Net-Leased Portfolio 10 DST

Consistently Delivering Diversified portfolios of long-term

TOTAL OFFERING PRICE: $45,700,000

Equity Offering Amount : $21,280,000

- Non-Recourse Debt: $24,420,000

- offering loan to value (ltv): 53.44%

- minimum purchase - 1031: $100,000

- minimum purchase - cash: $25,000

ExchangeRight Net Leased Portfolio 19 DST is a portfolio of 21 single-tenant, long-term net-leased retail assets that are 100% occupied and operated by Advance Auto Parts, CVS Pharmacy, Dollar General, Fresenius Medical Care, Hobby Lobby, NAPA Auto Parts, Verizon Wireless, and Walgreens.

Consistently Delivering Diversified portfolios of long-term

The portfolio is composed of high-quality tenants with strong credit and provides the investor with access to a diversified portfolio. First-year net operating income is diversified as follows: 29.6% Pharmaceutical (CVS, Walgreens)

highlights

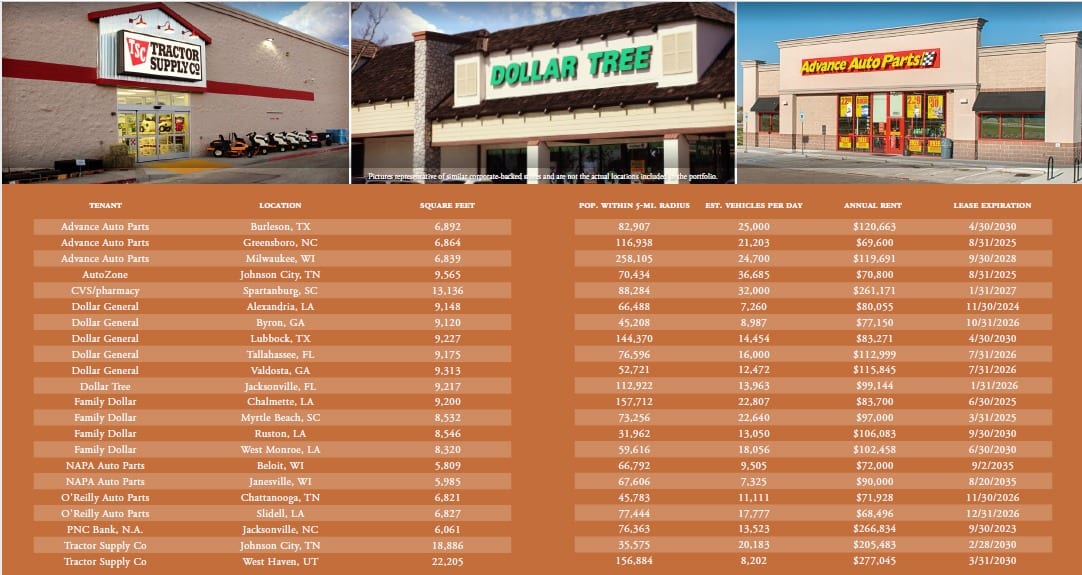

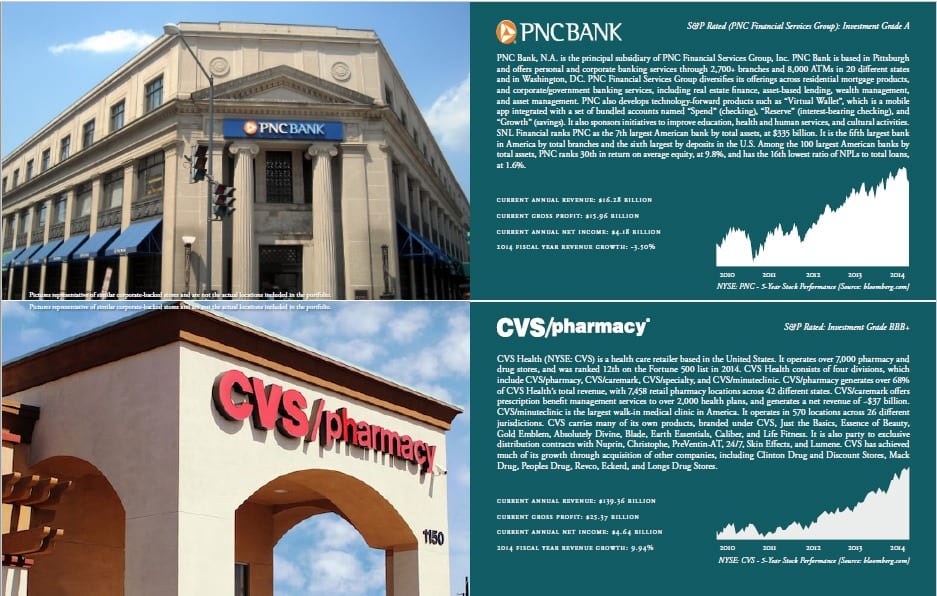

ExchangeRight Net-Leased Portfolio 10 DST is a portfolio of twenty two single-tenant, longterm net-leased retail assets that are 100% occupied by Advance Auto Parts, AutoZone, CVS/pharmacy, Dollar General, Dollar Tree, Family Dollar, NAPA Auto Parts, O’Reilly Auto Parts, PNC Bank, N.A., and Tractor Supply Co. Three of the properties are occupied by Advance Auto Parts and are located in Burleson, TX; Greensboro, NC; and Milwaukee, WI. One is occupied by AutoZone and is located in Johnson City, TN. One of the assets is occupied by CVS/pharmacy in Spartanburg, SC. Five are occupied by Dollar General and are located in Alexandria, LA; Byron, GA; Lubbock, TX; Tallahassee, FL; and Valdosta, GA. One is occupied by Dollar Tree in Jacksonville, FL. Four of the properties are occupied by Family Dollar and are located in Chalmette, LA; Myrtle Beach, SC; Ruston, LA; and West Monroe, LA. Two are occupied by NAPA Auto Parts and are located in Beloit, WI and Janesville, WI. Two of the properties are occupied by O’Reilly Auto Parts and are located in Chattanooga, TN and Slidell, LA. One of the assets is occupied by PNC Bank, N.A. in Jacksonville, NC. The final two properties are occupied by Tractor Supply Co and are located in Johnson City, TN and West Haven, UT. The Sponsor of the Offering is retaining at least a 1% ownership interest in the portfolio and is offering up to 99% of the beneficial interests in the DST to accredited investors.

The total offering amount is $45,700,000, of which $21,280,000 is equity and $24,420,000 is longterm fixed-rate financing. The Trust closed on the portfolio of properties on September 3rd, 2015, with 10-year interest-only non-recourse financing with an effective interest rate (APR) of 4.44% and a weighted-average lease term of 12 years and 5 months. The Offering’s projected cash f low as a percentage of equity for each year throughout the hold period is as follows: 7.03%, 7.04%, 7.06%, 7.09%, 7.13%, 7.27%, 7.32%, 7.32%, 7.37%, and 7.53%.

