Oak Park Office Center, LLC

Available for §1031 exchange w llc investment

Offering Purchase Price: $9,354,800

Offering LTV: 56.07%

- Purchase Date: October 30, 2008

- Offering Price Cap Rate: 7.86%

- 1st Year Cash Flow: 8.50%

Oak Park Office Center is an approximately 151,000-squarefoot Class A office building in Oak Park at Westchase, a 225- acre master-planned office park in Houston.

Available for §1031 exchange w llc investment

Situated on more than 11 acres, the building offers high visibility along the Sam Houston Parkway (Beltway 8). Oak Park Office Center features a two-story atrium complete with marble walls, wood accents and both cove and pendant lighting.

Property Summary

Oak Park Office Center is an approximately 151,000-squarefoot Class A office building in Oak Park at Westchase, a 225- acre master-planned office park in Houston. Situated on more than 11 acres, the building offers high visibility along the Sam Houston Parkway (Beltway 8). Oak Park Office Center features a two-story atrium complete with marble walls, wood accents and both cove and pendant lighting. The building has open floor plans, card key access, two electric vehicle fueling stations and cameras at all entries. The property offers ample parking with 855 parking spaces, an overall ratio of 5.7 spaces per 1,000 rentable square feet. Oak Park Office Center is conveniently located 30 minutes from both of Houston’s major airports and 10 minutes from the Houston Galleria. The property is currently 100 percent leased to Jacobs Engineering Group Inc. and 100 percent subleased to CB&I Inc.

- Address 6001 Rogerdale Road Houston, TX 77072

- Building Type Office

- Year Built 2008

- Total Square Foot 151,000

- Percentage Leased 100%

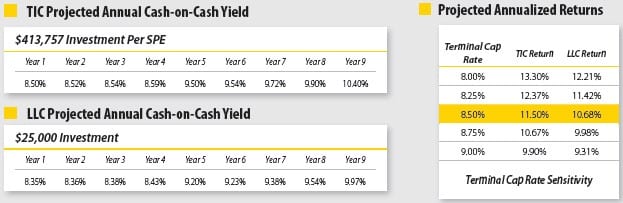

TIC Offering

- Offering Size: $4,110,000

- Price per 1% Ownership: $137,919 equity and $176,000 assumed debt

- Minimum Investment per SPE: 3% = $413,757 equity and $528,000 assumed debt for a total purchase price of $941,757

- Suitability: Accredited Investors Only

LLC Offering

- Offering Size: $4,110,000

- Price Per Unit: $5,000

- Minimum Investment: $25,000

- Suitability: Accredited investors only

Business Plan

- Preserve the capital investment.

- Realize income through the acquisition, operation and sale of the

property. - Make monthly distributions, which may be partially tax-deferred

as a result of depreciation and amortization expenses. - Within approximately 9 years, profitably sell the property based on the value added through effective management and operation of the property.

- There is no guarantee that the business plan will be successfully executed, that the property’s value will be enhanced, or that the property will be sold within the planned time period.

- The property is located within the desirable 225-acre masterplanned office park, Oak Park at Westchase, home to major corporations such as Halliburton and Quest Diagnostics.

- The property is located at the intersection of two major transportation arteries, Beltway 8 and the Westpark Tollway, and just minutes from Interstate 10, which runs east-west across the entire Houston metropolitan area. In addition, both of Houston’s major airports are within a 30-minute drive.

Tenant

Jacobs Engineering Group Inc.

www.jacobs.com

Square Feet Leased: 151,000 or 100% of the property

Lease Expiration: June 2018*

Jacobs Engineering Group Inc. was founded in 1947 and has since grown steadily to become one of the world’s largest and most diverse engineering service firms. One of Fortune magazine’s most admired companies with 38,000 employees in 160 offices in 20 countries, the company offers full-spectrum support to industrial, commercial and government clients across multiple markets and has annual revenues in excess of $11 billion.

Much of Jacobs Engineering’s revenues are generated from construction projects for the chemical, petroleum and pharmaceutical and biotech industries. U.S. government contracts, chiefly for aerospace and defense, also add significantly to the company’s revenue.

Subtenant

CB&I Inc.

www.cbi.com

Square Feet Subleased: 151,000 or 100% of the property

Sublease Expiration: December 31, 2012*

CB&I, formerly known as Chicago Bridge & Iron Company, designs, engineers and constructs some of the world’s largest energy infrastructure projects, providing a full spectrum of engineering, procurement and construction solutions and process technologies. Drawing upon more than a century of experience and approximately 16,000 employees worldwide, CB&I executes more than 600 projects a year through its three business sectors: CB&I Lummus builds upstream and downstream oil & gas projects, LNG liquefaction and regasification terminals, and a wide range of other energy related projects; CB&I Steel Plate Structures designs, fabricates and constructs storage tanks and containment vessels and their associated systems for the oil & gas, water & wastewater, mining and nuclear industries; Lummus Technology capitalizes on more than 1,500 patents and patent applications to provide process technologies, catalysts and specialty equipment for petrochemical facilities, oil refineries, and gas processing plants.

Location Information

Named in honor of the Lone Star State’s founding father, General Sam Houston, the city of Houston was founded in 1836. It is the largest city in the state of Texas and the fourth-largest in the United States. The port and railroad industry, combined with oil discovery in 1901, led to rapid growth of the city’s population. In the middle of the 20th century, Houston became the home of the Texas Medical Center — the world’s largest concentration of healthcare and research institutions — and NASA’s Johnson Space Center, home to Mission Control Center. Houston’s economy has a broad industrial base in the energy, aeronautics and technology industries; only New York City is home to more Fortune 500 company headquarters.

Office Market

- Overall occupancy in the Houston office market ended the fourth quarter of 2009 at 83.6 percent.

- The Houston office market’s net absorption for the fourth quarter of 2009 was negative 295,713 feet, bringing the total net absorption for 2009 to negative 2,409,560.

- Houston continues to be one of the nation’s leading office markets, driven by a strong local economy and an expanding business climate. In addition to being the “Energy Capital of the World”, Houston has emerged as a major center for international business, serving as the home of several of the largest energy, engineering and construction firms in the world.

- Houston is home to 26 Fortune 500 company headquarters, second only to New York City. Houston’s economy is being driven by companies in dynamic, high-tech sectors such as electronics, computers, software, biomedical technology, aerospace, integrated power and plastics manufacturing.

ABOUT Grubb & Ellis Realty Investors, LLC

Grubb & Ellis Realty Investors, LLC is the real estate investment and asset management subsidiary of Grubb & Ellis Company (NYSE: GBE), a leading real estate services and investment firm. Grubb & Ellis Realty Investors and affiliates manage a growing portfolio of assets valued in excess of $5.8 billion located throughout 29 states. One of the nation’s most active buyers and sellers of commercial real estate, Grubb & Ellis Realty Investors has completed acquisition and disposition volume totaling approximately $12.2 billion on behalf of program investors since its founding in 1998; more than 70 percent of this volume has been transacted since January 1, 2005.