Colorado Springs Multifamily DST

5520 Woodmen Ridge View in Colorado, Springs, Colorado

Beneficial Interests: $28,974,578

Offering Price: $64,974,578

- Loan Proceeds: $36,000,000

- Current Cash Flow: 4.75%

- Loan-to-Offering Price Ratio: 55.41%

- Minimum Investment[1031]: $100,000

Estate at Woodmen Ridge Apartment Homes

INVESTMENT HIGHLIGHTS

IPC believes that an investment in the Trust offers the following benefits:

Strong Location

• 2017 average household income of $103,305 within a three-mile radius

• Year-ago job growth is outpacing the state average

• Job additions are widespread, with construction, healthcare and finance leading gains

• Unemployment rate has fallen below 3% for the first time since the early 2000s, with average hourly earnings significantly increasing over the past six months

• Educated population with 29.59% having a degree higher than an

associate’s degree

Property Performance

• 91.2% occupancy as of 9/20/17

• $1,358 average rent as of 9/20/17

• Other potential income streams from the Property include pet fees,utility reimbursement, garage/parking fees and more

Experienced Property Management

• Inland management team has extensive experience in all aspects of acquiring, owning, managing and financing multifamily properties

• Acquired and managed more than 73,500 multifamily units throughout the United States as of 6/30/17

• Inland has a large multifamily presence in Colorado and will have approximately 3,220 units under management across the state, including Estate at Woodmen Ridge Apartment Homes

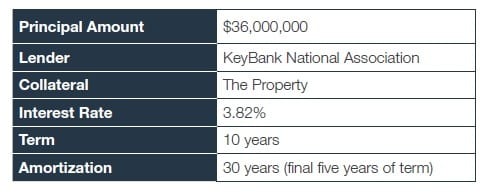

Long-Term, Fixed Rate, Amortizing Loans

• Loan will have a 10-year term

• Fixed interest rate equal to 3.82% per annum

• Monthly payments of principal and interest for final five years of the term

• Principal amortizing on 30-year schedule (final five years)

Master Lease Structure

• Master lease structure will allow Master Tenant to operate the Property on behalf of the Trust

• Will enable actions to be taken that the Trust would be unable to take, such as a restriction against re-leasing

THE OFFERING

The Offering is available to accredited investors seeking to participate in a tax-deferred exchange as well as those seeking a quality, multiple-owner real estate investment.Only accredited investors may purchase interests in this Offering. For more information, see “Summary of the Offering” and “The Offering” in the Memorandum.

THE FINANCING

The Trust expects to obtain a loan secured by a first mortgage on the Property (the Loan) through the Freddie Mac Capital Markets Execution Multifamily Standard Rate Lock Loan Program. Investors should note that the financing terms had not yet been finalized as of the date of the Memorandum. The material terms of the Loan are expected to be as follows.

PROPERTY OVERVIEW

Woodmen Ridge Apartment Homes

Estate at Woodmen Ridge Apartment Homes is a classically designed one-, two- and three-bedroom multifamily community. Capturing a resort feel, unit features include all electric kitchens, spacious closets, in-unit washers and dryers and more. Residents can take advantage of the long list of community amenities including a swimming pool, state-of-the-art fitness center and clubhouse. The Property’s convenient location at the intersection of Powers Boulevard and Woodmen Road, approximately five miles to the east of Interstate 25, puts residents close to a number of shopping centers, high-end and fast-casual restaurants and countless entertainment venues.

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.