*$275,380.85 of initial tax, insurance, and reserves for operations and repairs have been funded at the time of loan closing. As a part of the total ongoing reserve number, we are reserving $6,000 in annual ongoing reserves over and above the lender required amounts on the investors’ behalf.

** Asset Management Fees include Annual DST Trustee Fee and Accounting.

***These are estimated costs for bank setup and ongoing fees, tax filing preparation and various entity filing costs associated with the portfolio.

Projected cash f lows and total yield are ultimately derived from, and dependent upon, the net lease payments guaranteed by AutoZone, CVS Corporation, Dollar General, and Family Dollar parent corporations. The Advance Auto Parts, Dollar Tree Stores, Inc., Motor Parts and Equipment Corporation, O’Reilly Automotive Stores, Inc., and Tractor Supply leases are entered into directly with the entities listed in the Private Placement Memorandum. ExchangeRight NLP10 Master Lessee, LLC is entirely dependent upon the ongoing contractual rent payments of the above-listed tenants to make master lease payments and meet its obligations under the Master Lease. Though it is not anticipated, any material default by any of these corporations would have a materially adverse impact on cash f low and on operations.

ABOUT Exchange Right

ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 and 1033 investors. Our goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. We target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

ExchangeRight launched its 1031-exchangeable DST multifamily platform in 2015 targeting Class B apartments with stable income and value-added upside potential. Our multifamily offerings feature strong cash flow, high debt coverage ratios, conservative underwriting, long-term fixed-rate financing, and the potential to enhance return with value-added strategies.

ExchangeRight also raises limited preferred equity capital that allows accredited investors to participate in the cash flow and profits of our 1031 platform. This preferred equity is used alongside ExchangeRight’s capital to invest in the acquisition and inventorying of individual net-leased assets prior to their being structured in DST portfolios for offering to exchange investors. These preferred equity funds can provide investors with enhanced liquidity and short-term returns, and exit options with each DST portfolio disposition.