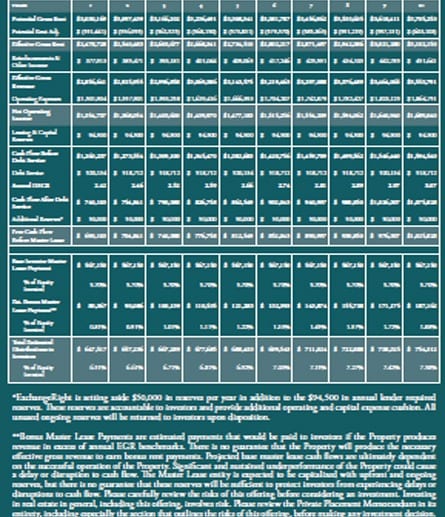

Annual Gross Revenue growth rate is conservatively underwritten at 2.3% average per annum over a 10-year hold. Rent realization (Effective Gross Rent percentage of Potential Gross Rent) average per annum is underwritten below current levels.

Stable multi family property in houston

The Property is located 20 miles northwest of Downtown Houston and just 12.5 miles northwest of George Bush Intercontinental Airport. Interstate 45, which is the primary thoroughfare from Houston to Dallas, is less than 1 mile from the Property.

Underwriting Highlights

- Net Cash Flow projected at 7.0% over a 10-year hold.

- Annual Gross Revenue growth rate is conservatively underwritten at 2.3% average per annum over a 10-year hold.

- Rent realization (Effective Gross Rent percentage of Potential Gross Rent) average per annum is underwritten below current levels.

- Most recent period Effective Gross Rent resulted in actual growth of 22% from prior year period due to repositioning efforts currently underway by the asset manager.

- The Sponsor plans to continue similar repositioning efforts by setting aside $500,000 of upfront reserves from offering proceeds, which will be used to upgrade units and improve the overall value of the Property.

- Annual expense growth is underwritten to exceed the annual effective gross revenue growth average per annum percentage increase over a 10-year hold.

- Pro-Forma Year 1 and 2 NOI per annum growth has been carefully underwritten at 0.5% and 1.0%, respectively.

- Tax expense growth has been underwritten more conservatively than the appraisal.

- Debt Service Coverage Ratio averages 2.71x per annum over a 10-year hold.

- In addition to the $500,000 in upfront reserves, incremental reserves of $50,000 per year are underwritten for investor safety, in addition to $94,500 per year in ongoing lender-required reserves.

property Details

Location:

- 22910 Imperial Valley Drive, Houston, TX 77073,

- 22921 Imperial Valley Drive, Houston, TX 77073, &

- 310 Parramatta Lane, Houston, TX 77073

Description:

- 378-unit Class B asset consisting of 26 two- and

three-story buildings - Year Built: 1980 & 1983

- Net Rentable Area: 284,672

- Land Area: 12.44 Acres

- Construction: The building exteriors are composed of brick, wood, and plank siding.

- Roofs: The roofs are pitched with composition shingles.

- Parking: 300 Parking Spaces

Utilities

- Electricity: Individually Metered

- Water/Sewer: Master Metered (4 Central Boilers)

- Gas: Gas-Heated Water

- Trash: Paid by Owner

the investment opportunity

- Stable 90%+ occupancy, with potential material upside from unit upgrades and rent increases.

- Opportunity to capitalize on strong market fundamentals and a surging submarket presence within the immediate area.

- The Property is well-positioned with immediate highway access near major employers that are actively growing their employment base.

- Houston’s job market is growing at more than double the national rate.

- ExxonMobil is currently building its new corporate campus directly north of the Property, which will serve to bring significant investment to the greater northern Houston area.

- Submarket benefits from excellent school systems, with positive indicators for job and income growth for the immediate and surrounding area.

The Property

- Two Class-B apartment communities, comprising 378 units on 12.44 acres.

- Approximately $1.7 million in upgrades have been performed, including full exterior repainting, roof replacements, clubhouse addition and renovations, landscaping enhancements, boiler replacement, pool upgrades, and exterior lighting.

- Interior upgrades have included cabinet and counter resurfacing, modern light fixtures, twotone paint, and faux vinyl flooring.

- Rental rates and occupancy have been trending significantly upward for the properties in response to substantial renovations and upgrades.

- Monthly Net Operating Income increased greater than 70% May 2014–May 2015.

ABOUT Exchange Right

ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 and 1033 investors. Our goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. We target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

ExchangeRight launched its 1031-exchangeable DST multifamily platform in 2015 targeting Class B apartments with stable income and value-added upside potential. Our multifamily offerings feature strong cash flow, high debt coverage ratios, conservative underwriting, long-term fixed-rate financing, and the potential to enhance return with value-added strategies.

ExchangeRight also raises limited preferred equity capital that allows accredited investors to participate in the cash flow and profits of our 1031 platform. This preferred equity is used alongside ExchangeRight’s capital to invest in the acquisition and inventorying of individual net-leased assets prior to their being structured in DST portfolios for offering to exchange investors. These preferred equity funds can provide investors with enhanced liquidity and short-term returns, and exit options with each DST portfolio disposition.