Colorado Multifamily Portfolio IV DST

Denver metropolitan area,Aurora-Denver,Lakewood,Thornton

Beneficial Interests: $115,374,057

Offering Price: $239,373,307

- Loan Proceeds: $123,999,250

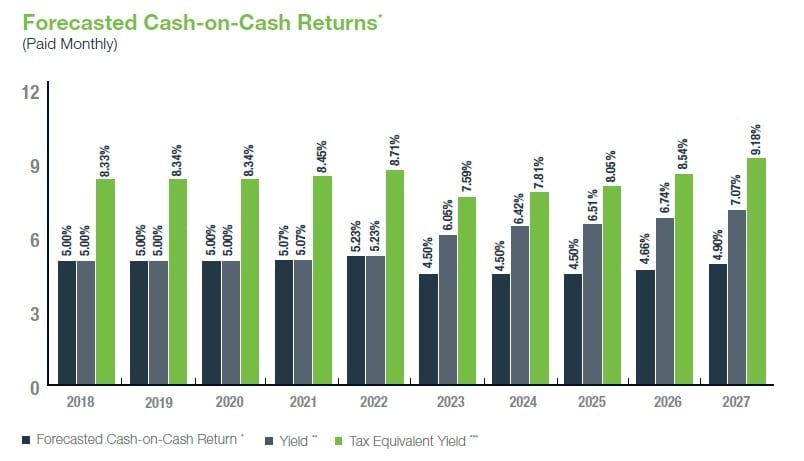

- Current Cash Flow: 5.00%

- Loan-to-Offering Price Ratio: 51.80%

- Minimum Investment[1031]: $100,000

Colorado Multifamily Portfolio IV DST, also known as the Parent Trust, is a newly formed Delaware statutory trust and an affiliate of Inland Private Capital Corporation (IPC).The Parent Trust indirectly owns, or will own, a portfolio of three multifamily properties located throughout the Denver metropolitan area, specifically in Aurora, situated just outside of Denver city limits, Lakewood, and Thornton.

The Denver Property,The Lakewood Property,The Thornton Property

The Lakewood Property, built in 2016, features 267 units that range from 548 square foot studios to 1,325 square foot three bedroom apartments. Park 88 Apartment Homes, located in Thornton, Colorado and directly off of Interstate 25, makes for a short 10-mile commute to downtown Denver.

INVESTMENT HIGHLIGHTS

IIPC believes that an investment in the Parent Trust offers the following benefits:

• Strong locations with properties dispersed throughout Denver metropolitan area

• Value-add potential with planned unit upgrades at the Denver Property and Thornton Property

• Denver’s median annual income of $73,2712 is higher than the average annual income in both

• Each Property is, or will be, financed with a separate Loan with no cross-collateralization

• Each Loan has or will have a 10-year term with fixed interest rates and amortizing principal

• Inland has extensive property management expertise

• Large multifamily presence in Colorado with approximately 4,920 units under management across the state, including the Properties

• Experience in all aspects of acquiring, owning, managing and financing multifamily properties

INVESTMENT STRATEGY

The market dynamics are anticipated to be sustainable throughout the hold period, providing the Property Manager the opportunity to maintain or increase occupancy and to increase rental rates at the Properties. In conjunction with rental growth, the operational strategy includes monitoring and controlling expenses, and utilizing reserves effectively. To maximize property performance, a state-of-the-art computerized revenue management program will be instituted to analyze market and submarket data and establish optimal unit pricing based on a number of factors including inventory, days on market, move-in date and location. In addition, the Property Manager intends to introduce, and/or monitor the recovery of, other income and fees, such as utility costs, trash removal fees, administrative fees, application fees and pet rent.

In an effort to retain residents, the Property Manager intends to implement a lease management system that targets the number of monthly lease expirations to approximately 10 percent of the Apartment Units. Programs will also be put in place to enhance the online rating scores on apartment rental sites as well as multiple search engines, which are critical in today’s technology-driven market.

