Orlando Student Housing DST

11037 Retreat Avenue, Orlando, Florida 32817

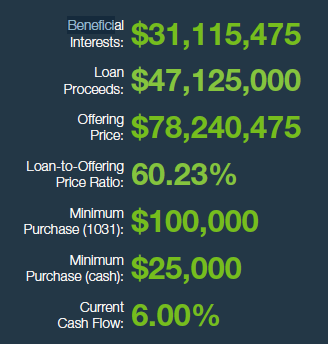

OFFERING PRICE: $78,240,475

BENEFICIAL INTERESTS: $31,115,475

- Loan Proceeds: $47,125,000

- Current Cash flow: 6%

- Loan-to-Offering Price Ratio: 60.23%

- Minimum Investment[1031]: $100,000

Orlando Student Housing DST, a newly formed Delaware statutory trust (the “Trust”) and an affiliate of Inland Private Capital Corporation (“IPCC”) is offering (the “Offering”) to sell to certain qualified, accredited investors (the “Investors”) pursuant to a Private Placement Memorandum (the “Memorandum”) 99.5% of the beneficial interests (the “Interests”) in the Trust.

Retreat at Orlando, Florida 32817

The Property is located approximately two miles southwest of the UCF campus and approximately 11 miles northeast of the Orlando central business district.

INVESTMENT HIGHLIGHTS

Orlando Student Housing DST, a newly formed Delaware statutory trust (the “Trust”) and an affiliate of Inland Private Capital Corporation (“IPCC”) is offering (the “Offering”) to sell to certain qualified, accredited investors (the “Investors”) pursuant to a Private Placement Memorandum (the “Memorandum”) 99.5% of the beneficial interests (the “Interests”) in the Trust.

Orlando Student Housing DST, a newly formed Delaware statutory trust (the “Trust”) and an affiliate of Inland Private Capital Corporation (“IPCC”) is offering (the “Offering”) to sell to certain qualified, accredited investors (the “Investors”) pursuant to a Private Placement Memorandum (the “Memorandum”) 99.5% of the beneficial interests (the “Interests”) in the Trust.

The Trust owns the real estate and improvements located at 11037 Retreat Avenue, Orlando, Florida 32817 and commonly known as the Retreat at Orlando (the “Property”). The Property consists of approximately 45.54 acres of land upon which are located an off-campus student cottage community serving the nearby University of Central Florida (“UCF”), consisting of 143 apartment buildings with 894 leasable bedrooms, one clubhouse building, one spin room building, one maintenance building and one pool facilities building.

THE FINANCING

The Trust funded a portion of the purchase price of the Property with cash, provided as a capital contribution from the depositor. The remaining portion of the purchase price was funded by a loan to the Trust in the original principal amount of $47,125,000 (the “Loan”) from PNC Bank, National Association, under the Federal National Mortgage Association Delegated Underwriting and Servicing loan program. The Loan bears interest at a fixed rate equal to 4.09% per annum, and has a maturity date of September 1, 2025.

Under the Loan Documents (as defined in the Memorandum), the initial payment will be due on October 1, 2015. During the period beginning on October 1, 2015, through and including the payment date on September 1, 2020, the Trust is required to make monthly, interest-only payments. Beginning on October 1, 2020 and on each payment date thereafter, the Trust is required to make monthly payments of principal and interest, with principal amortizing on a 30-year schedule.

LOCATION SUMMARY

The Property is located approximately two miles southwest of the UCF campus and approximately 11 miles northeast of the Orlando central business district.

The neighborhood consists primarily of public and governmental facilities, office parks, student-oriented apartments, single family residential homes and a growing inventory of commercial projects. The neighborhood is significantly influenced by the rapidly growing UCF and the adjacent office and research parks.

Some of the features of the Property’s community as well as the individual apartment units are highlighted below.

Community Highlights

Resort-Style, Multi-Tiered Swimming Pool with Cabanas and Hammocks

- Spa Suite and Sauna

- 24-Hour State-of-the-Art Fitness Center with Free Weights, Machines and Cardio Equipment

- Yoga/Pilates/Zumba Studio, Multiple Tanning Beds

- 11,000 Square Foot LEED-certified Clubhouse with Catering Kitchen, Internet Café and Computer Lab with Study Rooms

- Clubroom with Multiple Flat-Screen TVs, Comfortable Seating, Pool Tables and iPod Docking Stations, Golf Simulator

- Sand Volleyball Court, Horseshoe Pits and Tennis Court, Picnic Areas with BBQ Grills

- Shuttle Service to the UCF Campus

Apartment Highlights

- Spacious, Luxury Cottage-Style Apartments with Private Bedrooms and Bathrooms

- Furnished Units with Hardwood-Style Laminate Flooring in Common Areas

- Gourmet Kitchens with Stainless Steel Appliances, High-End Cabinets and Granite Countertops

- Modern Finishes and Wood Plantation Blinds in Bedrooms and Common Areas

- Spacious Closets, 9’ Ceilings

- Full-Size Washer and Dryer

- Front Porch or Back Patio with Private Access

- Security System, High-Speed Internet and Cable TV Included in Rent

Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estate related investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPCC offer securities to accredited investors on a private placement basis.