FOUR GSA PROPERTIES DST

Portland, OR|Minneapolis, MN|Cincinnati, OH|ST. LOUIS, MO

Investor Equity:

Total Offering:

- Loan Proceeds: $

- Loan-to-Value:

- Minimum Investment[1031]: $

Four GSA Properties Holding DST, a Delaware statutory trust (the “Holding Trust”) owns all of the beneficial interests in four Delaware statutory trusts (the “Realty Trusts”) each of which is the owner of one of the Properties. Each of the Properties is leased on a long term basis to the United States of America, acting through the General Services Administration (the “Government Leases”), and is subject to long term financing, as summarized on the attached Property Summary (the “Property Summary”).

FBI AND NARA PROPERTIES

Three of the Properties are used by the Federal Bureau of Investigation, and the fourth is used primarily by the National Archives and Records Administration. Descriptions of the Properties are attached to this Confidential Executive Summary. None of the Government Leases provides for fixed renewal or extension terms.

INVESTMENT HIGHLIGHTS

ASSET MANAGEMENT AGREEMENTS; PROPERTY MANAGEMENT AGREEMENTS

Each of the Realty Trusts has entered into a separate Asset Management Agreement (the “Asset Management Agreements”) with a separate affiliate of The Molasky Group of Companies (the “Asset Manager”). The terms of the Asset Management Agreements are co-terminus with the terms of the corresponding Government Leases.

Pursuant to the Asset Management Agreements, the Asset Managers perform the following services on behalf of the Realty Trusts:

(i) overseeing income and expenses and funding any cash flow shortfalls, to the extent of the positive cash flow generated by the Properties on an aggregate basis during the immediately preceding twelve month period,

(ii) negotiating an extension of the Government Lease or a new lease at the end of the term of the Government Lease,

(iii) negotiating a refinancing of the mortgage loans at their maturity dates (coterminous with the terms of the Government Leases)

(iv) performing any construction required under the Government Lease. In exchange for these services and the services of the Asset Manager under the Property Management Agreement (defined below), the Asset Manager is compensated by being entitled to retain any positive cash flow from the Property during the term of the Government Lease.

Each of the Realty Trusts has entered into a Property Management Agreement (the “Property Management Agreement”) with the respective Asset Manager for its Property. The terms of the Property Management Agreements are co-terminus with the terms of the corresponding Government Leases. Pursuant to the Property Management Agreements, the Asset Managers perform customary property management services on behalf of the Realty Trusts, including administration, maintenance, lease and loan servicing, reporting, budgeting, managing insurance and similar duties. The Asset Managers do not receive separate compensation for such services, but instead are compensated under the Asset Management Agreements .

Each Asset Manager is an affiliate of PH LLC, a Nevada limited liability company doing business as The Molasky Group of Companies and is an affiliate of most of the sellers which sold the Realty Trusts to the Holding Trust. The Asset Managers were formed for the purpose of this transaction. To assure continuity of management and results of operations, it is anticipated that the Asset Managers will retain the same individuals currently performing the functions of the “Landlords” under the Government Leases. For more information regarding The Molasky Group of Companies, you may access its website at

www.molaskyco.com

FINANCING

The Properties are subject to total mortgage and mezzanine debt of approximately $309 million, as shown on the Property Summary. A substantial principal balance will remain outstanding and be due and payable on each of the mortgage loans at their respective maturity dates. In addition, a substantial balance will be outstanding on the mezzanine debt at such times. All of the rental payments made by the Tenants will be paid to the mortgagee under the mortgage loans and to the Property Managers under the Asset Management Agreements.Therefore, investors will not receive any cash flow from the investment during the terms of the Government Leases. After each of the mortgage loans has been repaid in full, the Holding Trust will be required to make payments on the mezzanine debt in accordance with its terms. It is not anticipated that there will be any distributions to the investors during the terms of the Asset Management Agreements.

PROPERTY OVERVIEW

Three of the Properties are used by the Federal Bureau of Investigation, and the fourth is used primarily by the National Archives and Records Administration. Descriptions of the Properties are attached to this Confidential Executive Summary. The term of each Government Lease expires on the respective date shown on the Property Summary. None of the Government Leases provides for fixed renewal or extension terms.

