BR Beach House, DST

1300 SHETTER AVENUE, JACKSONVILLE BEACH, FLORIDA 32250

Total Fully Syndicated Price: $51,576,436

Equity Amount: $21,344,436

- Loan Amount: $30,232,000

- Purchase Price per Unit: $220,825

- Projected Hold Period: Approx. 7-10 Years

- Assumed Debt (1.04360% interest): $315,500

Beach House (the “Property”) represents an opportunity to invest in a Class A apartment community in a major economic metro and near the largest city in North Florida. The investment opportunity seeks to provide current cash flow with upside from growth in market rents and professional property management capitalizing on the Property’s Class A location.

1300 SHETTER AVENUE, JACKSONVILLE BEACH, FLORIDA

The Property features high-quality construction and a modern living space in one, two or three bedroom apartment homes. Located on approximately 11.4 acres one mile from Jacksonville Beach Pier, residents enjoy proximity to the beach, restaurants and other amenities.

Key Investment Considerations

- Top Beach Location: The Property is located in an amenity-rich, shopping and recreation beach destination with nearby restaurants and within walking distance to the beach.

- Jacksonville Growth: The Jacksonville metro is adding jobs and attracting new businesses as many companies announced their expansions in the last three years including Deutsche Bank, Florida Blue, United Healthcare, and several others. Nearly 30,000 net new jobs have been created in the Jacksonville metro during the past two years.

- Little Competition/High Barriers to Entry: There is only one other true Class A apartment community in Jacksonville Beach, and a lack of available sites to construct such properties in the Jacksonville Beach area.

- A Value-Add Opportunity: The potential exists to increase rents closer to the other Class A Jacksonville Beach property where existing per square foot rental rates are approximately 30% above those of the Property.

- Strong Multifamily Market: Both the Jacksonville market and the Ocean Beaches submarket (the Property’s submarket) maintain above 93% apartment occupancies.

Property Summary

The Property features high-quality construction and a modern living space in one, two or three bedroom apartment homes. Located on approximately 11.4 acres one mile from Jacksonville Beach Pier, residents enjoy proximity to the beach, restaurants and other amenities.

- Courtyard and golf course views

- Attached garages on select units expenses;

- Fitness center and cardio room

- Controlled access entry

- Business center/wi-fi area

- Outdoor fireplace

- Barbecue grills

- Media/billiards room

- Resident lounge with bar area, and

- A central swimming pool

Regional Overview

The Property is located in Jacksonville Beach, Florida in the Jacksonville Metropolitan Statistical Area (“Jacksonville Metro”) in the northeast corner of Florida, near Beach Boulevard approximately one mile from Jacksonville Beach, and approximately 17 miles east of downtown Jacksonville. The Jacksonville Metro is comprised of approximately 1.6 million residents. The State of Florida recently passed New York as the third largest state in America with a population reaching nearly 20 million (U.S. Census Bureau). The Jacksonville Metro area’s population grew by 5.1% from 2010-2014 and is projected to grow by an additional 10% by 2020. (Southeast Realty Consultants Appraisal/Economy.com).

According to the Appraisal

the Jacksonville economy is pushing ahead thanks to strong service growth and the improving housing market. The unemployment rate has dropped to its lowest level since 2008, and the tighter labor market is leading to bigger paychecks. Average weekly wages have increased by 3.8% over the last year, which is substantially faster than the statewide and national rates. The housing market is on fire. According to the Florida Association of Realtors, single-family home sales swelled by 30% year over year in the third quarter, the speediest growth rate in the state. The median sale price surged by 31%, Florida’s second-fastest increase.

Local Overview

According to the Appraisal, the Property’s neighborhood is quite varied and diverse and consists of numerous residential, commercial, and retail uses. For the most part, the neighborhood represents a stable portion of Jacksonville. The neighborhood has an extensive level of commercial and retail development, including community and neighborhood shopping centers, office parks and residential communities as well as a location just west of the Atlantic Ocean. There is only one other multifamily project located within close proximity to the Property. Due to the lack of available land sites, future development of additional multifamily projects will be limited. The remaining projects are located west of the Intracoastal Waterway and not considered Jacksonville Beach locations.

Commercial developments near the Property include Beach Plaza and The Boulevard. There is a Publix supermarket and a Walgreens with close proximity to the Property as well. Approximately 15 minutes from the Property is the St. John’s Town Center, which is a 45 million square foot open air regional center featuring Nordstrom, Brooks Brothers, Tiffany’s, Dillard’s, Target, PetSmart and Dick’s Sporting Goods. Additionally, there are numerous restaurants and local retail establishments located nearby. Multifamily development is quite limited as there are minimal sites available for development.

WHY APARTMENTS?

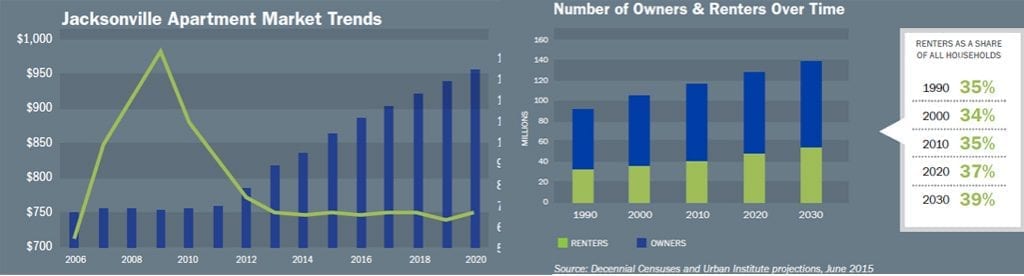

Nationwide, the apartment market has been a top performer driven by the growth of Echo Boomers (those born between 1980 and 2000) and aided by the lowest home ownership rate in 20 years.

The majority (59%) of the 22 million new households that will form between 2010 and 2030 will rent, while just 41% will buy their homes. This change will create a surge in rental demand from now until 2030.

Consistent with this national trend, the Jacksonville Metro apartment market is very robust with a low 6.7% vacancy rate. Rental rates have risen steadily since 2010 and the REIS Inc. forecasts sustained rent increases of 11% through 2020 driven by low vacancy rates.

About Bluerock Value Exchange, LLC

BVEX is a national sponsor of syndicated 1031 exchange offerings with a focus on Class A assets that can deliver stable cash flows and have the potential for value creation. BVEX is an affiliate of Bluerock Real Estate, L.L.C., a private equity real estate investment firm that sponsors a portfolio currently exceeding 25 million square feet of primarily apartment and office real estate, including approximately $1.1 billion in total property value and over 7.5 million square feet of property. Bluerock’s senior management team has an average of over 25 years investing experience, has been involved with acquiring over 35 million square feet of real estate worth approximately $10 billion, and has helped launch leading real estate private and public company platforms.