Thinking of investing your proceeds in a NNN property? NNN lease agreement is a legal agreement between the landowner and tenant in which the tenant agrees to cover everything from monthly property rent to property taxes, property insurance and common area maintenance.

In short, NNN lease investments help you tackle all landlord responsibilities while earning regular passive income every month. And in addition to the triple net lease properties, you can also invest in single net and double net properties.

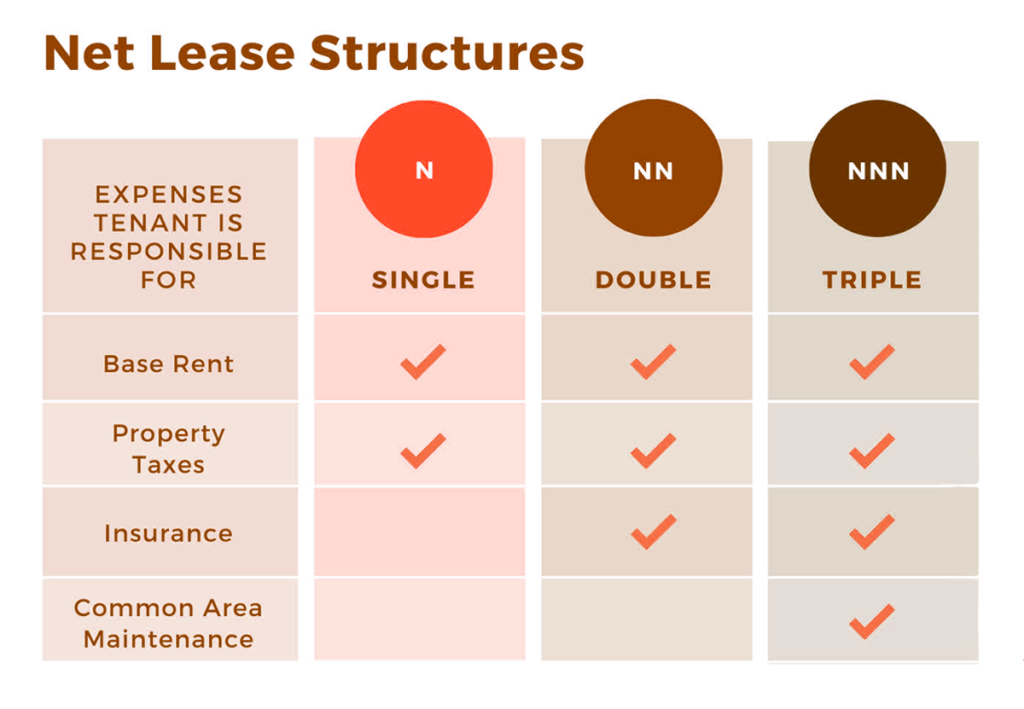

While all three are legal lease agreements, a single net lease requires to cover just the base rent and property taxes, whereas the tenant must cover base rent, insurance and property tax under a double net lease property.

Here’s how a triple net lease differs from single and double net leases.