BR Ansley, DST

6435 ZEBULON ROAD, MACON, GA 31220

Total Fully Syndicated Price: $30,764,621

Equity Amount: $14,027,121

- Loan Amount: $16,737,500

- Purchase Price per Unit: $98,506

- Projected Hold Period: Approx. 7-10 Years

- Assumed Debt (1.588% interest): $268,475

Make monthly distributions to Investors, which may be partially tax-deferred as a result of depreciation and amortization expenses;

Increase the net operating income of the Property through professional property management and diligent asset management to increase occupancy and rental rates and control expenses;

6435 ZEBULON ROAD, MACON, GA

Ansley Village features modern construction and an abundance of attractive amenities. The Property is also situated in the desirable, north Macon submarket.

Property Type: Class A, garden-style apartment community. The property is comprised of nine three and four-story garden-style apartment buildings and four two-story carriage apartment buildings situated on approximately 13.6 acres.

Key Investment Considerations

- Great Access:

The Property is situated in a desirable, accessible location along I-475 in the north Macon submarket. - Near Major Employers:

The Property is located approximately 11 miles from Mercer University, a private university with 8,300 students, and approximately 13 miles from the Medical Center of Central Georgia, a 637-bed hospital (the second largest in Georgia). - Affluent Submarket:

50% of the households in the one-mile radius of the property have a household income greater than $75,000 annually. - Experienced Property Management:

The Property will be managed by Carroll Organization, a national apartment owner and operator managing over 14,000 units. Carroll will provide day-today on-site property management. - Nearby Shopping:

The Property is located less than one mile from Plantation Centre (a Walmartanchored power center with Lowe’s, Kohl’s, and Amstar 16 movie theater) and necessity retail including Kroger and CVS.

Business Plan

- Preserve the Investor’s capital investment;

- Make monthly distributions to Investors, which may be partially tax-deferred as a result of depreciation and amortization expenses;

- Increase the net operating income of the Property through professional property management and diligent asset management to increase occupancy and rental rates and control expenses;

- Add value to the Property through selective capital improvements; and

- Sell the Property at a profit within approximately 7-10 years.

Regional Overview

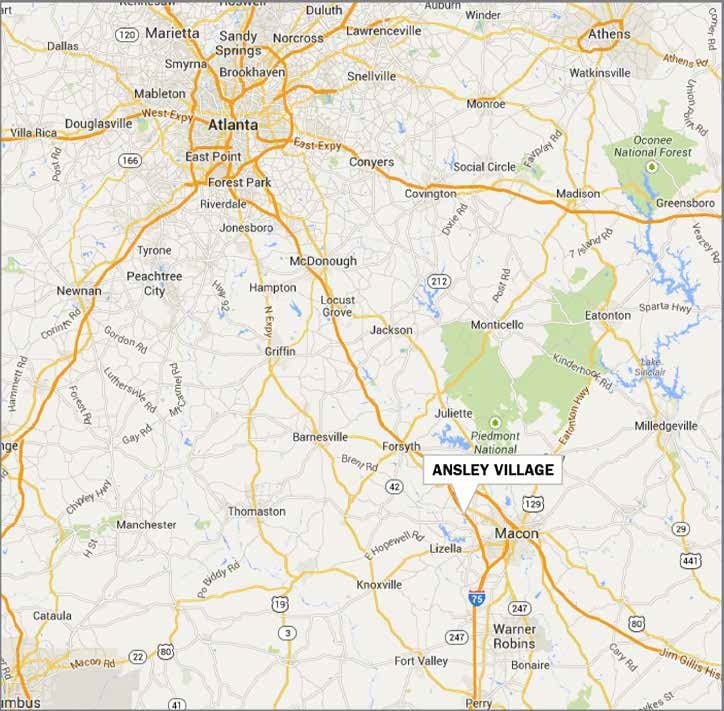

The Property is located in Macon, Georgia in the Macon Metropolitan Statistical Area (MSA) in the central part of Georgia, at the intersection of Interstates 75 and 16, approximately 75 miles south of Atlanta. The Macon MSA is part of the larger Macon-Warner Robins-Fort Valley, GA Combined Statistical Area (CSA). With a total population of nearly 400,000 residents in a 30-mile radius, and due to its accessibility, Macon has become an attractive location for businesses.

Macon offers proximity to Atlanta, four major seaports within four hours truck travel time, international air freight facilities only 75 minutes away, two railroads, and the largest rail switching center on the East Coast.

Robins Air Force Base

One of the largest employers in the region, Robins Air Force Base is located approximately 25 miles south of the Property. In addition to Avionics and the Joint Surveillance and Target Attack Radar System (JSTARS), Robins is home to the award winning Warner Robins Air Logistics Complex, one of three major Air Logistics centers in the country. Robins supports more than 27,000 active-duty military, family members, reserve component soldiers, retirees, and civilian

employees on a daily basis resulting in a $2.856 billion annual impact on the surrounding area.

Local Overview

The Property is located within the City of Macon in the Macon MSA with approximately 230,000 residents. The Macon MSA industry base consists of advanced manufacturing, services, and aerospace. (Source: Macon Economic Development Commission)

Located in North Macon, the area’s top submarket,

the Property benefits from a location within 20 miles from Macon’s 24 largest employers, with a combined total of over 20,700 jobs. Within the one-mile radius, the median household income is $75,123 and the population increased 20% from 2000-2010. (Source: Southeast Realty Consultants Appraisal)

The Macon multifamily submarket is very healthy, with a 6.7% vacancy rate and is projected to remain relatively flat through 2018. (Source: REIS, Inc., Performance Monitor Futures Q1 2014).

Plentiful higher education opportunities exist throughout the region. Macon is home to several higher learning institutions, including Middle Georgia State College, with over 8,000 students, Mercer University, a private university with approximately 8,300 students, and Central Georgia Technical College, with over 9,000 students.

WHY APARTMENTS?

With a projected increase in rents and low vacancies, apartments are poised for future growth. As of 2014, national vacancy rates have declined to 4% and rents are projected to increase nearly 14% by 2018.

A Hedge Against Inflation: apartments can strike new market rents as economic conditions improve, unlike other property types with longer-term fixed rate leases.

Good Fundamentals with Growing Demand: multifamily has the lowest vacancy rate of all property types and has a growing base of demand as the target renter-aged population (ages 20-34) continues to grow.

About Bluerock Value Exchange, LLC

BVEX is a national sponsor of syndicated 1031 exchange offerings with a focus on Class A assets that can deliver stable cash flows and have the potential

for value creation. BVEX is an affiliate of Bluerock Real Estate, L.L.C., a private equity real estate investment firm that sponsors a portfolio currently exceeding

25 million square feet of primarily apartment and office real estate, including approximately $1.1 billion in total property value and over 7.5 million square

feet of property. Bluerock’s senior management team has an average of over 25 years investing experience, has been involved with acquiring over 35 million

square feet of real estate worth approximately $10 billion, and has helped launch leading real estate private and public company platforms.