FEDERAL BUREAU OF INVESTIGATION

This four–story Class A LEED Gold Certified Office Campus serves as the State of Oregon’s headquarters for the Federal Bureau of Investigation. The campus consists of an 112,224 SF office building, 223-car secured parking structure, 21,400 SF vehicle maintenance annex and 535 SF vehicle screening facility. The office building houses typical office and service functions as well as specialized functions such as forensic evidence processing and storage, investigation processing and interview, polygraph examinations. It features Level IV Security with a progressive collapse structural system and blast force protection.

SPECIFICATIONS

Location : 9109 NE Cascades Parkway Portland, OR 97220

Total size : 134,159 rentable square feet

Leasehold terms : 20-Year Firm Leasehold Interest

Ground Lease Terms : 75 Year term with one, 14 Yr renewal

Total acreage : 8 Acres

Parking : 223 Total Site Parking

LEED certified : LEED Gold Certified

FEDERAL BUREAU OF INVESTIGATION

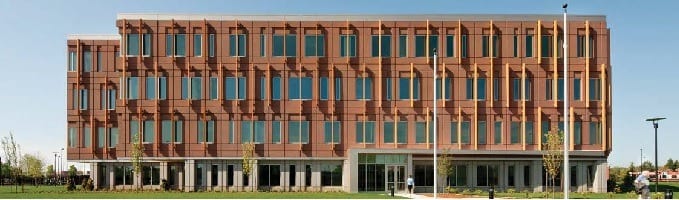

The Federal Bureau of Investigation Field Office in Minneapolis, MN is a five–story Class A LEED Gold Certified Office Campus that serves as the central command post for FBI law enforcement activities in Minnesota, North& South Dakota. The campus consists of a 134,770 SF office building, 300–car secured parking structure, 27,225 SF vehicle maintenance annex, and 535 SF vehicle screening facility. The office building houses typical office and service functions as well as specialized functions such as forensic evidence processing and storage, investigation processing and interview, polygraph examinations. It features Level IV Security with a progressive collapse structural system and blast force protection.

SPECIFICATIONS

Location : 1501 Freeway Boulevard Brooklyn Center, MN 55430

Total size : 162,530 RSF

Lease terms : 20-Year Firm Lease

Total acreage : 8.57 Acres

Parking : 347 Total Site Parking

LEED certified : LEED Gold Certified

FEDERAL BUREAU OF INVESTIGATION

This four–story Class “A” LEED Gold Certified Office Campus serves as the Federal Bureau of Investigation Field Office for Southern Ohio. The campus consists of a 90,112 SF office building, 180–car secured parking structure, 18,227 SF vehicle maintenance annex and 535 SF vehicle screening facility. The office building houses typical office and service functions as well as specialized functions such as forensic evidence processing and storage, investigation processing and interview, polygraph examinations. It features Level IV Security with a progressive collapse structural system and blast force protection.

SPECIFICATIONS

Location : 8020 Montgomery Road Sycamore Township, OH 45236

Total size : 108,874 rentable square feet

Lease terms : 20-Year Firm Lease

Total acreage : 6.26 Acres

Parking : 202 Total Site Parking

LEED certified : LEED Gold Certified

FEDERAL BUREAU OF INVESTIGATION

The National Personnel Records Center in St. Louis, MO is one of the National Archives and Records Administration’s largest operations. It is a central repository of personnel–related records, both military and civilian. Its mission is to provide world class service to government agencies, military veterans, former civilian Federal employees, family members as well as researchers and historians. This property sits on 29.5 acres and offers 239,690 SF of office, lab and exhibit space with a 235,000 SF archival records center. It houses 2.3 million boxes on 29–box high structural steel shelving record storage, the first of its kind for NARA.

SPECIFICATIONS

Location : 1829 Dunn Road St. Louis, MO 63138

Total size : 474,690 rentable square feet

Lease terms : 20-Year Firm Lease

Total acreage : 29.50 Acres

Parking : 700 Total Site Parking

LEED certified : LEED Certified

ABOUT Net Lease Capital Advisors

To meet the needs of investors seeking a stable long-term real estate investment with high leverage and a low equity requirement, which can serve as replacement property for 1031 exchanges, Net Lease Capital Advisors, Inc. (“NLCA”) has identified and secured four single-tenant properties (the “Properties”) leased by the United States of America. The transaction structure has been designed to enable multiple investors to use an interest in these Properties for purposes of gain deferral under Section 1031 of the Internal Revenue Code (“IRC”). Michael Weitzner of Clearview Trading Advisors, Inc. (“Clearview”), a registered broker-dealer and member of the Financial Industry Regulatory Authority, is the managing broker-dealer for the offering.