NB The Buckingham, DST

59 E VAN BUREN ST, CHICAGO, IL 60605

Investor Equity: $44,484,811

Total Offering: $89,784,811

- Loan Proceeds: $45,300,000

- Loan-to-Value: 61.00%

- Minimum Investment[1031]: $209,475

› Over $500M in real estate under management

› 21 Properties; 12 states

›Redstone —3rd Party Manager: Manages over 21,000 beds. 98% collective occupancy for 2017-18 school year

› Full Cycle Properties: 7 (average 50%+ total return)

› Predecessor firm, NPRE: Inc. 500 2017, #129 fastest growing private companies in the U.S.

THE BUCKINGHAM PROPERTY

The Buckingham is a 27-story, 129-unit, 438-bed made-for-student housing property. Built in 1929, this historical landmark is located in the heart of downtown Chicago’s vibrant Loop and just a few blocks away from key landmarks such as Cloud Gate, Willis Tower, Grant Park and over 13 colleges and universities

INVESTMENT HIGHLIGHTS

TARGETED BENEFITS

Location: Downtown Chicago within the Loop

6.25%: Targeted first year cash-on-cash return

Tax Efficiency: Pass through depreciation

Track Record: 100% occupancy – 8 consecutive years

Underserved Market: In the Loop, 58,000 student with only 2,600 off campus student housing beds

Value-Add Opportunities: Modern interior upgrades,all-new rooftop amenities, additional study rooms

TARGET STRATEGY

With a central location, secure environment and best-in-class amenities, NB believes the Buckingham is well-positioned in a tight, underserved market place and as a result, can potentially deliver a variety of compelling benefits.

Stability: Historical track record of 98%+ occupancy since conversion to students in 2008. CBD location.

Monthly Cash Flow: Targeted first year at 6.25% with steady increases

Tax Shelter: NB believes depreciation may be favorable given a potentially high building-toland ratio.

Capital Growth: NB plans a handful of initiatives to potentially drive growth (See figure below)

Competitive Advantages: NB believes location, pricing (9-month model), living experience and amenities and security are potentially sustainable and difficult to replicate.

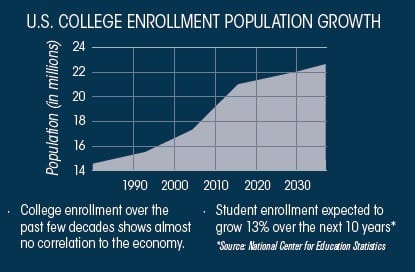

All are supported by enrollment at the estimated 60+ colleges and universities in the general Chicago area that may not be correlated to real estate cycles or the general market (see graph below).

Student Safety a Top Priority

While living in a major metro area can be a thrilling experience, there is a unique way student housing properties can differentiate themselves from non-student apartments and that is to provide extra safeguards. Not only do the students feel safe, but it helps put nervous parents at ease.

›› 24/7 on-site courtesy patrol provided by Andy Frain Services.

›› Surveillance cameras on all entrance doors.

›› Fob key required for after-hours entry, elevator, amenity rooms and room entry.

›› For front lobby, tenants are required to swipe fob for both entry and exit. Computer logs all activity.

›› Attendants must log all guests in with security prior to arrival

PROPERTY OVERVIEW

THE BUCKINGHAM PROPERTY

The Buckingham is a 27-story, 129-unit, 438-bed made-for-student housing property. Built in 1929, this historical landmark is located in the heart of downtown Chicago’s vibrant Loop and just a few blocks away from key landmarks such as Cloud Gate, Willis Tower, Grant Park and over 13 colleges and universities . For students, The Buckingham offers a well-balanced and secure living experience that features a number of unmatched community amenities and features within the units to help foster a well-balanced and safe living environment encouraging the social community with other students through entertainment, physical fitness, private study rooms and best-in-student-market and 24/7 on-site courtesy patrol.

COMMUNITY AMENITIES

›› SKY LOUNGE with spectacular views

›› Movie theater

›› Fully-equipped fitness center

›› Student lounge and private study rooms

›› Bicycle storage

›› Starbucks vending

›› 24/7 security

›› One block from public transit options

UNIT AMENITIES

›› Spacious kitchen with updated appliances

›› In-unit washer and dryer

›› Flat screen HD TV with cable

›› Hardwood-style flooring

›› 13 foot ceilings

ABOUT NB Private Limited

In 2017, NB Private Capital’s predecessor, Nelson Brothers Professional Real Estate was nominated by Inc. 500 as #129 fastest growing private company. Full cycle properties and Inc. 500 designation were achieved under Nelson Brothers Professional Real Estate. The predecessor for NBPC. According to principal Brian Nelson: “Inc. 500 recognition was amazing. But it incited the fear we may be growing too fast. Our team had proven we could accomplish world class achievements. But that’s not what we’re about. NBPC was created to take the same energy with a dead-centered focus on performance and dramatic improvements with investor relationships, communication and services. Primarily in the DST market space. 2017 tax returns showed 100% tax shelter for the vast majority of NB Private Capital properties.