Looking to expand your investment portfolio? For all the savvy investors considering a 1031 exchange, DSTs can be a great option to earn regular passive income and tackle most of your landlord responsibilities.

A 1031 exchange occurs when an investor sells their relinquished property and invests the 100% proceeds in a replacement property. However, it’s not that simple. You would have to keep in mind the severe timeline and rules associated with it. However, you can make this entire process easy by investing in a DST.

So, if you are considering investing in a DST 1031 exchange, here’s what you need to know.

What Is A DST?

A Delaware Statutory Trust (DST) allows investors to gain fractional ownership of institutional grade properties. The entire trust is actually operated and managed by a sponsor. But, you can pitch in with other investors and gain fractional ownership over it.

Moreover, because you’ll just own a certain part of it, you get to enjoy some major benefits like no or fewer maintenance responsibilities.

In fact, according to the amendments made by the IRS in 2004, DSTs qualify for like-kind exchanges as they are recognised as like-kind investment properties.

Understanding The Working Of A DST

Because DSTs are identified as like-kind investment properties, investing in DSTs is almost the same as conducting a 1031 exchange. However, you can just find DST properties everywhere. For that, you would need to get in touch with a securities broker-dealer. A broker-dealer is an entity that markets and sells DSTs to investors.

You can ask your Qualified Intermediary (QI) to find the right broker-dealer for you.

Moreover, another thing you must keep in mind is abiding by the 200% rule, as DST properties contribute to more than three properties. And, if you use the 200% rule, you might also trigger the 95% rule, which can make things a little confusing.

But, don’t worry. You can talk to our registered investment advisors for a better understanding.

A DST is usually set up by a sponsor who assigns trustees to manage the asset on a day-to-day basis. This includes rent collection, maintaining the asset and more. In fact, the trust collects the money from investors, and hires a maintenance company so that you can put your landlord responsibilities aside and enjoy passive income.

Different Types Of DST 1031 Exchange Properties

Here are different types of DST properties you can invest in-

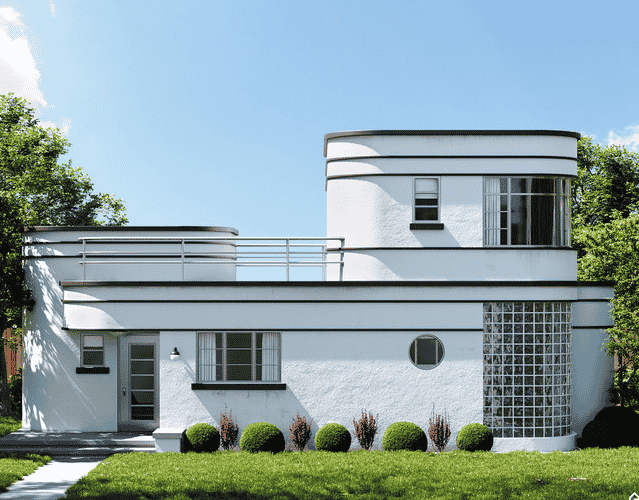

Residential Properties

Did you know that multifamily properties make up the major chunk of investment when doing a 1031 exchange? Investing in housing complexes and other residential apartments can help you generate a regular passive income without having to deal with rent collection, tenant finding and lease agreement formation. Although you get comparatively lower returns, investing in DST residential properties is considered a safe investment.

Retail

Contributing as the second widest choice for DSTs, retail properties include single-tenant and multi-tenant properties.

Self-Storgae Facilities

You can also invest in self-storage DSTs that come with assured returns but with a higher risk factor.

Industrial

Want to earn higher returns? Think about investing in industrial DSTs, and we bet you’ll never look back.

Office Spaces

Associated with a much higher risk but guaranteed higher returns, office spaces can be a great option to rev up your investment portfolio.

Benefits Of Investing In DSTs

In addition to teh assured returns, no-to-less landlord responsibilities and earning passive income, DSTs do come with a number of other benefits.

Here are some noteworthy benefits-

- You can defer the taxes on your capital gains by reinvesting your 100% of the proceeds in a DST.

- You can invest with as low as $100,000. This means that if you have generated boot in a 1031 exchange, you can invest that amount in a DST and defer taxes on that too.

- You can diversify your portfolio and become partial owners of institutional-grade properties.

- Investing in DSTs is actually quite easy and streamlined.

- DSTs are readily available.

However, the only downside of a DST is that you lose ‘control’ over teh property. Because the property is actually owned, operated and managed by sponsors and other trustees, you don’t actually get a say in management plans.

Wrapping Up- Are DSTs Right For You?

If you want to earn passively and stray away from all landlord responsibilities, we say invest in DSTs. They will diversify your portfolio, help you earn regularly and will be a no-hassle mode of investment. However, it’s imperative to identify the DST within a 45-day ID period and close on it within 135 days of identifying the property. In short, you must follow the usual 1031 exchange timeline.