NNN Woodside, LLC

Available for §1031 exchange w llc investment

Offering Purchase Price: $38,050,000

Offering Price Per SF: $196.65

- Purchase Date: 4th Quarter 2007

- Offering LTV: 61.76%

- Offering Price Cap Rate: 6.28%

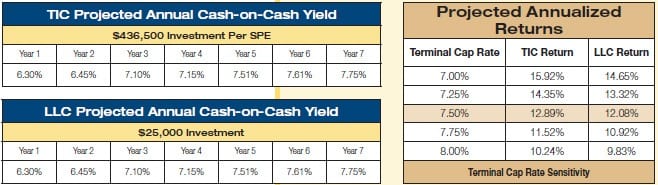

- 1st Year Cash Flow: 6.30%

Woodside is a five-building office portfolio totaling approximately 193,500 square feet in the Portland suburb of Beaverton, Oregon. Located in the master-planned Woodside Corporate Park, the property is located one mile from Highway 26, the state’s major east-west thoroughfare, and eight and a half miles from downtown Portland.

Available for §1031 exchange w llc investment

Built between 1987 and 2000, the buildings are situated on an attractive park-like campus within close proximity to restaurants, shopping and the Tualatin Hills Park and Recreation District. Woodside is 88 percent leased to numerous tenants, including the State of Oregon-Department of Human Services, the Kleinfelder Group, Inc., and Bright Horizons Family Solutions, Inc.

Property Summary

Woodside is a five-building office portfolio totaling approximately 193,500 square feet in the Portland suburb of Beaverton, Oregon. Located in the master-planned Woodside Corporate Park, the property is located one mile from Highway 26, the state’s major east-west thoroughfare, and eight and a half miles from downtown Portland. Built between 1987 and 2000, the buildings are situated on an attractive park-like campus within close proximity to restaurants, shopping and the Tualatin Hills Park and Recreation District. Woodside is 88 percent leased to numerous tenants, including the State of Oregon-Department of Human Services, the Kleinfelder Group, Inc., and Bright Horizons Family Solutions, Inc.

Property Information

- Address: 15050 SW Koll Parkway, 15100 SW Koll Parkway, 15150 SW Koll Parkway, 15655 SW Greystone Court, 15625 SW Greystone Court, Beaverton, OR 97006

- Building Type: Five-Building Office Park

- Year Built: 1987 – 2000

- Total SF: 193,494

- % Leased: 88%

TIC Offering

- Offering Size: $14,550,000

- Price Per 1% Ownership: $145,500 equity and $235,000 assumed debt

- Minimum Investment per SPE: 3.00% = $436,500 equity and $705,000 assumed debt for a total purchase price of $1,141,500

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $727,500

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the

property. - Make monthly distributions, which may be partially tax-deferred as a result of depreciation and amortization expenses.

- Within approximately eight years, profitably sell the property based on the value added through effective management and operation of the property.

- There is no guarantee that the business plan will be successfully executed, that the property’s value will be enhanced, or that the property will be sold within the planned time period.

- The seller of the property is an affiliate of the manager, which could result in a conflict of interest.

- The property will rely upon a master lease of a portion of the property (approximately five percent) by the seller to subsidize income.

- There is a large dependence on a single tenant, the State of Oregon – Department of Human Services leases 48,397 square feet of office space, or approximately 25 percent of the property.

- Although the manager has contracted to purchase the property, no assurances can be given that the company will acquire the property.

- Unless extended by the tenants, the leases representing approximately 48 percent of the property will expire within the next five calendar years. In addition, the leases representing approximately 34 percent of the property contain early termination options.

- Affiliates of the manager previously acquired the remaining seven buildings at Woodside Corporate Park, which could result in a conflict of interest.

- A high vacancy rate of 12.7 percent in the Sunset Corridor office submarket of Portland, Oregon could cause aggressive competition for new and renewal tenants at the property.

Major Tenants (24 Total Tenants)

State of Oregon – Department of Human Services1

www.oregon.gov/DHS

Square Feet: 48,397 Lease Expiration: December 2017

The Department of Human Services is made up of five divisions: Children, Adults and Families Division, Addictions and Mental Health Division, Public Health Division, Division of Medical Assistance Programs, and Seniors and People with Disabilities Division. The mission statement of the DHS is “helping people to become independent, healthy and safe.” The space at the property will be used for the administration of child welfare/family visitation/training by the children, adults and families division.

