nnn springfield apartments, llc

Available for §1031 exchange w llc investment

Offering Purchase Price: $21,175,000

Offering Price Per SF: $73,524

- Purchase Date: First Quarter, 2007

- Offering LTV: 64.11%

- Offering Price Cap Rate: 6.08%

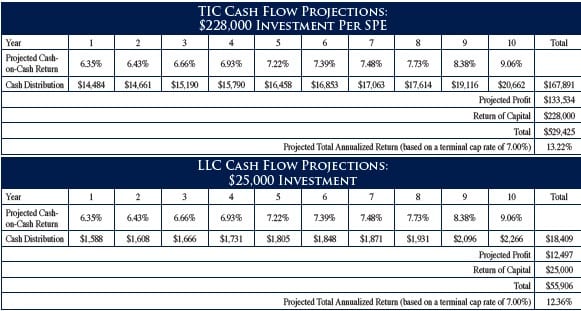

- 1st Year Cash Flow: 6.35%

Springfield Apartments is a 288-unit apartment community in Durham, North Carolina. Located on approximately 32 acres, the 207,712-square-foot property has recently undergone a major renovation, including appliance, cabinetry, countertop, lighting and flooring upgrades throughout 129 units, as well as the 24-hour clubhouse and fitness center.

Available for §1031 exchange w llc investment

Springfield Apartments enjoys easy access from University Drive, and lies just two miles south of the prestigious Duke University and two miles east of Interstate 40. The property is currently 95% occupied, and features a generous parking ratio of 1.5 spaces per unit.

Property Summary

Springfield Apartments is a 288-unit apartment community in Durham, North Carolina. Located on approximately 32 acres, the 207,712-square-foot property has recently undergone a major renovation, including appliance, cabinetry, countertop, lighting and flooring upgrades throughout 129 units, as well as the 24-hour clubhouse and fitness center. Springfield Apartments enjoys easy access from University Drive, and lies just two miles south of the prestigious Duke University and two miles east of Interstate 40. The property is currently 95% occupied, and features a generous parking ratio of 1.5 spaces per unit.

Property Information

- Address: 4600 University Drive

Durham, NC 27707 - Building Type: Multi-Family

- Year Built: 1986

- Total SF: 207,712

- % Occupied: 96%

- Total Apartment Units: 288

TIC Offering

- Offering Size: $7,600,000

- Price Per 1% Ownership: $76,000 equity and $135,750 assumed debt

- Minimum Investment per SPE: 3.00% = $228,000 equity and $407,250 assumed debt for a total purchase price of $635,250

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $380,000

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the

property. - Make monthly distributions, which may be partially tax-deferred as a result of depreciation and amortization expenses.

- Within approximately 5-10 years, profitably sell the property based on the value added through effective management and operation of the Property.

- There is no guarantee that the business plan will be successfully executed, that the property’s value will be enhanced, or that the property will be sold within the planned time period.

- The Property is currently not under contract and no assurance can be given that the purchase will occur when anticipated or at all.

- Due to the age of the Property, there may be a certain amount of functional obsolescence. Older buildings may also require higher capital expenditures to ensure that they maintain a positive, non-dated look in order to attract and retain tenants.

- Competition from apartment communities in the surrounding geographic area may reduce demand for the Property and impact the value of the Property itself.

- Affiliates of the Manager acquired the The Landing Apartments, located approximately seven miles from the Property. Thus, conflicts of interest will exist in managing the Property.

Unit Amenities

- Chair rail in dining area

- Mini and vertical blinds throughout

- European cabinetry

- Walk-in closets

- Screened porches

- Ceiling fans

- Automatic icemakers

- Full size or stackable washer/dryer connections

- Wood burning fireplaces

- Exterior storage rooms

- Vaulted ceilings

Community Amenities

- Clubhouse

- Raquetball court

- 24-hour fitness center

- Swimming pool

- Two car wash areas

- On-site management

- Lighted tennis court

- Indoor jacuzzi

- Picnic area with grills

- Playground area

Location Information

The Raleigh-Durham Metropolitan Area, more commonly referred to as the Triangle, is a thriving metropolis anchored by the cities of Raleigh, Durham, and Chapel Hill. Home to roughly 1.2 million people spread across an area of approximately 3,480 square miles, the Triangle is home to Research Triangle Park and three highly respected research universities – Duke University, the University of North Carolina at Chapel Hill, and North Carolina State University. This confluence of academia, business, and government has resulted in the emergence of the Raleigh-Durham metro area as one of the leading business centers in the United States, with a growing population, strong employment, and a “roaring economy.”

Apartment Market

- As of September 30, 2006, the South Durham submarket has a vacancy rate of 7.1% according to REIS.

- The South Durham submarket consists of 15,229 apartment units in 65 apartment communities. This accounts for approximately 18% of the apartment units within the Raleigh-Durham MSA.

- During the third quarter of 2006, in the South Durham submarket there were no units completed and 15 units absorbed.

- The Raleigh-Durham metro area economy is roaring, with strong employment growth across the board. According to Current Employment Statistics (CES) survey data from the Bureau of Labor Statistics (BLS), non-farm payroll employment was 30,000 (4.1%) higher in July 2006 than in July 2005. Employment growth continues in all sectors, but Financial Activities (up 1,700, or 4.8%) and Professional and Business Services (up 8,100, or 7.3%) are growing fastest.1

- Third Quarter 2006 unemployment rate for Raleigh Durham of 3.6% was substantially lower than the statewide unemployment rate of 4.8% and the national unemployment rate of 4.6%.

ABOUT REALTY ADVISORS, INC.

Triple Net Properties, LLC, a wholly-owned subsidiary of NNN Realty Advisors, Inc., has time-tested experience in real estate syndications, acquisitions, development, construction, leasing and property management. Triple Net currently manages a growing portfolio of over 32.5 million square feet of property in 28 states valued at over $4.3 billion. Although past performance is no guarantee of future results, Triple Net Properties, LLC has an unparalleled track record and has acquired 234 properties to date. Triple Net and affiliates have sold 83 properties valued at over $1.80 billion since 2000.

Securities Offered Through NNN Capital Corp., Member NASD/SIPC 4 Hutton Centre Drive w Suite 700 w South Coast Metro w California w 92707 w (714) 667-8252 January 18, 2007