Self-Storage Portfolio II DST

Knoxville, Tennessee metro area|Eight (8) self-storage properties

Beneficial Interests: $21,827,931

Offering Price: $40,802,931

- Loan Proceeds: $18,975,000

- Current Cash Flow: 5.00%

- Loan-to-Offering Price Ratio: 46.50%

- Minimum Investment[1031]: $100,000

Self-Storage Portfolio II DST, a newly formed Delaware statutory trust (DST), also known as the Trust,and an affiliate of Inland Private Capital Corporation (IPCC), is hereby offering (the Offering) to sell to certain qualified, accredited investors (Investors), pursuant to a Private Placement Memorandum dated November 1, 2016 (the Memorandum), 100% of the beneficial interests (Interests) in the Trust.

Eight (8) self-storage properties

In the aggregate, there are approximately 3,452 storage units accounting for 415,616 square feet of self-storage space and 101 rentable parking spaces totaling 23,350 square feet of outside parking space at the Properties.The Properties offer self-storage facilities for storing various household and commercial items as well as parking and/or storing a boat, RV or any motorized vehicle, with customizable storage options.

INVESTMENT HIGHLIGHTS

An investment in Self-Storage Portfolio II DST may offer the following benefits:

• Opportunity to Invest in Self-Storage Assets

According to the Self-Storage Association, a not-for-profit trade association representing the self-storage industry, the self-storage industry has been the fastest growing segment of the commercial real estate industry over the last 40 years. The U.S. self-storage industry generated approximately $31.6 billion in annual revenues in 2015.

• Property Locations in an MSA Boasting Superior Economic Growth with Strong Property Occupancy and Operating History

The Knoxville MSA’s unemployment rate has remained low and it is expected to continue to improve from the recent recession much faster than other metro areas. As of September 30, 2016, the average physical occupancy rate for the Properties, based on rentable square footage, was approximately 92.2%.The Offering consists of eight separate assets strategically positioned within the Knoxville MSA. This dominant geographic positioning creates management efficiencies while allowing for favorable pricing power and control of the Knoxville MSA which should drive Metro Storage’s ability to maximize rent, minimize discounts, and establish significant influence over rental rates.

• Experienced Property Management

Each of the Properties will be managed by Metro Storage, an established operator of self-storage properties. Metro Storage has positioned itself as one of the nation’s premier self-storage operators. As of 2016, Metro Storage was the third largest private self-storage company in the country and the ninth largest among private and public self-storage companies. Metro Self Storage operates 100 locations in 12 states serving 75,000 customers annually.

• Long-term, Fixed Rate, Amortizing Loan

The Properties will be financed with a loan that is expected to have a term of 10 years, with principal amortizing in years six through 10 on a 30-year schedule. The loan is expected to bear interest at a variable rate, which will be fixed at an estimated rate of 4.0% per annum pursuant to a swap agreement.The loan may be prepaid, in full or in part at any time, without penalty, subject to the breakage costs associated with terminating the swap agreement. See “Financing Terms.”

• Master Lease Structure

The Trust will lease each of the Properties to an affiliate of IPCC (the Master Tenant),pursuant to a master lease agreement (the Master Lease). The Master Tenant will sublease or rent the storage units and the rentable parking spaces, if any, at each of the Properties to space tenants pursuant to rental agreements. The Master Lease structure will allow the Master Tenant to operate the Properties on behalf of the Trust and to enable actions to be taken with respect to the Properties that the Trust would be unable to take due to tax law-related restrictions, including,but not limited to, a restriction against re-leasing the Properties. See “Summary of the Leases – Master Lease.”

THE FINANCING

The Trust expects to finance the Properties with a loan in the original principal amount of $18,975,000 (the Loan) from First Merchants Bank, an Indiana chartered banking institution (the Lender). The Loan will be secured by a deed of the trust on the Properties. Although financing arrangements for the Properties have yet to be finalized,the Trust anticipates that the Loan will have a 10-year term, maturing in 2026, and will bear interest at a variable rate equal to LIBOR plus 2.25%. Concurrent with obtaining the Loan, the Trust expects to enter into an interest rate swap agreement with the Lender. For purposes of the Memorandum, the effective fixed interest rate pursuant to the swap has been estimated at 4.0% per annum. The Loan may be prepaid, in full or in part at any time,without penalty, subject to the breakage costs associated with terminating the swap agreement.

THE OFFERING

The Offering is designated for accredited investors seeking to participate in a tax-deferred exchange as well as those seeking a quality, multiple-owner real estate investment.Only accredited investors may purchase interests in this Offering. For more information, see “Summary of the Offering” and “The Offering.”

The PROPERTY MANAGER

Each of the Properties will be managed by Metro Storage LLC, operating as Metro Self Storage® (Metro Storage), an established operator of self-storage properties. Metro Storage built the first self-storage facility located in the Midwest in 1973 and as of 2016 had over $1 billion of assets under management or development. Metro Storage is one of the top 10 largest owner/operators of self-storage facilities in the United States with over 100 properties covering 12 states. Metro Storage has positioned itself as one of the nation’s premier self-storage operators and, as of 2016, was the third largest private selfstorage company in the country and the ninth largest among private and public self-storage companies. As of September 30, 2016, Metro Storage operated over 6.4 million rentable square feet of self-storage space, consisting of over 56,000 self-storage units

PROPERTY OVERVIEW

Eight (8) self-storage properties

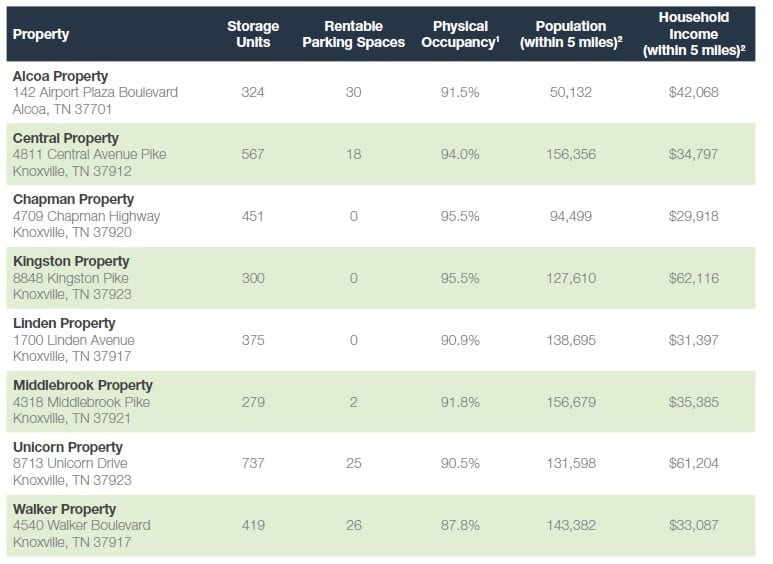

In the aggregate, there are approximately 3,452 storage units accounting for 415,616 square feet of self-storage space and 101 rentable parking spaces totaling 23,350 square feet of outside parking space at the Properties.The table on the next page summarizes certain information about each Property. See “The Properties” for additional detail. Also see “Risk Factors – Risks Related to the Properties.”

The Properties offer self-storage facilities for storing various household and commercial items as well as parking and/or storing a boat, RV or any motorized vehicle, with customizable storage options. The structure of the buildings vary from concrete block and metal with brick finish to steel structures with prefabricated metal rib roofing.

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.