NNN Tupper Building, LLC

Available for §1031 exchange w llc investment

Offering Purchase Price: $60,115,000

Offering Price Per SF: $616.19

- Purchase Date: 3rd Quarter 2007

- Offering LTV: 73.06%

- Offering Price Cap Rate: 6.12%

- 1st Year Cash Flow: 6.00%

The Tupper Building is a 14-story, 97,600-square-foot medical office building on the Tufts-New England Medical Center campus in Boston, Massachusetts. Laboratory space consumes 12 stories of the facility, with the two remaining floors housing supporting office space and the human resources department of the medical center.

Available for §1031 exchange w llc investment

The Tupper Building is within close proximity to Interstates 93 and 90 (the Massachusetts Turnpike), as well as the Massachusetts Bay Transportation Authority (MBTA) Orange and Red train lines. An Orange Line stop is located on the campus of the medical center, and additional bus routes run on and near the hospital campus.

Property Summary

The Tupper Building is a 14-story, 97,600-square-foot medical office building on the Tufts-New England Medical Center campus in Boston, Massachusetts. Laboratory space consumes 12 stories of the facility, with the two remaining floors housing supporting office space and the human resources department of the medical center. The Tupper Building is within close proximity to Interstates 93 and 90 (the Massachusetts Turnpike), as well as the Massachusetts Bay Transportation Authority (MBTA) Orange and Red train lines. An Orange Line stop is located on the campus of the medical center, and additional bus routes run on and near the hospital campus. Built in 1924, the property was completely renovated in 1983, and is 100 percent leased to the Tufts-New England Medical Center.

Property Information

- Address: 15 Kneeland Street Boston, MA 02111

- Building Type: Medical Office

- Year Built: 1924 (Renovated in 1983)

- Total SF: 97,559

- % Leased: 100%

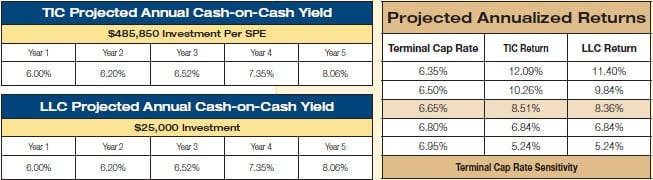

TIC Offering

- Offering Size: $16,195,000

- Price Per 1% Ownership: $161,950 equity and $439,200 assumed debt

- Price Per 1% OwnersaMinimum Investment per SPE: 3.00% = $485,850 equity and $1,317,600 assumed debt for a total purchase price of $1,803,450hip: $161,950 equity and $439,200 assumed debt

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $809,750

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the

property. - Make monthly distributions, which may be partially tax-deferred as a result of depreciation and amortization expenses.

- Within approximately eight years, profitably sell the property based on the value added through effective management and operation of the property.

- There is no guarantee that the business plan will be successfully executed, that the property’s value will be enhanced, or that the property will be sold within the planned time period.

- The purchase of the property is contingent on the purchase of another building owned by the seller.

- The purchase of the property is contingent on the approval of bondholders.

- The purchase price allocated to the property could exceed the fair market value of the property and may not represent a fair allocation of the purchase price paid for both the property and an additional building in the Tufts-New England Medical Center Campus that the manager or its affiliates will acquire.

- The property is dependent on a single tenant, Tufts – NEMC, which currently occupies 100 percent of the property.

- Certain materials used in the research facilities at the property produce radioactive waste that could lead to damaging claims in the future.

- The performance of the property is dependent on the healthcare industry and any regulation thereof.

Tenant

Tufts – New England Medical Center

www.nemc.org

Square Feet: 97,559 Lease Expiration: 08/2017

Tufts-New England Medical Center (Tufts-NEMC). The property’s sole tenant, Tufts-NEMC, is a 451-bed academic medical center. The origins of this nonprofit hospital date back to 1796 when the Boston Dispensary was founded as New England’s first permanent medical institution. The generosity of Revolutionary War luminaries such as Paul Revere and Sam Adams enabled the hospital to provide free medical care to the poor. In the 1960s, the Boston Dispensary merged with the Floating Hospital for Children and the Pratt Diagnostic Clinic. Medical breakthroughs at Tufts-NEMC have included the formulation of Similac, the discovery of the definitive test for syphilis and pioneering work in immunology that paved the way for organ transplants.

As the principal hospital for Tufts University Medical School, Tufts-NEMC offers residency programs in virtually all medical specialties. Tufts-NEMC oversees approximately $50,000,000 of active research and ranks in the top ten of the nation’s institutions that receive federal research funds.

The funding that Tufts-NEMC receives is utilized by research groups throughout the campus. The hospital’s Molecular Cardiology Research Institute, located in The Tupper Building, is a world leader in molecular cardiology and cardiovascular research. The MCRI areas of focus include vascular biology, cardiomyocyte biology, electrophysiology, human genetics and genomics, molecular pharmacology, and signal transduction. They are a major recipient of the grants that Tufts-NEMC receives from the U.S. Government and have recently been awarded a $11.3 million program project grant from the National Heart, Lung, and Blood Institute of the National Institutes of Health. The grant is titled “Molecular Mechanisms of Vascular Relaxation” and its long-term objective is to understand the complex underlying molecular mechanisms that regulate vascular tone and blood pressure in health and disease.

Location Information

Founded in 1630 by English Puritan colonists, Boston is the capital of Massachusetts and lies at the center of America’s eleventh-largest metropolitan area, which is home to 4.5 million people. Boasting more than 100 institutions of higher learning, the city and its surrounding area is a hub of education and health care. Boston’s colleges and universities have a major impact on the regional economy by attracting high-tech industries to the area. The city is home to numerous computer hardware and software companies, as well as biotechnology companies like Millennium Pharmaceuticals, Merck & Co., Genzyme Corporation, and Biogen Idec, Inc. Boston’s research institutions typically receive among the highest awards given by the National Institutes of Health (NIH), the primary agency of the United States government responsible for biomedical research funding.

Office Market

- Overall average asking rents increased 10 percent since the end of the first quarter and roughly 30 percent in the past year, currently standing at $47.55 per square foot, gross.

- The downtown office market experienced yet another quarter of decreasing vacancy, declining 60 basis points quarter-over-quarter to 7.1 percent. This marks the eighth consecutive quarter that vacancy has declined, and is the lowest it has been since the second quarter of 2001.

- Downtown Boston achieved the eleventh straight quarter of positive absorption, posting a healthy 241,000 square feet. At the close of the first half of the year, the downtown Boston market has achieved approximately 469,000 square feet of positive absorption year-to-date.

- As of April 2007, the unemployment rate in Boston was 4.2 percent. This number is 40 basis points lower than both the Massachusetts unemployment rate of 4.6 percent and 30 basis points lower than the national unemployment rate of 4.5 percent.

- The Worcester Business Journal reports that “according to the MassBenchmarks Current Economic Index, the commonwealth’s economy grew by 4.7 percent during the first quarter of the year.”

ABOUT Triple Net Properties, LLC

Triple Net Properties, LLC has time-tested experience in real estate syndications, acquisitions, leasing and property management. Triple Net currently manages a growing portfolio of over 37 million square feet of real estate in 28 states valued in excess of $5.1 billion. Although past performance is no guarantee of future results, Triple Net Properties, LLC has an unparalleled track record and has acquired 277 properties to date. Triple Net and affiliates have sold 100 properties for more than $2.3 billion since 2000.

Triple Net Properties, LLC is a wholly-owned subsidiary of NNN Realty Advisors, Inc., a nationwide commercial real estate asset management and services firm.