Zero Coupon Chicagoland Office DST

1299 ZurichWay in Schaumburg, Illinois

Beneficial Interests: $66,473,739

Offering Price: $399,480,642

- Loan Proceeds: $333,006,904

- Current Cash Flow: 0.00%

- Loan-to-Offering Price Ratio: 83.36%

- Minimum Investment[1031]: $25,000

Newly built Class A single-tenant office property comprised of 788,857 square feet located in a Northwest suburb of Chicago, ILInland Private Capital Corporation (IPC) is sponsoring the offering of 100 percent of the beneficial interests in Zero Coupon Chicagoland Office DST,a to-be-formed Delaware statutory trust (the Trust).The Tenant is a member company of Zurich Insurance Group (Zurich), a leading multi-line insurer that serves its customers in global and local markets.

Class A Office Building

The Trust will own the real estate and improvements located at 1299 ZurichWay in Schaumburg, Illinois (the Property), consisting of approximately 38.8 acres of land and an 11-story (plus basement) single- tenant office building leased to Zurich American Insurance Company (the Tenant).The campus provides 2,666 parking spaces, 2,501 of which are within the parking garage, and is the largest suburban office campus in the country.

INVESTMENT HIGHLIGHTS

INVESTMENT STRATEGY

The 1031 Exchange

The Property is highly leveraged and, by design, will produce no cash flow. An investment in the Trust may be especially appropriate for those selling a property and looking for suitable replacement property(ies) to execute a 1031 exchange. To meet IRS rules and accomplish a successful 1031 exchange, there must be equal or greater debt on the replacement property(ies). Through an investment in the highly leveraged Property, Investors have the opportunity to cover the debt associated with their relinquished property, and to deleverage their current debt position through the self-amortizing structure of this investment. The fully amortizing Loan also will give prospective Investors the opportunity to grow their equity position through the life of their investment. Many investors own business/income-producing properties that are encumbered by high levels of debt or investors may be interested in increasing the amount of debt on their investment, therefore creating the need for a highly leveraged opportunity.

Passive Loss Benefits

This investment is projected to generate passive activity losses for cash Investors through 2025. An Investor’s passive losses, if any, from an investment in Zero Coupon Chicagoland Office DST may be used to offset passive income generated by other passive real estate investments.Generally, for cash Investors, passive activity losses will arise in a year if the sum of (a) deductible loan payments (e.g., payments of interest on the Loan) and (b) any depreciation to which an Investor is entitled, exceeds the income generated by the investment in the year.

Given the complex nature of such tax strategies, it is imperative that Investors consult their own accounting and tax professionals to discuss this strategy further. Each Investor’s tax circumstances are unique, and this information does not constitute tax advice for any particular Investor.

THE OFFERING

The Trust will be offering (the Offering) to sell to certain qualified,accredited investors(Investors)100 percent of the beneficial interests in the Trust. The Offering is designed for accredited investors seeking to participate in a tax-deferred exchange as well as those seeking a quality, multiple-owner real estate investment.

THE FINANCING

Loans

The Property is subject to a mortgage loan, as described in the Memorandum (the Loan), from Wells Fargo Bank Northwest,National Association, as Trustee (the Lender). The original principal amount of the Loan is $333,134,755.94.The Loan has a maturity date of November 15, 2037 and a fixed interest rate equal to 4.918% per annum. The Trust will be required to make consecutive monthly payments of principal and interest, amortized over the remaining term of the Loan, with interest calculated on the basis of a 360-day year. The total amount of the monthly debt service payment (including the payment of a monthly trustee fee) is equal to the corresponding monthly base rent payable by the Tenant under the Lease. Through financing with monthly debt service equal to monthly base rent, a high loan-to-value ratio can be achieved, while also fully amortizing the Loan within the initial Lease term.

All income from the Property will be used to pay the Loan and thus no cash will be available for distribution to Investors while the Loan is outstanding.

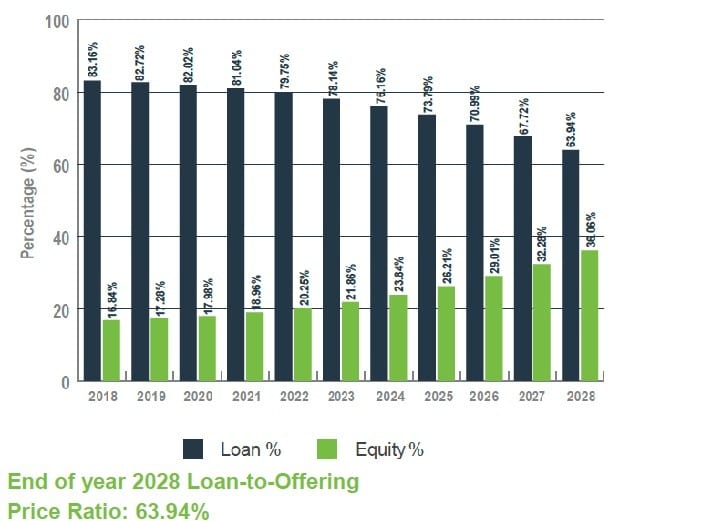

Amortization Schedule

This chart is designed to illustrate the concept of equity growth through principal amortization. These projections are based on the value of the Property remaining the same as at the date of acquisition. There is potential for property value loss, as with all real estate investments, therefore, these projections may not be realized if the value of the Property decreases.There is no guarantee that investment objectives will be achieve or that Investors will receive a return of their capital or any projected equity growth.

PROPERTY OVERVIEW

Class A Office Building

Constructed in late 2016, this Class A office building is 100 percent leased to the Tenant. The Property encompasses 788,857 square feet and is an 11-story building, home to nearly 3,000 employees and contractors, as well as Zurich’s executive team. The campus provides 2,666 parking spaces, 2,501 of which are within the parking garage, and is the largest suburban office campus in the country.

The U.S. Green Building Council has awarded the Property the LEED Platinum certification for the facility’s environmental sustainability initiatives, including multiple green roofs, energy efficient technologies, rainwater harvest and re-use, and a lush landscape with more than 600 trees. With Zurich’s commitment to the environment, it was essential that the building be efficient, inspiring and enhance employee wellness.

Zurich was also awarded the Build-to-Suit Project of the Year for its North America headquarters at the 29th annual Chicago Commercial Real Estate Awards and was the recipient of the 2017 International Architecture Award.

Building features:

• Fitness center

• Yoga studio & spin room

• Cafeteria

• Coffee bar station

• Sit / stand desks

• 200-seat theater room (for broker events & training)

• Outdoor terraces

• Walking trails

• Outdoor volley ball courts

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.