TSWR DEVELOPMENT SWD PORTFOLIO I,DST

Permian Basin Region of West Texas

Maximum Offering Amount : $3,200,000

- Minimum Investment: $100,000

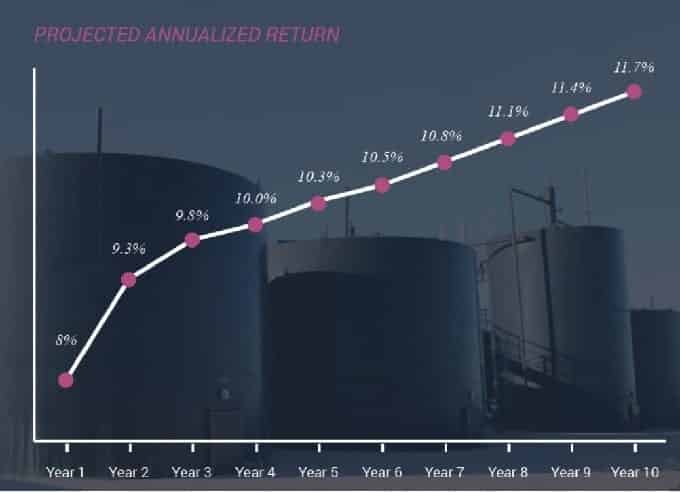

- Annualized Return : 8% increasing to 11.7%

- Projected Hold Period :10 Years

TSWR Development SWD Portfolio I, DST (the “Trust”), a Delaware statutory trust that intends to acquire several undivided fractional working interests in four fee simple salt water disposal facilities (including the Moreland SWD pictured above) located in Permian Basin Region of West Texas.

Permian Basin

The Permian basin continues to be the strongest region in the nation for oil production. The continued improvements in technology have allowed for consistent growth in oil production throughout the region.The Permian Basin is currently producing over 2 million barrels

of oil a day representing 21% of all US production.

INVESTMENT HIGHLIGHTS

INVESTMENT SUMMARY

The Sponsor’s business plan for the Properties and its principal investment objectives will be to:

(i) preserve the Beneficial Owners’ capital investment,

(ii) make scheduled distributions to the Beneficial Owners from the Trust’s cash flow from Rent collected under the Leases, after Trust expenses, starting at 8.0% per annum in Lease Year 1 and increasing to 12.8% per annum in Lease Year 10 and

(iii) sell the Properties within approximately 10 years. The Signatory Trustee anticipates that the Properties will provide the Investors with the potential for stable cash flow.

WHY IS PERMIAN SO STRONG?

The Permian continues to rule the U.S. oil production markets for two very simple reasons. First, the Permian has the largest oil reserves in the U.S., and, secondly, the infrastructure and support systems are in place to make drilling and extraction simple and lower risk then it has been historically. Even though drilling rigs counts have dropped from 463 in January 2013 to 212 in January 2016, average production per well has increased 227%. The increases have resulted mainly from new horizontal wells that are being drilled under old producing vertical well fields. This new lower horizontal drilling strategy involves drilling mile long horizontal wells that produce upwards of 3,500 barrels a day. The new giant wells in existing locations with existing infrastructure have cause average per well production to increase.

In a slower market, this has caused some of the production in some areas slow and other areas to explode.

The Permian Basin continues to be the most active and prolific region in the United States. Despite the decline in rig counts nationally, the ratio of rigs currently drilling in the Permian Basin has remained strong. New extraction techniques are driving the growth of oil production and activity in the region. This oil production creates an expanding need for salt water disposal.

ECONOMICS

The Trust, will enter into the Master Lease with the Master Tenant, an affiliate of the Sponsor.Under the Master Lease, the Trust leases the Properties to the Master Tenant for an original term of 10 years and the Master Tenant has the right, in its sole discretion, to renew the Master Lease for three additional terms of five years.

The Master Tenant’s rent for the original term of the Master Lease consists of

(i) an amount,which after estimated Trust expenses, equals 8.0% per annum yield on the Investors equity (assuming the Maximum Offering Amount is sold), paid in arrears to the Trust in monthly installments and

(ii) starting in Lease Year 2,bonus rent in a variable amount equaling 60% of the difference between the Property’s effective gross rental income and a threshold of $604,493 which will be adjusted upward each Lease Year thereafter at the rate of 1.0% per annum; provided, however, that any such bonus rent can never be a negative amount.Following Lease Year 1, the Sponsor expects,but cannot guarantee, the Property to generate Bonus Rent, leading to increasing yields.

PROPERTY OVERVIEW

Permian Basin

The Permian basin continues to be the strongest region in the nation for oil production. The continued improvements in technology have allowed for consistent growth in oil production throughout the region.The Permian Basin is currently producing over 2 million barrels

of oil a day representing 21% of all US production.Even as oil prices have continued to soften as of late, production of oil and saltwater have steadily increased throughout the region.The Permian has had continued increases in daily production of oil since 2007. Although the rate of completions has slowed with the oil industry, production per well has increased with January 2016 new wells producing on average of 400 barrels of oil per day. This increase of daily production has been steady per www.EIA.GOV statistics. In January 2013 Average production per new Oil Rig in the Permian Basin was 122 barrels of oil per day. In January 2016, the average new production was 416 barrels per day.

Per statistics from the EPA, the average ratio of water produced/recovered per barrel of oil extracted is 10:1. Total Oil production for January 2016 is 2,034,477 barrels per day, creating a significant need to properly dispose of an average 20 million barrels of water per day in the region in January 2016.

ABOUT SANDLAPPER STUDENT HOUSING, LLC

SANDLAPPER STUDENT HOUSING, LLC (“SSH”) is a real estate investment company and sponsor of fractional real estate investment programs focused on the acquisitions and management of student housing apartment complexes around the country. Founded in 2014 to capitalize on the growing demand for non-dormitory student housing, SSH has acquired and syndicated more than $83 million in student housing properties with more than 700 units and 1,500 beds. The firm is a subsidiary of Sandlapper Capital Investments, LLC, an award winning opportunistic investment firm and sponsor of private placement securities offerings covering a wide cross section of industries and asset classes. The principals of the firm, founders Trevor Gordon and Jack Bixler, have extensive experience with real estate acquisitions, syndications and management having acquired, syndicated and managed in excess of $1.1 billion in assets covering more than 10 million square feet nationwide since 200