Zero Coupon Pharmacy VI DST

Eastern half of the United States | CVS Health Property

Beneficial Interests: $9,642,836

Offering Price: $52,959,275

- Loan Proceeds: $43,316,439

- Current Cash Flow: 0.00%

- Loan-to-Offering Price Ratio: 81.79%

- Minimum Investment[1031]: $25,000

Zero Coupon Pharmacy VI DST, a newly formed Delaware statutory trust (Trust VI) and an affiliate of Inland Private Capital Corporation (IPCC), is offering (the Trust VI Offering) to sell to certain qualified, accredited investors (the Investors) pursuant to a Private Placement Memorandum dated October 13, 2016 (the Memorandum) 100% of the beneficial interests (the Trust VI Interests) in Trust VI

CVS Health Property

The Zero Coupon Pharmacy VI DST portfolios consist of 10

free-standing, single-tenant, NNN properties. All of the assets are located in the eastern half of the United States and were built between 2014 and 2016. CVS Health places an emphasis on convenience, service and accessibility. The company challenges itself to deliver increasingly greater convenience to its customers through selecting the right sites for its stores.

INVESTMENT HIGHLIGHTS

An investment in Zero Coupon Pharmacy VI DST may offer the following benefits:

- National, Investment Grade Tenant – The tenants under the leases are affiliates of CVS Health (NYSE: CVS). CVS Health guarantees the payment of all rent and the performance of all obligations by the tenants under the leases. CVS Health offers more than 9,600 retail pharmacies and more than 1,100 walk-in medical clinics, and is a leading pharmacy benefits manager with nearly 80 million plan members, a dedicated senior pharmacy care business serving more than one million patients per year and expanding specialty pharmacy services. As of the date of this Memorandum, CVS Health has a credit rating of BBB+ (stable) from Standard & Poor’s, as last updated May 9, 2011, and Baa1 (stable) from Moody’s, as last updated September 23, 2013.

- Long-term Leases – Each lease has a remaining lease term of approximately 25 years with 10 five-year renewal options. Each lease requires the tenant to pay monthly rent in a fixed amount.

- Net Leases – All of the leases are absolute “net” leases, with the tenant directly responsible for real estate taxes, insurance and other operating expenses. See “Summary of the Leases” in the Memorandum.

- High-Leverage, Long-term, Fixed-Rate, Amortizing Financing – The Property is highly leveraged and, by design, will produce no cash flow to maximize the amortization. Each Loan has a maturity date of October 10, 2038 and a fixed interest rate equal to 3.416% per annum. Principal is amortized over the term of each Loan. See “Financing Terms” in the Memorandum. An investment in Zero Coupon Pharmacy VI DST may be appropriate for Investors who are selling a property and looking for suitable replacement property to effectuate a Section 1031 Exchange, particularly where an Investor’s previous property was encumbered by high levels of debt.

- Passive Loss Benefits – An Investor’s passive losses, if any, from an investment in Zero Coupon Pharmacy VI DST may be used to offset the Investor’s other passive income.

INVESTMENT STRATEGY

The 1031 Exchange

The property owned by Trust VI is highly leveraged and, by design, will produce no cash flow. An investment in the Trust may be especially appropriate for those selling a property and looking for suitable replacement property to execute a 1031 exchange.

To meet IRS rules and accomplish a successful 1031 exchange, there must be equal or greater debt on the replacement property. Many Investors own business/income-producing properties that are encumbered by high levels of debt or Investors may be interested in increasing the amount of debt on their investment, therefore creating the need for a highly leveraged opportunity.

Passive Activity Losses for Cash Investors – PIG/PAL Strategy

This investment may generate passive activity losses (PAL) for cash Investors. Generally, for cash investors, passive activity losses will arise in a year if the sum of (a) deductible loan payments (e.g., payments of interest on the Loans) and (b) any depreciation to which an investor is entitled, exceeds the income generated by the investment in the year.

Passive activity losses may be used to offset passive income generated (PIG) by other passive real estate investments. Given the complex nature of such tax strategies, it is imperative that Investors consult their own accounting and tax professionals to determine if the PIG/PAL strategy is applicable to their particular situation. Each Investor’s tax circumstances are unique, and this information does not constitute tax advice for any particular Investor

THE FINANCING

Loans

The Trust VI Properties are financed by 10 separate mortgage loans on each of the Trust VI Properties, as described in this Memorandum, collectively referred to as the Trust VI Loans, from Wells Fargo Bank Northwest, National Association, as Trustee (the Lender), in the aggregate original principal amount of $43,316,438.73.

Financing Terms

The monthly debt service payment includes payment of interest and principal, amortized over each Loan term. The maturity date for the Loans is October 10, 2038 and the Loans bear interest at a fixed rate equal to 3.416% per annum. Through financing with monthly debt service equal to monthly base rent, a high loan-to-value ratio can be achieved, while also fully amortizing the Loans within the initial lease terms. All income from the Properties will be used to pay the Loans and thus no cash will be available for distribution to Investors while the Loans are outstanding.

THE OFFERING

The Offerings are designated for accredited investors seeking to participate in a tax-deferred exchange as well as those seeking a quality, multiple-owner real estate investment. Only accredited investors may purchase interests in the Offerings. For more information, see “Summary of the Offerings” and “The Offerings” in the Memorandum.

National Drug Store Overview

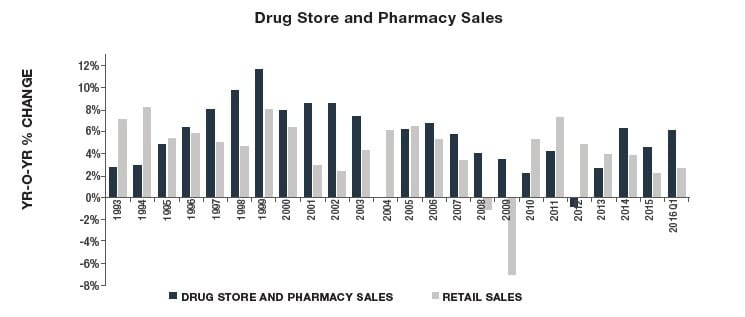

Chain drugstores and pharmacies remain attractive assets to many investors. Traditional advantages of the drugstore format include credit-rated tenants, high sales productivity, long-term leases and stable growth in the pharmaceutical and personal care industry.

The following chart compares drugstore and pharmacy sales growth to total retail sales growth on an annual basis

PROPERTY OVERVIEW

CVS Health Property

The Zero Coupon Pharmacy VI DST portfolios consist of 10 free-standing, single-tenant, NNN properties. All of the assets are located in the eastern half of the United States and were built between 2014 and 2016.

CVS Health places an emphasis on convenience, service and accessibility. The company challenges itself to deliver increasingly greater convenience to its customers through selecting the right sites for its stores. CVS store location criteria includes the following items, therefore the Properties have the following attributes:

• Highly visible

• Easy access with traffic signal

• High traffic intersections

• Freestanding sites with drive-thru pharmacy capability

• Parking for 60+ cars*

• Sufficient population in a trade are

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.