STADIUM VIEW SUITES DST

1206S 4th Street Ames, IA 50010

Beneficial Interests: $18,790,000

Offering Price: $44,010,000

- Loan Proceeds: $25,220,000

- Current Cash Flow: 3.95%

- Loan-to-Offering Price Ratio: 57.95%

- Minimum Investment[1031]: $100,000

Arrimus Capital is a Southern California-based firm led by a team of real estate industry veterans, including Ray Wirta, Chris Lee and Ryan Gahagan. In addition to co-founding Arrimus with Chris Lee, Ray Wirta is also the current chairman of the board at CBRE. The Company pursues value-add and opportunistic investments throughout the country with a particular focus on: Student Housing; Multifamily; Entitlement and development projects; Triple-net leased investment properties

STADIUM VIEW SUITES PROPERTY

We believe that student housing is currently one of the most compelling opportunities for real estate investors and attracting increased attention from major investors, who see the sector as offering less rental growth volatility. In fact, over the last three years, student housing has emerged as a leading property type in the preference of respondents to the Pension Real Estate Association’s annual investor survey.

INVESTMENT HIGHLIGHTS

- An investment in a newly constructed, Class A, 197-unit student housing property located on 11.23 acres within walking distance of Iowa State University (“ISU”) in Ames, Iowa.

- Offers first-class amenities and a mix of two-, three- and four-bedroom units.

- Currently 99% occupied with in-place rents that the Trust Manager believes are below market.

- Demand is forecasted to remain steady based on overall enrollment trends and minimal new supply in the pipeline.

- With more than 36,000 students enrolled, ISU is the third-largest university in the Big 12 Conference. Enrollment has grown over 40% in the past decade*.

- Managed by Asset Campus Housing (“ACH”), the nation’s largest third party student housing property manager

INVESTMENT STRATEGY

Stadium View is currently a stabilized, well performing, high quality, core product. Arrimus Capital Advisors’ objectives for the property are to:

• Preserve and return investors’ capital investment;

• Yield attractive and stable distributions to investors;

• Steadily increase rental growth; and

• Realize capital appreciation over the hold period.

STRATEGIES TO MAXIMIZE RENTAL REVENUE

Strategy #1: Furnishing bedrooms

Units at Stadium View are offered with furnished common areas including a couch, a chair or a loveseat, a coffee table, a TV stand with a flat screen TV, kitchen bar stools and all kitchen appliances. However, the bedrooms come unfurnished with the option to rent furniture from a third party provider at a cost of $75/month.

Most of the comparable properties in the ISU student housing market provide fully furnished units, so the addition of bedroom furniture will bring Stadium View up to the market standard while allowing the property to increase asking rents accordingly.

Assuming a premium of $25/bed/month for the addition of bedroom furniture, the potential incremental annual revenue generated by furnishing the 518 bedrooms equates to $155,400, or 4% of the in-place gross potential rent based on the rent roll as of November 27, 2017. Adding the $25/month premium to the in-place rents at Stadium View would result in rental rates 11.7% below, on average, the 2017/2018 average rents at five stabilized competitive properties.

Strategy #2: Increasing two-bedroom rents

Prior ownership did not charge a meaningful premium for two-bedroom units compared to three- and four-bedroom units. Market rents for three- and four-bedroom units are $10 and $20 per bed per month more, respectively, than two-bedroom units.

Among the five stabilized competitive properties in the market, two-bedroom units rent for a premium of $57 and $114 per bed per month compared to three-bedroom or four-bedrooms, respectively. As a result, the two-bedroom units at Stadium View are 24.8% below the average market rate.

Strategy #3: Implement a Ratio Utility Billing System (RUBS)

Of the six closest competitors in the market, five properties charge residents for electricity. Stadium View is one of the few properties that includes all utilities in the rent. Implementing an electricity bill-back program will generate an estimated $115,000 for the 2019/2020 academic year, or a 5% increase to underwritten NOI. Per ACH, half of the competitive properties also bill-back the cost of water and sewer to residents, presenting an additional opportunity to recapture utility costs. Water and sewer bill-back, which is not projected to occur until the 2020/2021 academic year, would generate an additional 3.5% of NOI.