Regular meetings are held between the Asset Managers and Property Managers to review performance, discuss new leasing activity, and improve tenant retention as well as other topics. The Property Manager also expects to host regular Resident functions to foster a sense of community, and help to increase tenant retention.

Additionally, an annual property tax review and appeal program will be put in place and annual property insurance reviews will be conducted. Finally, the Asset Managers will leverage economies of scale in order to provide the most cost-effective pricing structure on contractor and vendor services.

THE OFFERING

The Parent Trust is offering (the Offering) to sell to qualified, accredited investors pursuant to this Memorandum, 100 percent of the beneficial interests in the Parent Trust. The Offering is designed for accredited investors seeking to participate in a tax-deferred exchange as well as those seeking a quality, multiple-owner real estate investment. Only accredited investors may purchase interests in this Offering.

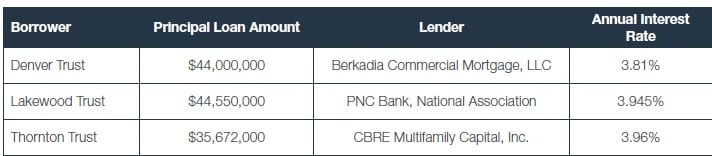

THE FINANCING

Each Property is, or will be, separately financed with a first mortgage loan (each, a Loan and collectively, the Loans), as described below. Each Loan has or is expected to have a term of 10 years. Investors should note that the financing terms for the Denver Loan have not been finalized as of the date of the Memorandum, and remain subject to change.

Each of the Loans is, or will be, made under the Federal National Mortgage Association Delegated Underwriting and Servicing loan program. For the first five years of each Loan term, the borrower is, or will be, required to make monthly, interest-only payments, and for the final five years of each Loan term, the borrower is, or will be, required to make monthly payments of principal and interest, with principal amortizing on a 30-year schedule.

Each Loan is, or is expected to be, secured by a deed of trust on the respective Property. The Loans are not, and will not be, cross-collateralized or cross-defaulted, meaning a default under one of the Loans will allow the applicable lender to recover against only the particular Property securing the particular Loan and will not trigger a default under any other Loan.

PROPERTY OVERVIEW

The Denver Property

Après Apartment Homes is strategically located in Aurora, just outside Denver city limits, between two of Denver’s largest employment regions, the Southeast Business Corridor and the Central Business District. The Denver Property includes 408 one- and two-bedroom units, with wood-burning fireplaces, modern appliances, large closets and in-unit washers and dryers. Residents can enjoy the brand new clubhouse, constructed in 2016, which offers a community kitchen, a state-of-the-art fitness center, and mountain views. Conveniently situated between I-25, I-225, and the Regional Transportation District’s (RTD) newest light rail line, the Denver Property offers residents a short commute to the area’s many employment centers.

The Lakewood Property

Located between the Rocky Mountain foothills and downtown Denver, Union West Apartments offers its residents an expansive list of amenities, as well as a very desirable location. Community amenities include a state-of-the art fitness center with a spin and yoga studio, year-round resort-style pool, and a community clubhouse with shuffleboard, gourmet kitchen and bar area. The Lakewood Property, built in 2016, features 267 units that range from 548 square foot studios to 1,325 square foot three bedroom apartments, all equipped with spacious kitchen islands, stainless steel appliances, quartz countertops and over-sized patios and balconies.

The Thornton Property

Park 88 Apartment Homes, located in Thornton, Colorado and directly off of Interstate 25, makes for a short 10-mile commute to downtown Denver. The Thornton Property features mountain views, a recently remodeled clubhouse, and 322 studio, one-, and two-bedroom apartment homes. Recent property renovations include all new roofs, new siding, and new windows and sliding doors. The Thornton Property is situated less than two miles from the future “North Metro Rail Line”, which is expected to open in 2019 and is anticipated to be a big draw for residents looking for a convenient daily commute.

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.