THE RIDGE WEST VIRGINIA UNIVERSITY dst

350 Wedgewood Dr. Morgantown, West Virginia 26505

Investor Equity: $

Total Offering: $

- Loan Proceeds: $

- Loan-to-Value:

- Minimum Investment[1031]: $

Home to over 28,000 students, West Virginia University offers 353 majors in diverse programs including agriculture, business, creative arts and nursing in 15 colleges. Recently, several of its graduate programs including law, engineering and education are ranked in U.S. News and World Report’s 2017 edition of America’s Best Graduate Schools.

THE RIDGE PROPERTY

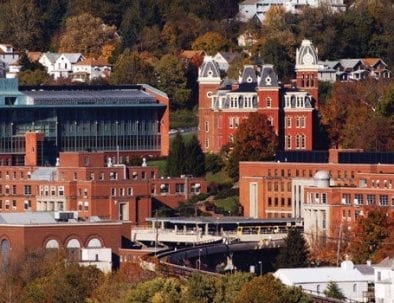

The Ridge is situated less than one mile from West Virginia University in Morgantown, WV. This investment provides a perfect opportunity to acquire a property at a Tier one University in the Big 12 conference. The fully amenitized property was built in 2002 and has an outstanding location and legacy within the WVU market.

INVESTMENT HIGHLIGHTS

MARKET ANALYSIS

Negative enrollment in combination with a surplus of new student beds has impacted the property’s recent performance. However, we believe we are buying the property close to a turning point in the market based on no new off campus supply currently planned over the next three school years and enrollment growth turning positive and projected to increase by an average of 1.2% per year thru 2022.

Axiometrics forecasts the ratio of purpose built bed to enrollment to normalize around 43% if enrollment continues to see positive growth and the number of students comes close to a level seen pre Fall 2013. We believe other buyers have begun to see the same opportunity in the market; and that is to buy at a perceived low cost per bed in a market that will recover over the next couple of years and invest in upgrading the property. A total of three properties are either in escrow or on the market to be sold (which includes The Ridge) and one that can currently be disclosed at the time of this writing is Campus Evolution.

STRATEGY

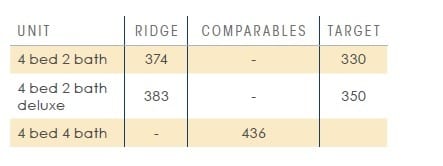

The opportunity to purchase, at what we believe to be a low enough acquisition price, allows us to underprice market rents to a level where we can return the property’s occupancy to 90 percent occupancy. Based on our research, we believe leasing can be accelerated if the 4 bedroom 2 bathroom units are discounted to a greater extent to the 4 bedroom 4 bathroom comparable units in the market. The reduction in rents and 90 percent occupancy we believe will still provide the support the property needs to allow us to target a 5.75 percent distribution before the market fully recovers.

PROPERTY OVERVIEW

THE RIDGE PROPERTY

The Ridge is situated less than one mile from West Virginia University in Morgantown, WV. This investment provides a perfect opportunity to acquire a property at a Tier one University in the Big 12 conference. The fully amenitized property was built in 2002 and has an outstanding location and legacy within the WVU market.

Although the property was nearly 100% occupied for the 2016-2017 academic year, it has experienced a slower leasing velocity and lower current occupancy at 77 percent for the 2017-2018 academic year. As pockets of the national student housing market begin to mature and go through peaks and troughs we believe The Ridge presents itself as a value centric investment opportunity.

Mark Twain’s investment advice was, “Buy a stock and sell it when it goes up. If it doesn’t go up, don’t buy it.” NB Private Capital is not Mark Twain so our approach is not foolproof but we do agree that buying low helps investment returns in the long run. We believe the acquisition price is relatively low compared to what the property value could potentially be using our operational strategy that we have in place over the next couple of years if enrollment begins to climb.

The Ridge is currently being priced at around $23,000 per bed which is about half of what the average price per bed was in 2017 for national B/C student housing transactions. It is also the lowest price per bed compared to the most recent sales comparables. This is why we believe this property to be the most compelling in location, cleanliness and amenities it has to offer.

We believe as the market continues to improve,we will invest in the property providing minor cosmetic upgrades to improve its competitiveness and potentially drive rents higher. Over time, these improvements can potentially bring back the property’s valuation to be in line if not more than the comparables.

ABOUT NB private capital

In 2017, NB Private Capital’s predecessor, Nelson Brothers Professional Real Estate was nominated by Inc. 500 as #129 fastest growing private company. Full cycle properties and Inc. 500 designation were achieved under Nelson Brothers Professional Real Estate. The predecessor for NBPC. According to principal Brian Nelson: “Inc. 500 recognition was amazing. But it incited the fear we may be growing too fast. Our team had proven we could accomplish world class achievements. But that’s not what we’re about. NBPC was created to take the same energy with a dead-centered focus on performance and dramatic improvements with investor relationships, communication and services. Primarily in the DST market space. 2017 tax returns showed 100% tax shelter for the vast majority of NB Private Capital properties.