Pharmacy Sale Leaseback II DST

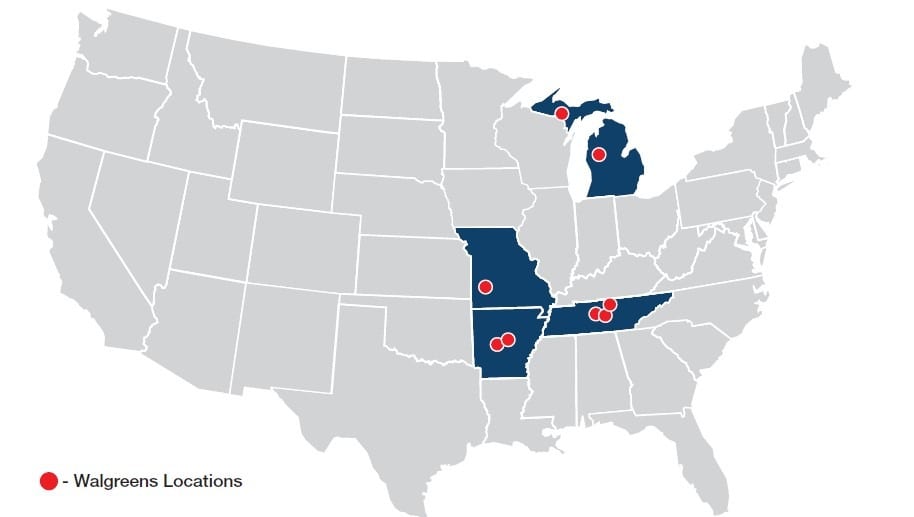

Arkansas | Michigan | Missouri | Tennessee

Beneficial Interests: $10,332,609

Offering Price: $35,900,870

- Loan Proceeds: $25,568,261

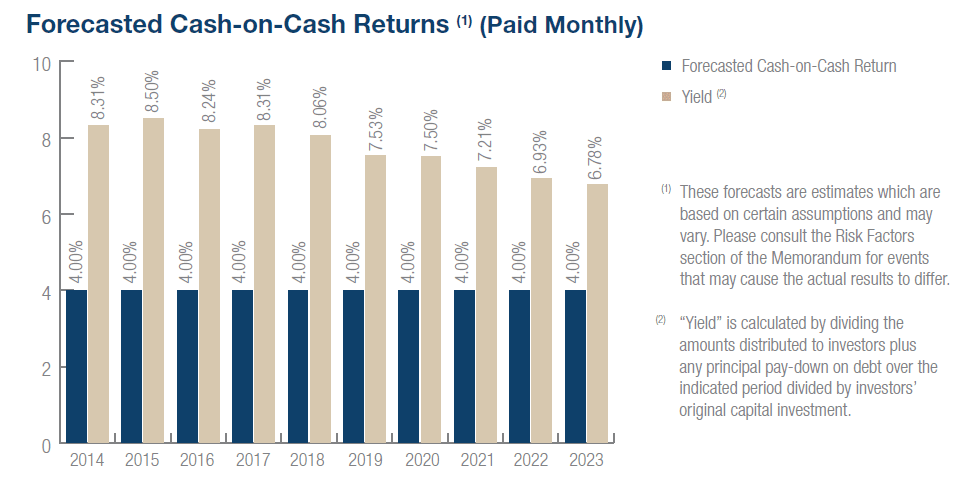

- Current Cash Flow: 4.00%

- Loan-to-Offering Price Ratio: 71.22%

- Minimum Investment[1031]: $100,000

Pharmacy Sale Leaseback II DST, a newly formed Delaware statutory trust (the “Trust”) and an affiliate of Inland Private Capital Corporation (“IPCC” ), is hereby offering (the “Offering”) to sell to certain qualified, accredited investors (the “Investors”) pursuant to this Private Placement Memorandum (the “Memorandum”) 99% of the beneficial interests (the “Interests”) in the Trust.

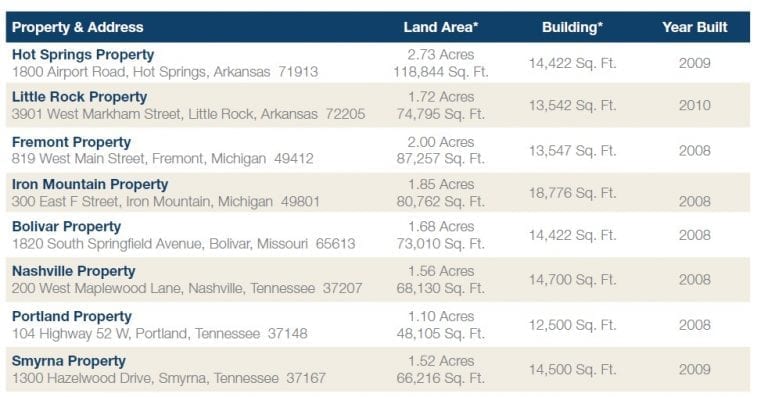

Eight Walgreens Properties

The Trust owns a portfolio of 8 properties leased to Walgreen Co. located at different regions Arkansas, Michigan, Missouri, Tennessee. As of November 30, 2013, Walgreens operated 8,681 locations in 50 states. In 2013, Walgreens opened or acquired 350 locations for a net increase of 197 locations after relocations and closings.

INVESTMENT HIGHLIGHTS

THE FINANCING

The Properties were financed with an amortizing loan in the principal amount of $25,641,816 from Parkway Bank and Trust Company (the “Loan”). The outstanding principal balance of the Loan as of the date of the Memorandum is approximately $25,568,261.

The maturity date of the Loan is March 14, 2024 (the “Maturity Date”). Interest on the principal balance of the Loan will accrue at a fixed rate, but the fixed rate will re-set during the term of the Loan.

The Trust may prepay the principal amount of the Loan, in whole or part, prior to the Maturity Date without premium or penalty, so long as the Trust provides the Lender thirty days’ prior written notice of such prepayment.

The Trust is responsible for repayment of the Loan. The Loan is nonrecourse to the Investors. Accordingly, the Investors will have no personal liability in connection with the Loan.

THE OFFERING

The Offering is designed for accredited investors seeking to participate in a tax-deferred exchange, as well as those seeking a quality, multiple owner real estate Investment. Only accredited investors may purchase Interests in this Offering. See “Summary of the Offering” and “The Offering” in the Memorandum.

PROPERTY OVERVIEW

Eight Walgreens Properties

The Trust owns a portfolio of 8 properties leased to Walgreen Co. (collectively, the “Properties”). See “The Properties,” “Summary of the Leases,” and “Risk Factors – Risks Related to the Properties.”

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.