Option to terminate with not less than 180 days prior written notice to lessor if sufficient funds have not been provided in the legislatively approved budget of lessee to permit lessee in the exercise of its reasonable administrative discretion to continue the lease. During such termination notice period, lessee may negotiate with lessor for continued occupancy in a portion of the premises at a reduced rent. If that is not feasible on mutually acceptable terms, then the lease will terminate at the end of the termination notice period.

1State of Oregon – Department of Human Services has executed its lease, but will not occupy its space or begin paying rent until January 2008.

Bright Horizons Family Solutions, Inc.

www.brighthorizons.com

Square Feet: 16,467 Lease Expiration: May 2012

Founded in 1986, Bright Horizons Family Solutions, Inc. is the world’s leading provider of employer sponsored childcare, early education and work/life solutions. Bright Horizons manages more than 550 Family Centers in the United States, Europe and Canada for more than 400 clients, including 80 of the Fortune 500. Bright Horizons Back-Up Solutions is the leader in one of the hottest trends in work-site child care, meeting emergency child care needs at the workplace, and offering flexible child care arrangements, such as travel care, conference care and stormy-day care.

Northwest Regional Education School District

www.nwresd.k12.or.us

Square Feet: 13,015 Lease Expiration: June 2015

The Northwest Regional Educational Service district is a leader in providing special education, instructional services and technology support to the 20 school districts in the Northwest corner of Oregon; Clatsop, Columbia, Tillamook and Washington counties. Services are provided to over 3,000 students with autism, orthopedic impairments, vision impairments, hearing impairments, and speech impairments through the ESD’s Related Services Department. Northwest Regional ESD is one of the State’s largest providers of Early Intervention/Early Childhood services. As of December 1, 2006, there were 1,500 children being served or in the referral process.

Location Information

Portland, the largest city in the state of Oregon, is located near the confluence of the Willamette and Columbia Rivers. Founded in 1845 and incorporated as a city in 1851, the city was named as a result of a coin toss between founders Francis Pettygrove and Amos Lovejoy. When it came time to name their new town, the gentlemen each wished to commemorate their hometowns of Portland, Maine and Boston, Massachusetts. They settled the argument with a coin toss which Pennygrove won. The city has a diverse economy with a broad base of manufacturing, distribution, wholesale and retail trade, regional government, and business services. Major manufacturing industries include machinery, electronics, metals, transportation equipment, and lumber and wood products. Technology is a thriving part of Portland’s economy, with more than 1,700 high-tech companies located in the metropolitan area.

Office Market

- Overall net absorption for the Portland office market was positive 930,652 for the second quarter 2007.

- Overall vacancy dropped to 10.1 percent in the second quarter 2007; this marked a drop of 120 basis points from the end of the first quarter 2007.

- Average asking rental rates rose 0.4 percent in the second quarter to $19.39 per square foot per year across all property types.

- The Portland metro area has an estimated 2007 population in excess of two million people, making it the 24th largest in the country. The area is expected to have a population of nearly 2.3 million by the year 2012.

- The Portland metro unemployment rates fell from 5.1 percent in January to 4.7 percent in May 2007. Area businesses added 15,800 new jobs over the past year with construction being one of the fastest-growing industries, adding 1,500 jobs in May for an annual growth rate of 5.4 percent.

- According to Frommer’s® Cities Ranked & Rated, 2nd Edition, the Portland metropolitan region is the third most desirable place to live in the United States.

ABOUT Triple Net Properties, LLC

Triple Net Properties, LLC has time-tested experience in real estate syndications, acquisitions, leasing and property management. Triple Net currently manages a growing portfolio of over 39 million square feet of real estate in 29 states valued in excess of $5.4 billion. Although past performance is no guarantee of future results, Triple Net Properties, LLC has an unparalleled track record and has acquired 293 properties to date. Triple Net and affiliates have sold 107 properties for more than $2.5 billion since 2000.

Triple Net Properties, LLC is a wholly-owned subsidiary of NNN Realty Advisors, Inc., a nationwide commercial real estate asset management and services firm.