US Immigration & Customs Enforcement Building

Jacksonville, Florida

Equity: $6,910,000

Loan: $8.505 million

- Projected Rate: 4.70%

- Interest: 120 months

- 55% loan-to-value,

- 10-year term

Syndicated Equities Group, LLC (“Syndicated”) is pleased to advise you of an investment opportunity in Cahaba Village (“Cahaba”), an upscale, Whole Foods anchored retail center located in the affluent city of Mountain Brook (Birmingham), AL.

Jacksonville, Florida

Jacksonville is the largest city in the state of Florida and the largest city by area in the United States. Top employers in Jacksonville include Bank of America Merrill Lynch, JP Morgan Chase, CSX Corporation, BI-LO Winn Dixie, PGA Tour Inc., Fidelity National Financial, Baptist Health, and Florida Blue.

Property Description

The Property is located at 13077 Veveras Drive in Jacksonville, Florida and is situated in Flagler Center, a 1,022 acre business park that houses 1.4 million square feet of Class A office and industrial space. The park is adjacent to I-95, the main highway on the East Coast that runs from Florida to Maine and provides direct access to the central business district of Jacksonville. Notable facilities and tenants within Flagler Center include Citicorp’s 600,000 square-foot Credit Card Division campus, Baptist Health’s new 125-bed medical center, and a Marriott hotel. Within five miles of the Property, the population is 62,184 and the average household income is $100,123. The surrounding area grew significantly from 2000 to 2010, as the population within three miles increased nearly 200% and the number of households rose more than 225%.

Jacksonville is the largest city in the state of Florida and the largest city by area in the United States. Top employers in Jacksonville include Bank of America Merrill Lynch, JP Morgan Chase, CSX Corporation, BI-LO Winn Dixie, PGA Tour Inc., Fidelity National Financial, Baptist Health, and Florida Blue.

Syndicated expects that the Property’s enhanced security and strategic proximity to I-95, I- 295, Florida State Highway 9B, and US Highway 1 will remain a valuable feature for the Agency throughout its lease term and beyond.

Tenancy & Lease Terms

U.S. Immigration and Customs Enforcement is the principal investigative arm of the U.S. Department of Homeland Security. Created in 2003 through a merger of the investigative and interior enforcement elements of the U.S. Customs Service and the Immigration and Naturalization Service, the Agency now has more than 20,000 employees in offices in all 50 states and 47 foreign countries. The Agency’s primary mission is to promote homeland security and public safety through the criminal and civil enforcement of federal laws governing border control, customs, trade, and immigration. The Agency has an annual budget of more than $5.7 billion dollars.

The lease for the Property is guaranteed by the US Government (S&P: AA+) and has an initial 15 year firm term that runs through January 2027. Unlike many leases guaranteed by the US Government, this lease does not contain any early, non-casualty related tenant termination or cancellation options prior to January 2027.

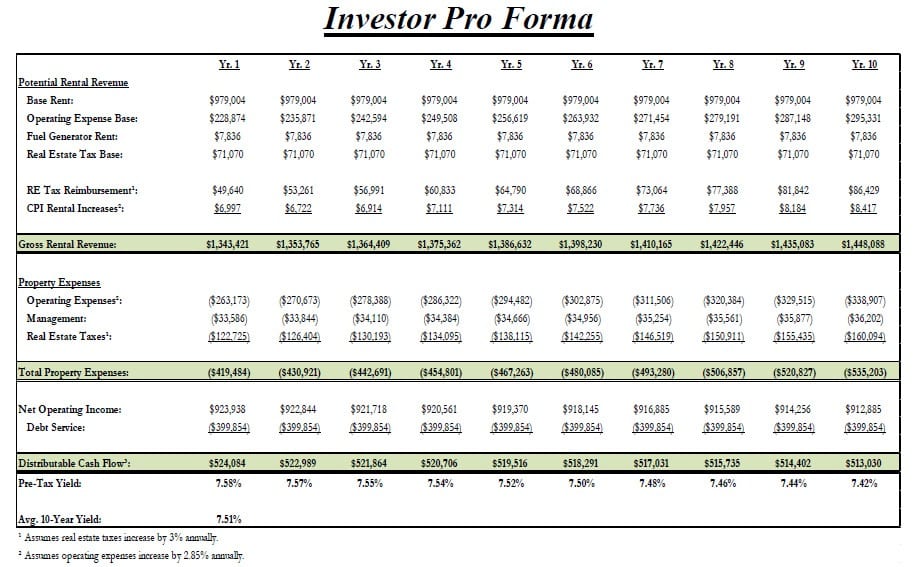

The current gross rental income paid under the lease is approximately $1,343,421. The operating expense portion of the overall rental amount (established at approximately $228,874) adjusts annually pursuant to the Cost of Living Index, and the US Government reimburses for all increases in real estate taxes above a “base year” amount. Throughout the term of the lease, these features should help mitigate increases in operating expenses and help keep the Property’s net operating income stable.

Management

Syndicated will provide asset management services for investors, including oversight of property management and preparation of year-end tax information. Syndicated currently provides such services for 10 other US Government leased properties within its 30+ property portfolio. W.D. Schorsch will be responsible for the day-to-day management and operation of the Property and will charge a market rate management fee equal to 2.5% for such services.

The following is a brief description of each group:

Syndicated Equities Group, LLC – Asset Manager

Founded in 1986, Syndicated is a national real estate investment company that specializes in offering investors risk-adjusted returns through the acquisition of institutional-grade and other prime, well-located real estate throughout the country. Currently, Syndicated manages over 30 real estate assets throughout the country, including 10 other US Government leased properties. Syndicated’s clients are private investors who wish to own real estate as part of their investment portfolio. Please see www.syneq.com for more information about Syndicated.

W.D. Schorsch – Property Manager

For over 15 years, W.D. Schorsch has been integrally involved with all facets of development projects for the US government including: sourcing, bidding, financing, constructing and managing build-to-suit assignments for Immigration and Naturalization, US Post Office, Social Security Administration, , IRS, FBI and US Customs. W.D. Schorsch currently manages 260,000 square feet of office space for the US Government in five states.

Ownership Strategy

Syndicated anticipates that an investment in the Property will provide investors with a stabilized, long-term income stream at a projected 7.51% average annual cash-on-cash return over ten years. During the holding period, Syndicated will continually evaluate the sale market to determine whether selling the asset would be advantageous to investors. Additionally, Syndicated will actively seek to extend the Agency’s lease prior to the maturity of the loan in 2024. Based on the Property’s proximity to I-95 and customized Agency features, Syndicated believes that it will remain a long-term (15+ year) location for the Agency.

ABOUT Syndicated Equities

Syndicated will make available up to $6,910,000 of equity interests to accredited investors, including those seeking to complete a Section 1031 exchange.

Syndicated Equities Group, LLC (“Syndicated”) is pleased to advise you of an investment opportunity in Cahaba Village (“Cahaba”), an upscale, Whole Foods anchored retail center located in the affluent city of Mountain Brook (Birmingham), AL.