Chicagoland Supermarket Portfolio DST

Glenview,Illinois | Naperville, Illinois | Stickney, Illinois

Beneficial Interests: $11,676,256

Offering Price: $39,769,696

- Loan Proceeds : $28,093,440

- Loan-to-Offering Price Ratio : 70.64%

- Current Cash Flow: 4.00%

- Minimum Investment[1031]: $100,000

Chicagoland Supermarket Portfolio DST, also known as the Parent Trust, is a newly formed Delaware statutory trust and an affiliate of Inland Private Capital Corporation (IPC). The Parent Trust indirectly owns a portfolio of three supermarket chain stores operating as Jewel-Osco stores and located in Glenview, Illinois (the Glenview Property), Naperville, Illinois (the Naperville Property) and Stickney, Illinois (the Stickney Property).

The Glenview Property, the Naperville Property, and the Stickney Property

The portfolio consists of three, single-tenant grocery stores, each located in a suburb of Chicago. The Properties were constructed between 1994 and 2000, with renovations performed a decade or more later. The Properties are conveniently located in shopping centers that draw regular traffic from local area consumers and have the following attributes:

• High visibility

• Easy access with traffic signal

• Abundant parking

INVESTMENT HIGHLIGHTS

IPC believes an investment in the Parent Trust will offer the following benefits:

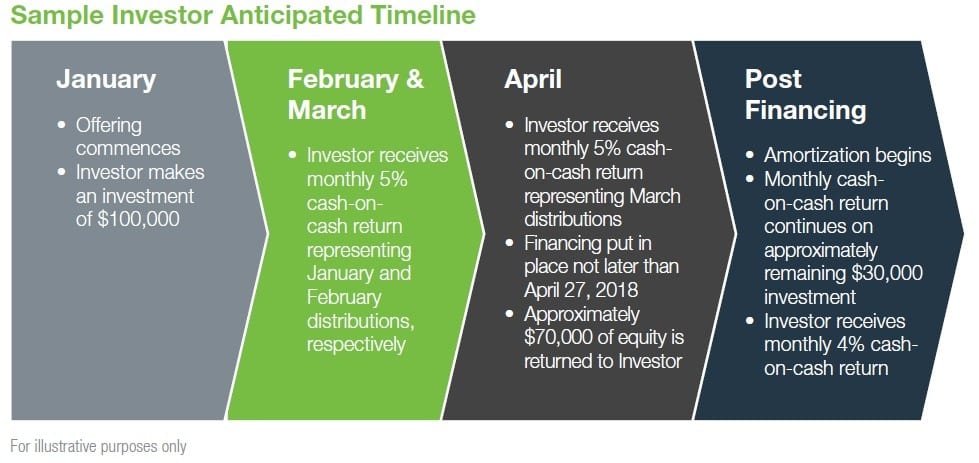

• 1031 cash-out DST offering with projected 70% expected return of initial equity investment not later than April 27, 2018

• After the Lender Election Date, approximately 30% of Investors’ equity will remain invested in the Parent Trust

• Albertsons Companies operates more than 2,300 grocery stores across the U.S.

• Albertsons is the 3rd largest supermarket chain nationwide

• Jewel-Osco is a recognized Midwest brand with strong customer loyalty, across 187 stores

• Low occupancy costs at all Properties

• Strong store sales at all Properties

• Average rent at the Properties is $11.23 per square foot, significantly lower than average rents in their respective markets

• Net leases with Tenant responsible for real estate taxes, insurance and other operating expenses

• Each Lease provides for an initial term of 20 years, ending in 2037, with eight 5-year renewal options

• Mortgage loans on the Properties expected to be put in place not later than April 27, 2018

• Non-recourse, long-term, fixed rate loans with variable rate adjustment, amortizing financing, with flexible prepayment

THE OFFERING

The Parent Trust is offering (the Offering) to sell to certain qualified, accredited investors 100 percent of the beneficial interests in the Parent Trust. The Offering is designed for accredited investors seeking to participate in a tax-deferred exchange as well as those seeking a quality, multiple owner real estate investment.s

