CS1031 Birmingham MOB, DST

Location: 3671 Roosevelt Boulevard, Birmingham, Alabama 35235

Offering Details

Equity Raise: $2,018,000

- INVESTMENT COST: $4,818,000

- CASH-ON-CASH RETURN: 5.75%

- OFFERING LOAN TO VALUE: 58.1%

- FIXED INTEREST RATE: 4.90%

- LOAN TERMS: 10-Year Term

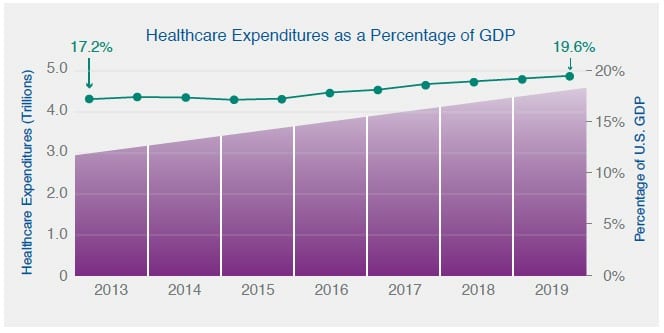

The aging of America has created a demand for more healthcare real estate. Healthcare expenditures are expected to increase to $4.8 trillion by 2021, up over 58% from 2012. Between 2008 and 2018, healthcare job growth is projected to increase by nearly 29 percent.

Roosevelt Boulevard, Birmingham, Alabama

Newly built-to-suit for Fresenius, this 8,140-square-foot medical office building is 100 percent leased on a longterm basis to Fresenius Medical Care Trussville. The lease is guaranteed by Fresenius Medical Care Holdings, Inc. (“Fresenius Medical Care Holdings”), a wholly-owned subsidiary of Fresenius Medical Care AG & Co.

INVESTMENT HIGHLIGHTS

- Strong Corporate Parent: Fresenius has posted strong revenues – more than $16.7 billion.

- Stabilized Lease Economics: The property is 100 percent leased for 15 years, with three five-year renewal options.

- Positioned for Stability through Necessary Medical Care: Fresenius provides products and services for people with chronic kidney failure, a disease that affects many worldwide. More than 2.5 million patients regularly undergo dialysis therapy. Fresenius has completed more than 42.7 million dialysis treatments in the Americas alone.

PROPERTY DETAILS

LEASE: 15-year lease

STRUCTURE: Double net lease, expiring May 31, 2031

RENEWAL OPTIONS: Three five-year renewal options

STORIES: One

PARKING: 42 spaces

Investing in Medical Real Estate

BY THE NUMBERS: The Increasing Demand for Medical Real Estate

- Approximately 20 million people have obtained coverage under the Affordable Care Act, generating additional need for medical real estate.

- The aging of America has created a demand for more healthcare real estate.

- Healthcare expenditures are expected to increase to $4.8 trillion by 2021, up over 58% from 2012.

- Healthcare represents 18 percent of the U.S. gross domestic product, and is expected to increase to nearly 20 percent of GDP by 2021.

- Between 2008 and 2018, healthcare job growth is projected to increase by nearly 29 percent.

- Advances in technology and research increase life expectancies, producing additional interest in healthcare assets.

Birmingham*

- Largest City in the State of Alabama with a population currently estimated at 212,237, and a metro population of 1,136,650

- Represents 22 percent of Alabama’s total population

- County seat

- 99 historic neighborhoods (often referred to as the cradle of the American Civil Rights Movement)

- Home to 40,680 businesses

- Centrally located in the southeast and easily accessible to major hubs in the region

- Medical research, banking and service-based economy

- One of the nation’s most livable cities with a vibrant downtown, a burgeoning loft community, a world-class culinary scene and more green space per capita than any other city in the nation

ABOUT CAPITAL SQUARE

Capital Square 1031, LLC specializes in the creation and management of real estate investment programs for Section 1031 exchange investors and other investors using the Delaware Statutory Trust structure. Louis J. Rogers, founder and chief executive offi cer of Capital Square, has been involved in the creation and management of more than 100 investment offerings totaling over $3 billion, including DSTs, tenant-in-common offerings, numerous real estate funds, and multiple publicly registered non-traded real estate investment trusts.