Strategy #4: Refine Property Operations

The Master Tenant has contracted with ACH to oversee operations at Stadium View Suites. ACH has more than 30 years of experience managing student housing properties and is now the nation’s largest third-party student housing property management company with over 118,500 beds under management, including 2,555 beds within the ISU market. ACH’s experience in the ISU market provides a number of advantages:

• Comprehensive market intel. It is important to be well-informed about pre-leasing seasons, concessions, utility bill-back, furniture options and market rates. As the manager of six, including Stadium View, student housing properties within the ISU market, ACH can provide this insight.

• Leverage economies of scale. As the operational manager overseeing more than 2,500 beds in the ISU market, ACH has relationships with local service providers and vendors. On a larger scale, ACH’s national breadth and presence results in wholesale rates and discounts on larger costs, such as general liability insurance from national providers.

THE OFFERING

The offering (the “Offering”) of interests (the “Interests”) of ACA Stadium View Student Housing DST (the “DST”) will not be registered under the Securities Act of 1933 (the “Securities Act”) or the securities laws of any state and are being offered and sold in reliance on exemptions from the registration requirements of the Securities Act and such laws. Certain disclosure requirements which would have been applicable if the Interests were registered are not required to be met. Neither the Securities and Exchange Commission nor any other federal or state agency has passed upon the merits of or given their approval to the Interests, the terms of the Offering or the accuracy or completeness of the “Memorandum.”

PROPERTY OVERVIEW

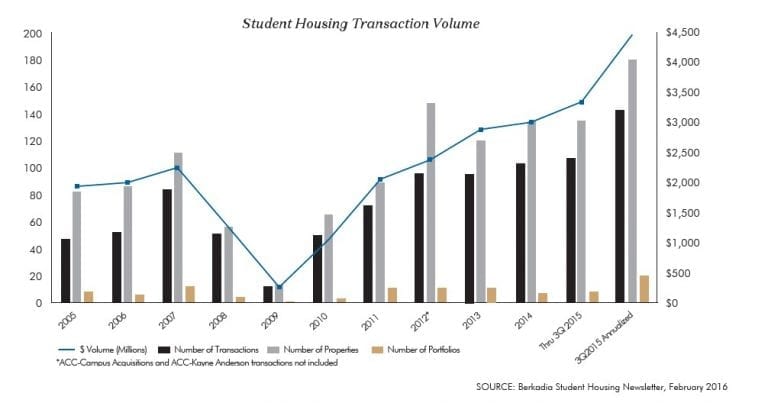

THE STUDENT HOUSING OPPORTUNITY

We believe that student housing is currently one of the most compelling opportunities for real estate investors. Once an overlooked niche, the student housing sector is attracting increased attention from major investors, who see the sector as offering less rental growth volatility and a recession-resistant hedge to conventional apartments. In fact, over the last three years, student housing has emerged as a leading property type in the preference of respondents to the Pension Real Estate Association’s annual investor survey. The property type is similar to conventional multifamily, but offers several unique features and benefits that can make it a superior investment opportunity.

MULTIFAMILY SIMILARITIES

• Leases guaranteed by parents or residents

• Short-term 12-month leases provide hedge against inflation

• One of the highest depreciation schedules available to shield income from taxes

• Fannie Mae and Freddie Mac financing provides attractive interest rates and is a dependable source of debt.

UNIQUE FEATURES

• Typically less volatile cash flow and valuations anchored by universities providing a renewed renter base each year

• Non-correlation to the business cycle and other real estate investments; demand can increase in market downturns with students returning to school or staying longer

• Enrollment increasing as a college degree is a driver of socio-economic mobility, with college graduates earning 61% more than nongraduates

• Favorable supply and demand characteristics

ABOUT ARRIMUS CAPITAL ADVISORS

Arrimus Capital is a Southern California-based firm led by a team of real estate industry veterans, including Ray Wirta, Chris Lee and Ryan Gahagan. In addition to co-founding Arrimus with Chris Lee, Ray Wirta is also the current chairman of the board a CBRE. The company pursues value-add and opportunistic investments throughout the country with a particular focus on:

• Student Housing;

• Multifamily;

• Entitlement and development projects;

• Triple-net leased investment properties

The management team has broad investment expertise and deep industry relationships to source, acquire, reposition and develop compelling opportunities. Senior management’s collective experience includes acquisitions, asset management,development, structuring unique public and private alternative investment programs, originating and underwriting loans, and the securitization of CMBS loans.