STADIUM VIEW - STUDENT HOUSING DST

1206 S 4th Street Ames, IA 50010

ACQUISITION COST: $44,010,000

OFFERING SIZE: $18,790,000

- LOAN AMOUNT: $25,220,000; 3.95% Fixed Rate

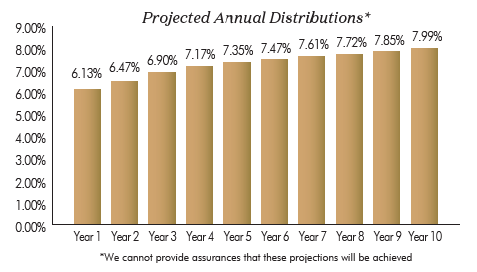

- Current Cash flow: 6.13% - 7.99%

- Loan-to-Offering Price Ratio: 57.95%

- Minimum Investment[1031]: $100,000

The property type is similar to conventional multifamily, but offers several unique features and benefits that can make it a superior investment opportunity. Typically less volatile cash flow and valuations anchored by universities providing a renewed renter base each year

STADIUM VIEW APARTMENTS, IA

Occupancy levels among Stadium View’s existing direct competitors ranged from 86% to 99% with an average of 94%. Stadium View is 99% leased for the current school year and is already 61% pre-leased for the 2018-2019 academic year.

INVESTMENT HIGHLIGHTS

THE OPPORTUNITY

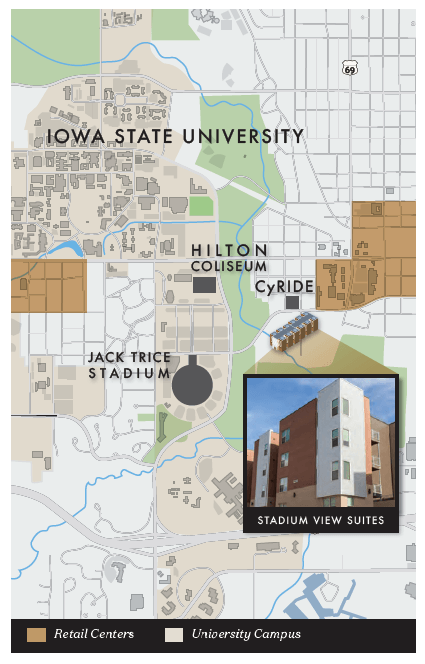

- An investment in a newly constructed, Class A, 197-unit student housing property located on 11.23 acres within walking distance of Iowa State University (“ISU”) in Ames, Iowa

- Offers first-class amenities and a mix of two-, three- and four-bedroom units

- Currently 99% occupied with in-place rents that the Trust Manager believes are below market

- Demand is forecasted to remain steady based on overall enrollment trends and minimal new supply in the pipeline

- With more than 36,000 students enrolled, ISU is the third-largest university in the Big 12 Conference. Enrollment has grown over 40% in the past decade*

- Managed by Asset Campus Housing (“ACH”), the nation’s largest third party student housing property manager

THE STUDENT HOUSING OPPORTUNITY

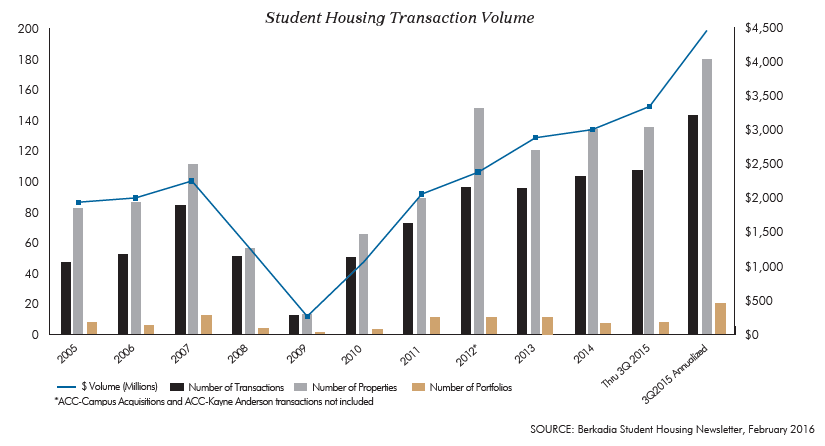

We believe that student housing is currently one of the most compelling opportunities for real estate investors. Once an overlooked niche, the student housing sector is attracting increased attention from major investors, who see the sector as offering less rental growth volatility and a recession-resistant hedge to conventional apartments. In fact, over the last three years, student housing has emerged as a leading property type in the preference of respondents to the Pension Real Estate Association’s annual investor survey.

THE STRATEGY

Stadium View is currently a stabilized, well performing, high quality, core product. Arrimus Capital Advisors’ objectives for the property are to:

- Preserve and return investors’ capital investment;

- Yield attractive and stable distributions to investors;

- Steadily increase rental growth; and

- Realize capital appreciation over the hold period.

MARKET OVERVIEW

Stadium View is located in Ames, Iowa, home of Iowa State University. ISU was established in 1858 and became one of the nation’s first land-grant universities in 1864. ISU is a nationally recognized academic institution and home to 10 colleges and schools that offer 116 bachelor’s degree programs, 100 master’s degree programs and 83 Ph.D.- level programs.

ISU has been named one of the nation’s most affordable colleges with high returns on investment, and is consistently ranked by College Atlas as one of the “Best Colleges and Universities in the Nation.”

ISU is already the largest university in Iowa with an enrollment of more than 36,000 students and, according to AXIOMetrics University Report Summary for Iowa State University Fall 2017, ISU’s enrollment is projected to continue to grow by an additional 3,350 students by 2021 with an average rate of enrollment growth of 1.8% annually for the next five years.

According to the ISU Residence Department, ISU currently only offers 11,677 beds in university-owned or operated residential housing projects despite student enrollment of more than 36,000 and growing. There are no plans for construction of additional campus owned units in the near future, which means more than two thirds of ISU students will continue to require off-campus, independently owned student housing.

There is no requirement for ISU students to live on campus, resulting in average off-campus occupancy rates of 98%. Currently, there are 29 off-campus “purpose-built” student housing properties totaling 5,179 beds. New off-campus purpose built student housing in the pipeline consists of:

- 537 beds deliver in 2018; adjacent to campus

- Another 800 beds planned, but not scheduled; 2.09 miles from campus

ABOUIT ARRIMUS CAPITAL ADVISORS

Arrimus Capital is a Southern California-based firm led by a team of real estate industry veterans, including Ray Wirta, Chris Lee and Ryan Gahagan. In addition to co-founding Arrimus with Chris Lee, Ray Wirta is also the current chairman of the board at CBRE. The company pursues value-add and opportunistic investments throughout the country with a particular focus on:

- Student Housing;

- Multifamily;

- Entitlement and development projects;

- Triple-net leased investment properties

The management team has broad investment expertise and deep industry relationships to source, acquire, reposition and develop compelling opportunities. Senior management’s collective experience includes acquisitions, asset management, development, structuring unique public and private alternative investment programs, originating and underwriting loans, and the securitization of CMBS loans.