121 Airport Centre I & II

2200—2208 Highway 121 Bedford, TX

MORTGAGE AMOUNT: $26,900,000

EQUITY OFFERING: $16,874,000

- MINIMUM EQUITY INVESTMENT: $506,220

- LOAN TO OFFERING PRICE 61.45%

- YEAR BUILT: 2000—2001

- TERM: 10 year

Principle Equity Management (PEM) is offering accredited investors the opportunity to purchase LLC interests in 121 Airport Centre I & II.

2200—2208 Highway 121 Bedford, TX

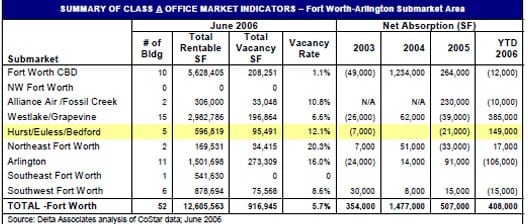

The asset includes two Class A two story multi-tenant office buildings totaling 251,168 net square feet, located on 18.35 acres in Bedford, Texas a suburb of the Dallas/Fort Worth Metroplex.

Property Description

Principle Equity Management (PEM) is offering accredited investors the opportunity to purchase LLC interests in 121 Airport Centre I & II. The asset includes two Class A two story multi-tenant office buildings totaling 251,168 net square feet, located on 18.35 acres in Bedford, Texas a suburb of the Dallas/Fort Worth Metroplex. This offering provides an opportunity for investors to acquire an institutional quality asset leased entirely by five national credit tenants. 121 Airport Centre is currently 90% leased.

- Internationally recognized tenants: CitiFinancial (a member of Citigroup); State Farm Mutual Automobile Insurance Company; Warrantech; Lanier Worldwide (a subsidiary of Ricoh Company)

- Long term tenancy, 80% of the complex is leased through 2010. Only 6,797 sf (2.7%) of tenant rollover prior to 9/09.

- Buildings were recently constructed in 2000 and 2001.

- Very attractive 6:1,000 sf parking ratio. Currently, the occupancy rate for Class A assets with parking ratios greater than 4:1,000 in this submarket is greater than 95%.

- Large floor-plates with ability to subdivide.

- Annual bumps in rent and 100% electrical expense pass throughs provide cash flow growth opportunity.

KEY INVESTMENT CRITERIA

- INVESTMENT NAME: 121 Airport Centre I & II

- LOCATION: 2200—2208 Highway 121 Bedford, TX

- PROPERTY TYPE: Multi-Tenant Office

- RENTABLE SQUARE FEET: 251,168

- OCCUPANCY: 90%

- YEAR BUILT: 2000—2001

- BUILDING CLASSIFICATION: Class A

- MORTGAGE AMOUNT: $26,900,000

- TERM: 10 year

- AMORTIZATION: Interest only years 1 – 3, then amortizes on 30 year schedule

- RATE: 6.13%

- STRUCTURE: Property Management Pass Thru

- EQUITY OFFERING AMOUNT: $16,874,000

- MINIMUM EQUITY INVESTMENT: $506,220

- LOAN TO OFFERING PRICE 61.45%

- HOLD PERIOD: 10 years

- INVESTOR CASHFLOW (year one): 7.04%

- AVERAGE YIELD OVER HOLD: 7.94%

- PROJECTED IRR 10.35%

ABOUT PRINCIPLE EQUITY MANAGEMENT

PRINCIPLE EQUITY MANAGEMENT

10303 NW Freeway, Suite 300 Houston, TX 77092 Contact: Randy McQuay Phone 281-847-9955 Fax 281-847-9966

This material does not constitute an offer to sell or a solicitation of an offer to purchase securities and is only authorized for use when accompanied or preceded by 121 Airport Centre Placement Memorandum (PPM). One may not rely on the information presented herewith for investment purposes. The information herein is qualified entirely by the PPM. All potential investors must be “accredited investors” under the federal securities laws, must read the PPM and acknowledge receipt and review of PPM.