Central Park I & II

330 Garfield Street, Santa Fe, New Mexico 87501

Gross Sales Proceeds: $41,607,585

EQUITY: $380,718

- Net Sales Proceeds: $8,571,318

- MINIMUM UNIT PRICE: $899,718 (3% INTEREST)

- MORTGAGE: $519,000

- AVAILABLE FOR 1031 EXCHANGE

Central Park I & II includes two Class B office buildings totaling 237,537 square feet, on a 7 acre site in the north central portion of Oklahoma City, Oklahoma. Other improvements include two underground parking garages, ample surface parking, extensive landscaping and an on-site restaurant.

330 Garfield Street, Santa Fe, New Mexico

Oklahoma City is the largest city in Oklahoma and serves as the state capital and seat of Oklahoma County. The Oklahoma City MSA, encompasses a total area of about 4,250 square miles and six counties, and has an estimated 2006 population of approximately 1,142,506 people.

Property Description

Central Park I & II includes two Class B office buildings totaling 237,537 square feet, on a 7 acre site in the north central portion of Oklahoma City, Oklahoma. Other improvements include two underground parking garages, ample surface parking, extensive landscaping and an on-site restaurant. Each building has a sixstory atrium, an attractive lobby, card access security, central mailbox, and high-speed communication wiring. The Property is well maintained and well located with easy access to services and the greater Oklahoma City MSA. It is approximately 15 miles north of Oklahoma City’s central business district. The Property is easily accessible from major arteries in and around the city, and is part of an established and stable suburban neighborhood. As of December 1, 2007, the Property was approximately 96.83% leased to 15 tenants. Five major tenants (all of which rent more than 12,000 square feet of space) collectively occupy approximately 77.35% of the Property and include three energy companies, a student loan authority, and a software technology company.

Oklahoma City Highlights

Oklahoma City is the largest city in Oklahoma and serves as the

state capital and seat of Oklahoma County. The Oklahoma City

MSA, encompasses a total area of about 4,250 square miles and six

counties, and has an estimated 2006 population of approximately

1,142,506 people. Oil and gas have been major factors in the

growth of this energy resource rich region. The Oklahoma City

MSA serves as the financial center for the state, as well as the

center for health care and higher education. Located in the area are

numerous banks and savings and loan offices and eight major

hospital complexes. The Property’s neighborhood is a well-located

and established residential area with good accessibility to major

employment centers that provide stable employment for its

residents. The neighborhood exhibits strong demographics with

population growth, younger residents, and stable household income

levels. Utility infrastructure is in place and operative at less than

capacity and as such, the community appears well able to support

growth.

PROJECT SUMMARY

- Two, six-story Class B office buildings with approximately 237,537 square feet of rentable space, located on an approximately 7 acre site.

- Currently 96.83% occupied, with 15 tenants, including a public oil & gas company, and energy, financial, insurance and technology firms.

- Located in the desirable North submarket, with easy access to services and the greater Oklahoma MSA

- Priced at a discount to replacement cost

- Offeror and affiliates to acquire any unsold interests for greater assurance of a timely closing

Market Overview

The Okalahoma City regional economy is growing, with new jobs and new development projected during the next ten years. The region is experiencing economic diversification, population growth, and relatively low unemployment rates. Metro area population growth is expected to proceed at an average rate of about 1% per year, and general employment growth is also expected to be moderate during the next few years. Efforts by local government, business and civic leaders have been successful at diversifying the economic base to avoid reliance on the energy sector. Recent price increases in oil and gas futures have strongly impacted the area, increasing demand within the local office market. The Property is located in the north central portion of Oklahoma City in the North submarket. This submarket is experiencing decreasing vacancy rates and increasing demand with overall submarket vacancy rates averaging 5.6% in Q3 2007. Class A vacancy rates were at 1.6% with average rents of $18.23- $20.50. Class B vacancy averaged 3.9% – 7.3% with average rent of $15.04. Vacancy rates are projected to decline as local energy companies continue to acquire space and buildings. As of Q3 2007, there was no new construction in the North submarket. With asking rates for Class A properties at a 36% premium over Class B buildings, it is projected that there will be upward pressure on rental rates in Class B space, and that the levels of tenant improvement and other leasing incentives will trend downward. Demand for Class B real estate, such as the Property, is projected to increase steadily in the short term as well as over the long term.

