MADISON REALTY SENIOR CARE ALTA RIDGE DST

1360 East 9400 South Sandy | 1375 East 9400 South Sandy | 1009 East Murray Holladay Road Salt Lake City, UT

TOTAL OFFERING PRICE: $14,600,000

Offering Size $8,500,000

- Target Master Lease Distribution: 6.27% to 7.02%

- Loans to Loaded Purchase Price: 41.8%

- Minimum Investment[1031]: $100,000

Investors have an opportunity to invest in three stabilized senior care properties with a return objective of both fixed income and value-add.1 The value-add component includes enhancements to the levels of care and ancillary services to capitalize on the fastest growing senior population—those living with Alzheimer’s disease and other forms of Dementia.

980-1100 Ken Pratt Blvd, Longmont, CO

Madison Realty Companies is a full service real estate investment management company that currently operates 22 senior housing properties, two of which are in Utah.

INVESTMENT HIGHLIGHTS

- Ownership Entity: Madison Realty Senior Care Alta Ridge DST (the “Parent Trust” or “DST”)

- Managing Broker-Dealer: Orchard Securities, LLC

- Offering Structure: DST (for 1031 exchanges)

- Offering Size: $8,500,000

- Anticipated Percentage of Equity Invested into the Real Estate: 87.4%

- Minimum 1031 Investment: 1.1764706% ($100,000 equity and $71,764 of estimated attributable debt)

- Minimum Cash Investment: $50,000

- Who May Invest: Accredited Investors as set forth in the Memorandum

- Real Estate Purchase Price: $12,210,000 (Appraised: $12,200,000 as of November 21, 2016)

- Combined Price Per Licensed Bed: $116,285 (before offering costs and reserves)

- Loaded Purchase Price (Including $869,512 of Reserves): $14,600,000

- Nonrecourse Loans: $6,100,000 (7-years; 25-year amortization; no interest-only period)

- Loans to Loaded Purchase Price: 41.8%

- Debt Service Coverage Ratio (Year 1): 2.68

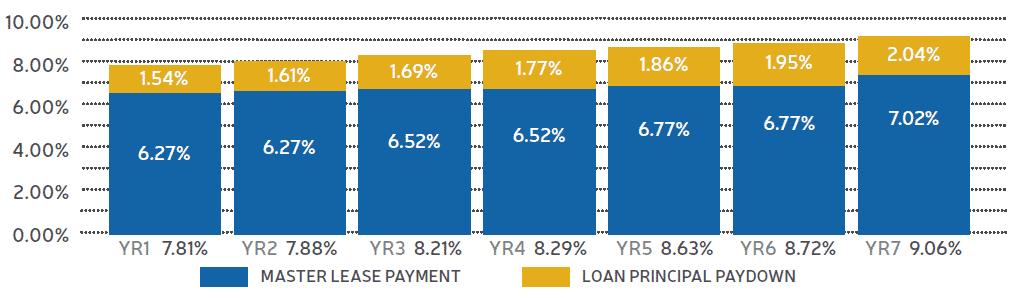

- Target Master Lease Distribution: 6.27% to 7.02% (Increases every two years during lease term)

- Target Yield Amount with Loan Amortization: 7.81% to 9.06%

- Estimated Hold Period: 4 to 7 years

- Investment Objectives: Preservation of Capital, Income, Loan Paydown, Value-Add

INVESTMENT OBJECTIVES

- Stability of Principal

- Increasing cash flow

- Growth Potential

LOAN AMORTIZATION AND PROJECTED RETURNS**

**Loan Amortization and Projected Returns Disclosure: Refer to section, “Acquisition and Financing,” subsection, “Loan Amortization and Projected Returns,” and section, “Plan of Distribution,” pages 76-81 of the Memorandum. The projected returns are based upon the Sponsor’s assumptions and estimates concerning future events and circumstances which may or may not occur. These projections are inherently subject to varying degrees of uncertainty, and achievability depends on the timing and probability of complex series of future events, both internal and external, to the enterprise. Therefore, the actual results achieved during the forecast period will vary from the projections and the variations may be material. No representations or warranties of any kind are made, intended, or should be inferred as to any of the projections herein. Accordingly, the projections may not and should not be relied upon to indicate actual results which may be obtained. Percentages in the chart above are rounded to the nearest 100th of a percent

PROPERTY HIGHLIGHTS

ASSISTED LIVING SANDY (The “Sandy AL Property”)

1360 East 9400 South Sandy, UT 84093

- Licensed Beds: 46

- Constructed: 1999

- Economic Occupancy: 96%

- Location: Salt Lake City MSA

MEMORY CARE SANDY (The “Sandy MC Property”)

1375 East 9400 South Sandy, UT 84093

- Licensed Beds: 31

- Constructed: 2001

- Economic Occupancy: 100%

- Location: Salt Lake City MSA

ASSISTED LIVING HOLLADAY (The “Holladay Property”)

1009 East Murray Holladay Road Salt Lake City, UT 84117

- Licensed Beds: 28

- Constructed: 1986

- Economic Occupancy: 80%

- Location: Salt Lake City MSA

ABOUT MADISON REALTY

Madison Realty Companies is a full service real estate investment management company that currently operates 22 senior housing properties, two of which

are in Utah. Collectively, its management team has over 150 years of real estate experience. For over 25 years, Madison and its affiliates have purchased,

managed, and disposed of over $1 billion in commercial real estate including: assisted living, senior apartments, and skilled nursing. All in all, the Sponsor’s

primary focus is acquiring cash flowing assets with value-add upside for clients.