NNN San Marin Apartments, LLC

Available for §1031 exchange w llc investment

Offering Purchase Price: $18,635,000

Offering Price Per SF: $84,705

- Purchase Date: 2nd Quarter, 2007

- Offering LTV: 64.39%

- Offering Price Cap Rate: 5.95%

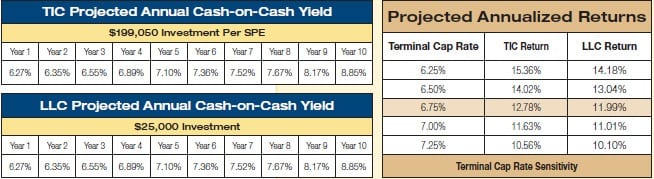

- 1st Year Cash Flow: 6.27%

San Marin Apartments is a 220-unit multifamily community located in one of the most affluent neighborhoods in Corpus Christi, Texas. The Property consists of 10 three-story apartment buildings and a clubhouse containing a leasing office on approximately nine and a half acres. Built in 1998, San Marin Apartments offers tenants a healthy parking supply, with 445 spaces, including 60 attached breezeway garages.

Available for §1031 exchange w llc investment

Individual apartment units feature nine-foot ceilings, ceiling fans, alarm systems, and full size washer dryer connections. The unit mix consists of 88 one-bedroom units, 108 two-bedroom units, and 24 three-bedroom units. The net rentable area of the property is approximately 192,000 square feet, with an average unit size of 873 square feet. San Marin Apartments is currently 94% occupied.

Property Summary

San Marin Apartments is a 220-unit multifamily community located in one of the most affluent neighborhoods in Corpus Christi, Texas. The Property consists of 10 three-story apartment buildings and a clubhouse containing a leasing office on approximately nine and a half acres. Built in 1998, San Marin Apartments offers tenants a healthy parking supply, with 445 spaces, including 60 attached breezeway garages. Community amenities include a pool, sand volleyball court, barbeque/picnic areas, playground, business center, fitness center, and controlled access entry gates. Individual apartment units feature nine-foot ceilings, ceiling fans, alarm systems, and full size washer dryer connections. The unit mix consists of 88 one-bedroom units, 108 two-bedroom units, and 24 three-bedroom units. The net rentable area of the property is approximately 192,000 square feet, with an average unit size of 873 square feet. San Marin Apartments is currently 94% occupied.

Property Information

- Address: 7221 South Staples Street Corpus Christi, TX 78413

- Building Type: Multifamily

- Year Built: 1998

- Total SF: 192,004

- Total Apt. Units: 220

- % Occupied: 94%

TIC Offering

- Offering Size: $6,635,000

- Price Per 1% Ownership: $66,350 equity and $120,000 assumed debt

- Minimum Investment per SPE: 3.00% = $199,050 equity and $360,000 assumed debt for a total purchase price of $559,050

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $331,750

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the

property. - Make monthly distributions, which may be partially tax-deferred as a result of depreciation and amortization expenses.

- Within approximately 10 years, profitably sell the property based on the value added through effective management and operation of the Property.

- There is no guarantee that the business plan will be successfully executed, that the property’s value will be enhanced, or that the property will be sold within the planned time period.

- A military base, located 20 miles northeast of downtown Corpus Christi, was selected for closure. At least 7,000 jobs are expected to be reassigned to other military bases.

- The Property was originally constructed in 1998 and may require more capital expenditures than newer buildings.

Unit Amenities

Nine-Foot Ceilings

- Kitchen Pantries

- Garbage Disposal

- Individual Alarm Systems

- Full-Size Washer & Dryer Connections

- Ceiling Fans

- Fireplaces

Community Amenities

- Clubhouse

- Resort Style Swimming Pool

- Playground

- Fitness Center

- Sand Volleyball Court

- Business Center

- Barbeque/Picnic Area

- Controlled-Access Entry Gates

- Breezeway Garages

Location Information

Founded in 1839 as a trading post, the South Texas city of Corpus Christi was the scene of Mexican War operations and U.S. Civil War skirmishes. The arrival of the railroad in 1881 stimulated a land boom. The exploitation of gas (1923), development of a deepwater port (1926), and discovery of the Saxtet oil field (1939) laid the city’s economic foundation. Today, Corpus Christi has a thriving economy based largely on energy and tourism. Resort facilities are based on the bay and the coastal barrier islands, including Padre Island. The city is also the site of the Corpus Christi Naval Air Station, a branch of Texas A&M University, and home to the sixth-busiest port in the United States. Unemployment is low, 4.5 percent as of December 2006, mirroring the historically-low national average.

Apartment Market

- Per Hendricks and Partners 2006 Overview, vacancy rates in the South submarket in 2006 was 4.9%, down from 5.3% in 2005. Average rents increased from $633 in 2005 to $650 in 2006.

- Corpus Christi has a tight apartment market, with projected population increases and limited new construction, both occupancy levels and rental rates are expected to rise.

- According to the Bureau of Labor Statistics, unemployment in Corpus Christi decreased from 5.5% in July 2006 to 4.5% in December 2006 as the labor force grew from 189,300 to 193,700.

- The tourism industry is thriving in Southeast Texas; 16 new hotels, roughly 1,000 new rooms, are scheduled to be built in the near future. Healthcare and retail are expanding, while new roadways are being built to accommodate population growth. In addition, large-scale mixed-use projects are positioning the area for future expansion, and the planned La Quinta Container Terminal is expected to create thousands of jobs and increase trade volume capacity.

ABOUT Triple Net Properties, LLC

Triple Net Properties, LLC has time-tested experience in real estate syndications, acquisitions, development, construction, leasing and property management. Triple Net currently manages a growing portfolio of over 34 million square feet of property in 28 states valued at more than $4.6 billion. Although past performance is no guarantee of future results, Triple Net Properties, LLC has an unparalleled track record and has acquired 249 properties to date. Triple Net and affiliates have sold 90 properties for over $2.0 billion since 2000.

Triple Net Properties, LLC is a wholly-owned subsidiary of NNN Realty Advisors, Inc., a nationwide commercial real estate asset management and services firm.