Offeror, Property Manager & BGK Group

Under a Confidential Private Placement Memorandum and Addendum thereto dated December 20, 2007 (the “Memorandum”), BIG Central Park I & II, LLC and BIG Central Park I & II Investors, LLC are offering investors tenancy-in-common interests in the Property, and limited liability company units in an entity that will own a tenantin- common interest in the Property. The offerors and the property management company are owned by BGK-Integrated Group, LLC. Since November 2006, BIG’s wholly-owned subsidiaries have conducted 10 offerings of tenancy in common and/or limited liability company interests involving over 1,348,791 square feet of office and light industrial properties in Alabama, New Mexico, Texas, Louisiana, Ohio, Kansas, Florida, and West Virginia for an aggregate price (including investor equity and assumed debt) in excess of $203,902,975. Formed in 1991, BGK has acquired more than 300 properties nationwide, sponsored real estate projects involving over $800,000,000 of equity from more than 2,500 investors, and obtained over $2,500,000,000 in mortgage loans. BGK presently manages almost 18,000,000 square feet of space.

The property is presently owned by a real estate limited partnership controlled by affiliates of BGK. The TIC offeror will acquire at least a 2% interest in the property, and the current owner or its affiliates will retain unsold TIC interests, which better assures investors of a timely closing. The property owner has obtained an assumable $17,300,000 mortgage loan at a 6.025% interest rate. Financial projections for the property are based on historic income and expense statements, and familiarity with leases, tenants and the local market. The property will continue to be operated by an experienced management team to provide a smooth transition in management with no “down time,” or disruption of leasing/tenant relations. The TIC offeror has also arranged a $300,000 credit facility for certain future leasing costs, if needed.

Investment Objectives/Strategy

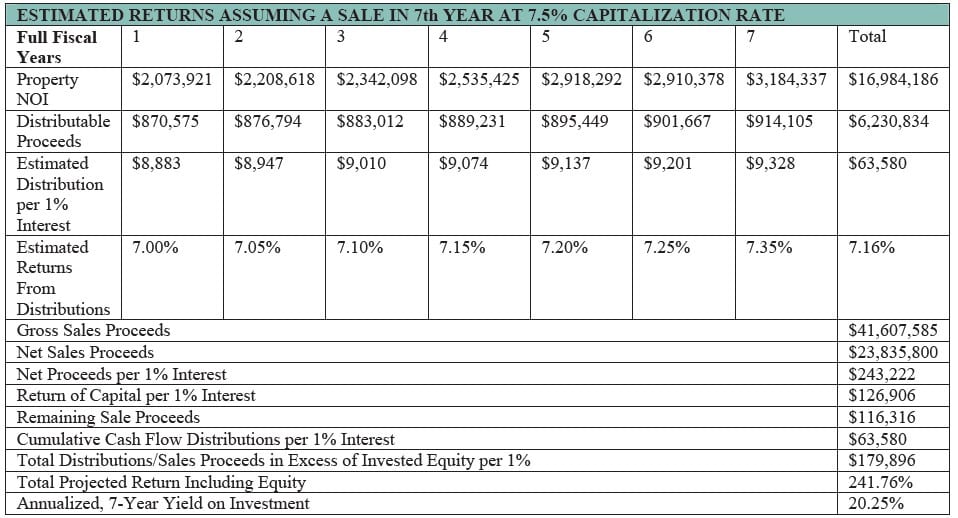

Our objective is to continue the property’s high occupancy rates and cash flow levels, while seeking rental rate/value appreciation based on projected tightening in the office market, with higher rents and lower leasing costs. Priced below replacement cost, and given its superior location and condition with regards to competing properties, the Property appears well positioned to maintain its competitive edge. Management will seek to renew key tenant leases at market rents to improve future cash flow, while seeking new tenants if and when space becomes available. A property sale is projected in 7 to 10 years. The following table reflects a projected sale in the 7th year. All financial information therein is based on the assumptions set out in the Memorandum and included forward looking statements. There is no guaranty or certainty that the projected results will be achieved.

ABOUT BGK-INTEGRATED GROUP

Direct All Inquiries to:

K-One Investment Company, Inc. – Managing Broker-Dealer

1-866-668-2997

1900 North Loop West – Suite 101, Houston, TX 77018