NNN Northmark Business Center II, LLC

Available for §1031 exchange w llc investment

Offering Purchase Price: $13,420,000

Offering Price Per SF: $134.33

- Purchase Date: 2nd Quarter, 2007

- Offering LTV: 67.96%

- Offering Price Cap Rate: 6.59%

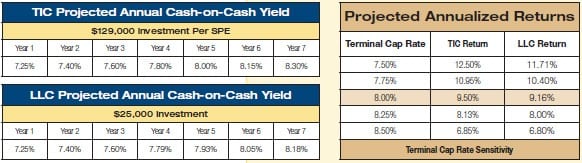

- 1st Year Cash Flow: 7.25%

Northmark Business Center II is a three-story office building totaling nearly 100,000 square feet in Cincinnati, Ohio. Located on more than six acres in the affluent Blue Ash office submarket, Northmark Business Center II enjoys ready access to the Cincinnati central business district, and benefits from exceptional visibility on the Reed Hartman Highway.

Available for §1031 exchange w llc investment

The Property offers ample parking with a total of 361 spaces, including a 55-space parking garage beneath the building. Northmark Business Center II is 100% leased to seven tenants, including CTI Clinical Trial and Consulting Services, Lockwood Green, Inc., and Great Traditions Development Group.

Property Summary

Northmark Business Center II is a three-story office building totaling nearly 100,000 square feet in Cincinnati, Ohio. Located on more than six acres in the affluent Blue Ash office submarket, Northmark Business Center II enjoys ready access to the Cincinnati central business district, and benefits from exceptional visibility on the Reed Hartman Highway. The Property offers ample parking with a total of 361 spaces, including a 55-space parking garage beneath the building. Northmark Business Center II is 100% leased to seven tenants, including CTI Clinical Trial and Consulting Services, Lockwood Green, Inc., and Great Traditions Development Group.

Property Information

- Address: 10123 Alliance Road Cincinnati, OH 45242

- Building Type: Office Building

- Year Built: 1984

- Total SF: 99,901

- % Leased: 100%

TIC Offering

- Offering Size: $4,300,000

- Price Per 1% Ownership: $43,000 equity and $91,200 assumed debt

- Minimum Investment per SPE: 3.00% = $129,000 equity and $273,600 assumed debt for a total purchase price of $402,600

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $215,000

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the property.

- Make monthly distributions, which may be partially tax-deferred as a result of depreciation and amortization expenses.

- Within approximately seven years, profitably sell the property based on the value added through effective management and operation of the property.

- There is no guarantee that the business plan will be successfully executed, that the Property’s value will be enhanced, or that the property will be sold within the planned time period.

- The Property is largely dependent on two tenants that collectively lease approximately 68% of the building.

- Unless extended by the tenants, leases representing 50% of the Property will expire within the next five calendar years. In addition, leases representing 48% of the Property contain early termination options.

Major Tenants (7 Total Tenants)

CTI Clinical Trial and Consulting Services

Sq. Ft.: 39,670 Lease Exp.: 4/2019

CTI is a specialty drug development organization that provides clinical trial and commercial expertise to clients developing therapies for solid organ transplant, hepatitis, infectious disease and hematology/bone marrow transplant. CTI’s expertise encompasses over 20 years of designing and implementing drug development programs. Its involvement spans the entire life cycle of the product from drug development pathway design, clinical trial design, strategic marketing plan development, product management and sales. CTI is capable of managing all phases of the clinical trial process from pre-study planning and concept development to the preparation of the final trial manuscript. CTI has the unique ability to incorporate both clinical and market driven endpoints and interpretations. Northmark Business Center II serves as the headquarters for CTI.

Lockwood Greene, Inc.

Sq. Ft.: 27,739 Lease Exp.: 7/2011*

Lockwood Greene is a global industrial engineering and construction firm, with approximately $600 million in annual revenues and 2,500 salaried professionals worldwide. Founded in 1832, Lockwood Greene is America’s oldest professional services firm in continuous operation for industrial power engineering and construction. With headquarters in Spartanburg, South Carolina, Lockwood Greene serves U.S. – based Fortune 500 and international companies around the globe, including North America, Latin America, Asia-Pacific, and Europe. Lockwood Greene serves the manufacturing, process, power and institutional markets. Lockwood Greene is a whollyowned subsidiary of CH2M HILL, a $3 billion employee-owned enterprise with nearly 13,000 professionals in over 200 locations who expertly manage programs and deliver projects worldwide with enhanced service and greater value. *Option to terminate on February 1, 2010 by providing written notice in writing to the landlord and payment of termination penalty fee of $177,835.11.

Location Information

Cincinnati, with a population of more than 331,000, is the third largest city in the state of Ohio, trailing Columbus and Cleveland. The Greater Cincinnati metropolitan area, however, is much larger, with an estimated population of 2.1 million. The U.S. Census Bureau estimates that Greater Cincinnati will surpass Greater Cleveland as the largest metropolitan region in the state by the end of 2007. Located on the banks of the Ohio River, Cincinnati became an important river port following the opening of the Miami and Erie Canal in 1832, and is a major inland coal port. The city is home to an orchestra, opera, and ballet companies, as well as several professional sports teams, including the National Football League’s Cincinnati Bengals and Major League Baseball’s Cincinnati Reds.

Office Market

- Overall quoted rents (Class A, B, C) slightly increased since last quarter to $18.26

- Net absorption for the overall Cincinnati office market was positive 307,115 square feet in the first quarter 2007.

- The Property is located in the Blue Ash submarket of the Cincinnati MSA. This area is considered one of the more affluent areas of the Cincinnati MSA, with median household income ($70,000) that exceeds that of the Cincinnati MSA ($38,000), the state of Ohio ($44,000) and the United States ($57,000).

- The Bureau of Labor Statistics (“BLS”) reported a seasonally unadjusted unemployment rate for this MSA of 4.8% in November 2006. Further, the BLS also reported that the professional and business services segment of the job market continued to rise with an increase in employment of 3.1% in November 2006 as compared to the previous year, and a 1% increase in non-agricultural employment overall over the same period.

ABOUT Triple Net Properties, LLC

Triple Net Properties, LLC has time-tested experience in real estate syndications, acquisitions, development, construction, leasing and property management. Triple Net currently manages a growing portfolio of over 34 million square feet of property in 28 states valued at more than $4.6 billion. Although past performance is no guarantee of future results, Triple Net Properties, LLC has an unparalleled track record and has acquired 249 properties to date. Triple Net and affiliates have sold 90 properties for over $2.0 billion since 2000.

Triple Net Properties, LLC is a wholly-owned subsidiary of NNN Realty Advisors, Inc., a nationwide commercial real estate asset management and services firm.