CS1031 Crossroads Apartments, DST

2222 West Beardsley Road, Phoenix, Arizona 85027

INVESTMENT COST: $28,620,000

EQUITY RAISE: $12,110,000

- CASH-ON-CASH RETURN: 6%

- OFFERING LOAN-TO-VALUE: 57.69%

- FIXED INTEREST RATE: 3.44%

- Minimum Investment[1031]: $100,000

Marcus & Millichap is projecting a 2.9 percent increase in employment in the Phoenix MSA for 2016. They believe that this will result in a 6.5 percent increase in effective rents and a decrease in vacancy to 4.5 percent, as apartment developers are unable to keep up with demand.

2222 West Beardsley Road, Phoenix

The Sponsor intends to replace all original kitchen appliances during the first three years of the holding period and significantly upgrade one-third of the apartment units with refreshed kitchens, bathrooms, and other features.

INVESTMENT HIGHLIGHTS

Strong Rental Market Fundamentals

Marcus & Millichap is projecting a 2.9 percent increase in employment in the Phoenix MSA for 2016. They believe that this will result in a 6.5 percent increase in effective rents and a decrease in vacancy to 4.5 percent, as apartment developers are unable to keep up with demand. Of the 9,000 units in the construction pipeline, none are in the property’s submarket. Accordingly, Crossroads Apartments is well positioned to benefit from these strong market conditions.

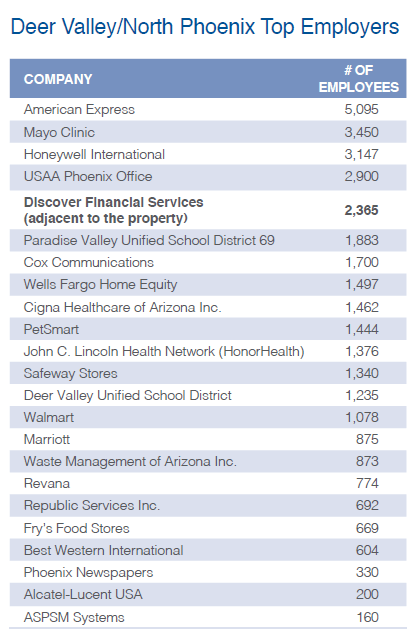

Surrounded by Jobs

The property is located in an area that is a major employment hub within the Phoenix MSA. Large employers include Discover Financial Services adjacent to the property (2,365 employees), Honeywell (3,000 employees), American Express (2,500 employees), Cox Communications (1,700 employees), PetSmart (1,356 employees), Safeway (1,145 employees) and HonorHealth (926 employees).

Easy Access – See Map on right side

The property is located at the northeast corner of the intersection of Interstate 17 and State Route 101, with average daily traffic counts of 127,900 and 162,954, respectively. There is easy access to every major employment hub from the property.

Well Maintained

The seller has made significant capital expenditures to the property. The renovated leasing office was reopened just three months ago. The grounds are immaculate and all of the amenities are in excellent condition.

Enhanced Value by Renovating Units

Although the seller focused on the exterior and amenities, the apartment units, while very well maintained, are largely unchanged from their original condition. The Sponsor intends to replace all original kitchen appliances during the first three years of the holding period and significantly upgrade one-third of the apartment units with refreshed kitchens, bathrooms, and other features. The Sponsor is making this investment to increase cash flow and favorably position the property for sale at the end of the holding period.

PROPERTY OVERVIEW

- UNITS: 316

- PERCENTAGE OCCUPIED: Approximately 94%

- BUILDINGS: 18

- LOT SIZE: 10.38 Acres

- PARKING: 322 Open Spaces + 70 Covered Spaces

- UNIT MIX: Studio, One, Two and Three Bedroom Units

- AVG. UNIT SIZE: 642 Square Feet

Property Amenities

• Gated entry and covered parking

• New, fully renovated clubhouse and leasing center

• Two resort-style swimming pools with a sundeck/cabana

• Lighted tennis court and basketball courts

• Covered playground

• Four on-site laundry rooms

• Door-to-door valet trash service

• Park-like setting with fountains

Unit Interior Amenities

• Spacious floor plans

• Fully equipped kitchens

• Ceiling fans

• Select units feature upgraded interiors, pantries,

walk-in closets and private patios or balconies

MARKET OVERVIEW

Crossroads Apartments is located in the vibrant, young and growing North Phoenix submarket, in an area commonly referred to as “Deer Valley” in the Phoenix metropolitan area. This area provides a mix of residential, office, retail, recreational and resort uses. Proximity to three major freeways, Interstate 17, Loop 101 and State Route 51, provides convenient access throughout the entire metro area, including direct access to the Valley’s largest employment corridors in the downtown Phoenix and Scottsdale.

Adjacent to Crossroads Apartments is a major operations center of Discover Card, the third-largest credit card brand in the United States, with nearly 61 million cardholders. Deer Valley boasts more than 1.5 million square feet of flex space and 4 million square feet of office space, with other major office employers including American Express, Best Western and PetSmart. Additionally, the area has nearly nine million square feet of industrial space and is home to major high tech and aerospace employers such as Alcatel-Lucent Technologies, Honeywell International and L3 Avionics. HonorHealth Deer Valley Medical Center, a 204-bed, full-service hospital, serves the area.

North Phoenix is also home to more than 14 million square feet of retail space, hosting restaurants, hotels and entertainment venues. Larger power and specialty centers are near Crossroads Apartments, including the 1.2 million-square-foot Desert Ridge Marketplace, Deer Valley Town Center, High Street and Outlets at Anthem.

ABOUT SPONSORS

Capital Square 1031 is a real estate advisory company specializing in the creation and management of real estate investments. The company uses the DST and other investment structures to fit the needs of its high net worth individual and institutional investors. Capital Square 1031 is also active in property and asset

management, key elements in a successful real estate investment.

This is Capital Square’s 33rd DST offering. Capital Square manages over 50 properties with a value over $500 million, based on Investment Cost.

Rincon was founded to invest primarily in institutional quality commercial real estate located in the southwestern United States. Its partners have over 60 years of combined experience in the acquisition, disposition, development, financing, and management of commercial real estate. The partners of Rincon, in their capacity as executive officers of their prior companies, have developed, acquired, and managed over $18 billion of institutional quality real estate across several asset classes, including, single and multi-tenant retail, office, industrial, self-storage and multifamily. Since 2003, Rincon’s partners, in their capacity as executive officers, have participated in raising over $13 billion of public and private equity, consisting of over $630 million from approximately 5,500 investors through 61 private placements, including, four limited partnerships, four debt offerings, 27 Delaware Statutory Trusts, 26 Tenant-In-Common programs, and a private REIT, and over $12.5 billion from approximately 245,000 investors, through seven publicly offered non-listed REITs.