1031 Cash-Out Investment Strategy

Through this investment program, IPC is offering investors a unique opportunity to benefit from a “cash-out structure” with approximately 70 percent expected return of equity to investors on a tax-deferred basis. Specifically, the Parent Trust will offer its beneficial interests (Interests) to accredited investors (Investors) on an all-cash basis, without any mortgage loans in place as of the commencement of the Offering (as defined herein). Long-term financing in the aggregate amount of $28,093,440 (the Loans) is expected to be put in place on each of the Properties, in the sole discretion of Parkway Bank & Trust Company (the Lender), on or about April 27, 2018 (the Lender Election Date), subject to certain risks and uncertainties described in the Memorandum. The proceeds of such debt will be distributed out to all then-current Investors in the Parent Trust as a return of equity. This distribution of loan proceeds is referred to herein as the cash-out transaction.

It is important to note, however, that the Lender will be under no obligation to fund the Loans, and if the Loans are not funded, the Parent Trust will not have the ability to provide to Investors the proceeds from a cash-out transaction.

Prior to the Lender Election Date, Investors are projected to receive a monthly cash-on-cash return equal to 5.0% of their equity. On and after the Lender Election Date, Investors are expected to continue to receive a monthly cash-on-cash return, at a reduced rate as described herein, for the duration of the investment period.

PROPERTY OVERVIEW

The portfolio consists of three, single-tenant grocery stores, each located in a suburb of Chicago. The Properties were constructed between 1994 and 2000, with renovations performed a decade or more later. The Properties are conveniently located in shopping centers that draw regular traffic from local area consumers and have the following attributes:

• High visibility

• Easy access with traffic signal

• Abundant parking

The Glenview Property

The Village of Glenview is about 15 miles northwest of the Chicago Central Business District (CBD). Glenview is an affluent and established suburb with a population of 45,969 and a low unemployment rate of 3.1 percent.15 The village is well-represented in the business community, and is home to several large corporations such as Astellas and Kraft Foods as well as nonprofit organizations, including Kohl Children’s Museum and The Leukemia & Lymphoma Society.16 Interstates 94 and 294 provide easy access to this area, which also features retail options, including The Glen, an upscale retail and housing development on the grounds of the former Naval Air Station, where the Glenview Property is located

The Naperville Property

Naperville offers small-town charm with the vibrancy of a modern economic powerhouse. Situated in western DuPage County, approximately 27 miles west of Chicago’s CBD, Naperville has grown to 145,000 residents and continually ranks as a top community in the nation to live, raise children and retire.18 Naperville school districts are ranked among the best in Illinois and its public library has been recently named a 5-Star Library by the Library Journal. In 2017, Naperville made Livability.com’s Top 100 Best Places to Live and came in number two on Niche.com’s Best Cities to Live In and Safest City in America rankings. The city is home to many prominent businesses including Nalco, Nicor, BP, Tellabs, Navistar and Exelon Nuclear. The unemployment rate was 4.1 percent as of October 201719 with job growth at 1.4 percent.

The Stickney Property

Stickney is located in Cook County, approximately 9.5 miles southwest of Chicago’s CBD. Ninety percent of the local area has been developed for commercial, office and light industrial use. Harlem Avenue and Pershing Road are main city arteries, with Interstate 55 just to the south. The Stickney Water Reclamation Plant is one of the largest sewage treatments plants in the world and serves roughly 2.3 million people in a 260 square mile area.Stickney’s job growth of 1.4 percent is expected over the next year, and 36.4 percent growth projected over the next 10 years.

ABOUT Inland Real Estate Group of Companies, Inc.

The Inland Real Estate Group of Companies, Inc. (Inland) is one of the nation’s largest commercial real estate and finance groups, representing nearly 50 years of expertise and integrity in the industry. As a business incubator, Inland specializes in creating, developing and supporting member companies that provide real estaterelated investment funds – including limited partnerships, institutional funds and nonlisted real estate investment trusts (REITs) – and real estate services for both third parties and Inland-member companies.

In March 2001, Inland Private Capital Corporation was formed to provide replacement properties for investors wishing to complete a tax-deferred exchange under Section 1031 of the Internal Revenue Code of 1986, as amended, as well as investors seeking a quality, multiple-owner real estate investment. The programs sponsored by IPC offer securities to accredited investors on a private placement basis.