NNN NORTHWOODS, LLC

Available for §1031 exchange w llc investment

Offering Purchase Price: $13,740,000

Offering Price Per SF: $118.68

- Purchase Date: Fourth Quarter, 2006

- Offering LTV: 59.68%

- Offering Price Cap Rate: 6.72%

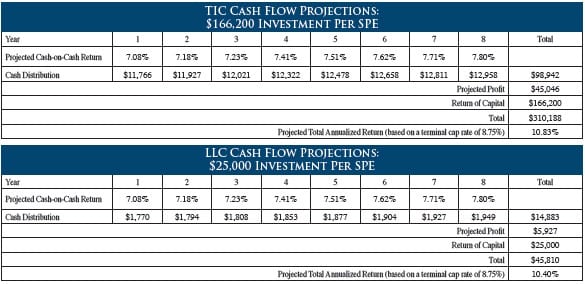

- 1st Year Cash Flow: 7.08%

Northwoods is a 115,770 square foot, 3-story office building located in the Worthington submarket of Columbus, Ohio. The property is located 15 miles north of downtown Columbus and is located directly on High Street (Route 23), a four-lane major artery located 1/4 mile north of I-270.

Available for §1031 exchange w llc investment

The Property is situated on approximately 6 acres and provides tenants with ample parking including 424 surface parking spaces and 29 underground executive spaces for a total of 453 parking spaces.

Property Summary

Northwoods is a 115,770 square foot, 3-story office building located in the Worthington submarket of Columbus, Ohio. The property is located 15 miles north of downtown Columbus and is located directly on High Street (Route 23), a four-lane major artery located 1/4 mile north of I-270. The Property is situated on approximately 6 acres and provides tenants with ample parking including 424 surface parking spaces and 29 underground executive spaces for a total of 453 parking spaces. Northwoods is approximately 99% leased to 16 tenants including: Molina Healthcare, Inc., WFS Financial, AIG, Lawyers Title Insurance Corporation and Salem Media.

Property Information

- Address: 8101 North High Street Columbus, OH 43235

- Building Type: Office Building

- Built: 1988

- Total SF: 115,770

- % Leased: 99%

TIC Offering

- Offering Size: $5,540,000

- Price Per 1% Ownership: $55,400 equity and $82,000 assumed debt

- Minimum Investment per SPE: 3.00% = $166,200 equity and $246,000 assumed debt for a total purchase price of $412,200

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $277,000

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the

property. - Make monthly distributions, which may be partially tax deferred as a result of depreciation and amortization expenses.

- Within approximately ten years, profitably sell the property based on the value added through effective management and operation of the property.

- There is no guarantee that the business plan will be successfully executed, that the property’s value will be enhanced, or that the property will be sold within the planned time period.

- The property is not under contract and no assurance can be given that the purchase will occur when anticipated or at all.

- There is a high 26.1% vacancy rate in the Worthington submarket of Columbus.

- There is a large dependence on one tenant. When its expansion is completed, Molina Healthcare of Ohio, Inc. (“Molina”) will occupy 47,082 square feet, or approximately 40.67% of the Property, under a lease that expires in December, 2013.

Major Tenants (16 Total Tenants)

Molina healthcare of ohio, Inc.

Sq. Ft.: 47,082 Lease Exp.: 12/2013

Molina Healthcare of Ohio, Inc. is a wholly-owned subsidiary of Molina Healthcare, Inc. (“Molina”). Molina (NYSE: MOH) is a managed healthcare companies serving patients who have traditionally faced barriers to quality healthcare – including individuals covered under Medicaid, the Healthy Families Program, the State Children’s Health Insurance Program and other government-sponsored health insurance programs. Molina focuses primarily on the Medicaid and low-income population, and is committed to case management, member outreach and low-literacy programs.

WFS Financial

Sq. Ft.: 8,097 Lease Exp.: 04/2011*

In 1973, WFS Financial Inc (“WFS”) was an auto loan lender that began operations with one dealer in one state. It grew quickly, expanding its territory and making auto loans to consumers through automobile dealerships across California. Today, over 30 years later, WFS has become a national lender with approximately 8,600 dealer relationships nationwide. With a portfolio of over $12 billion, WFS is the nation’s largest non-captive securitizer of automobile contracts. It offers a full spectrum of prime and non-prime credit quality automobile loans through its network of dealer relationships and also offer refinancing and end-of-term leasing options directly to consumers. WFS Financial was formerly traded on the NASDAQ, but became a wholly owned subsidiary of Wachovia Corporation after its purchase in March 2006. *Tenant has option to terminate lease after May 2009 with six months notice and payment of termination fee.

Location Information

The city of Columbus was founded in 1812 and has served as the state capital since 1816. The city has gradually grown into the most populous city in the state of Ohio. Helping to facilitate this population growth has been the city’s tremendous land area expansion. Annexation has enabled the city to grow from 39.9 square miles in 1950 to over 225.9 square miles today.

Office Market

- At midyear 2006, the Columbus office market appears to be on an upswing. Vacancy rates have remained reasonably stable since the end of 2005, with decreasing rates in the Downtown, Northeast and Northwest Suburban submarkets.

- With absorption at high levels and vacancy rates decreasing in key markets, the outlook for the Columbus office market for the remainder of 2006 is good.ess

- The unemployment rate in the Columbus Metropolitan Statistical Area decreased during second quarter 2006 from 5.3% at the end of first quarter to a rate of 4.4% currently.

- Economy.com forecasts slow but steady growth of around 10,000 jobs per year for the area, with 2006 expected to be slightly higher and 2007 lower.

ABOUT Triple Net Properties, LLC

Triple Net Properties, LLC has time-tested experience in real estate syndications, acquisitions, development, construction, leasing and property management. Triple Net currently manages a growing portfolio of over 34 million square feet of property in 28 states valued at more than $4.6 billion. Although past performance is no guarantee of future results, Triple Net Properties, LLC has an unparalleled track record and has acquired 249 properties to date. Triple Net and affiliates have sold 90 properties for over $2.0 billion since 2000.

Triple Net Properties, LLC is a wholly-owned subsidiary of NNN Realty Advisors, Inc., a nationwide commercial real estate asset management and services firm.