North Austin Apartment Portfolio DST

Value-Add Class B Multifamily Portfolio in North Austin Available for 1031 Exchange

TOTAL OFFERING PRICE: $44,640,000

Equity Offering Amount : $21,030,000

- Non-Recourse Debt: $23,610,000

- offering loan to value (ltv): 52.89%

- minimum purchase : $100,000

- Minimum Purchase: $25,000

North Austin Apartment Portfolio DST is a 422-unit Class B Multifamily portfolio with 3 properties that is projected to provide year-1 investor cash flow of 6.25% and the potential to increase income and add value by upgrading approximately half the units.

Value-Add Class B Multifamily Portfolio

ExchangeRight is committed to providing 1031-exchangeable DST offerings of value-added multifamily properties and net-leased portfolios. Our multifamily platform targets Class B apartments with stable income and valueadded upside potential.

underwriting highlights

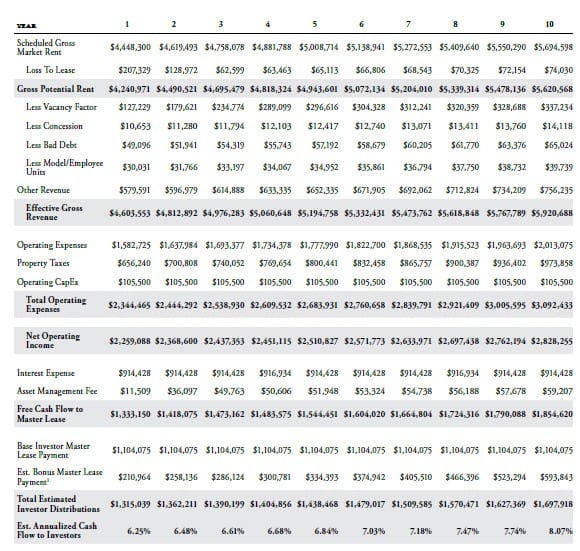

- Initial cash flow projected to be 6.25%, growing to 8.0%+ over a 10-year period and averaging 7.0% over the hold period.

- Economic occupancy underwritten at approximately 92.5% though the property was currently averaging 97.3% physical and 95.7% economic occupancy and the market occupancy for Class B is 97.7%.1

- Years 1 and 2 Net Operating Income (NOI) conservatively underwritten to have no growth in years 1 and 2 of operations when compared to historical financials.

- Offering Loan to Value anticipated to be 52.89% with a Debt Service Coverage Ratio average of 2.79x per annum over a 10-year hold.

- 10-year operating expense growth rate average underwritten to 3.65%, outpacing underwritten EGR growth rate by a factor of 30%. NOI growth over 10-year hold period is underwritten at 1.98%.

- $2.5 million of accountable reserves are being funded by the lender and investors to execute on the property upgrades and to provide an operating reserve cushion, with over $1.0 million in excess reserves above identified replacements projected over the next 10 years:

- $670,000 for unit interior renovations

- $160,000 for common-area upgrades

- $1.55 million for upfront replacement reserve funding and contingency

- $100,000 for initial operating reserves

Bonus Master Lease Payments are estimated payments that would be paid to investors if the property produces revenues in excess of annual effective gross revenue benchmarks. There is no guarantee that the property will produce the necessary effective gross revenue to earn bonus rent payments.

Projected base master lease cash flows are ultimately dependent on the successful operation of the property. Significant and sustained underperformance of the property could cause a delay or disruption to cash flow. The Trust is expected to be capitalized with upfront and ongoing reserves, but there is no guarantee that these reserves will be sufficient to protect investors from experiencing delays or disruptions to cash flow. Please carefully review the risks of this offering before considering an investment.

Property Details

Community Amenities

- Leasing Office

- Swimming Pool

- Laundry Facilities

- Gated Community

- Walking Distance to Adjacent Quail Creek Park & North Austin YMCA

- Year Built 1984

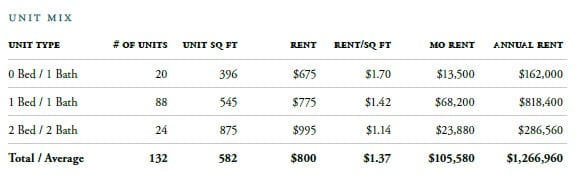

- No. of Buildings 132 units

- Net Rentable Area 76,880 sq ft

- Avg. SqFt/Unit 582 sq ft

- Occupancy/Leased 98%

- Land Area 3.9 acres

- Density 33.8 units/acre

asset manager experience

ExchangeRight and its affiliates are currently managing over $600 million of assets including 22 apartment communities consisting of over 4,000 units in Alabama, Louisiana, North Carolina, South Carolina, Texas, and Georgia and 195 single-tenant retail properties located across 27 states. ExchangeRight principals have an extensive background investing in Class B multifamily over the past 15 years, taking a value-added approach

through common-area and unit upgrades, hands-on management, and operating expense control to maximize cash flow and total returns.

property Manager

Since its entry into the marketplace in 1995, United Apartment Group has increased the number of its managed units more than twenty-five times over and watched its portfolio value of those properties approach the billion-dollar mark and over 50,000 units. Headquartered in San Antonio, TX, its steady increase in both unit occupancy and management renewal contracts is a result of executive leadership and highquality, positive interactions with the residents under their care. Each type of community receives UAG’s full complement of management services and due diligence.

Working Together

ExchangeRight will work closely with United Apartment Group to ensure that all potential avenues of income and value creation are being pursued on behalf of investors in this property. Our master lease is structured to align our interests with investors’, as master lease participation occurs only if we are able to control expenses and drive rents and effective gross revenues higher.

ABOUT Exchange Right

ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 and 1033 investors. Our goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. We target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

ExchangeRight launched its 1031-exchangeable DST multifamily platform in 2015 targeting Class B apartments with stable income and value-added upside potential. Our multifamily offerings feature strong cash flow, high debt coverage ratios, conservative underwriting, long-term fixed-rate financing, and the potential to enhance return with value-added strategies.

ExchangeRight also raises limited preferred equity capital that allows accredited investors to participate in the cash flow and profits of our 1031 platform. This preferred equity is used alongside ExchangeRight’s capital to invest in the acquisition and inventorying of individual net-leased assets prior to their being structured in DST portfolios for offering to exchange investors. These preferred equity funds can provide investors with enhanced liquidity and short-term returns, and exit options with each DST portfolio disposition.