Crystal Lake Florida Apartments, DST

Value-Add Class B Multifamily Portfolio in Pensacola Available for 1031 Exchange

TOTAL OFFERING PRICE: $23,430,000

Equity Offering Amount : $10,895,000

- Non-Recourse Debt: $12,535,000

- offering loan to value (ltv): 53.50%

- minimum purchase – 1031: $100,000

- minimum purchase – cash: $25,000

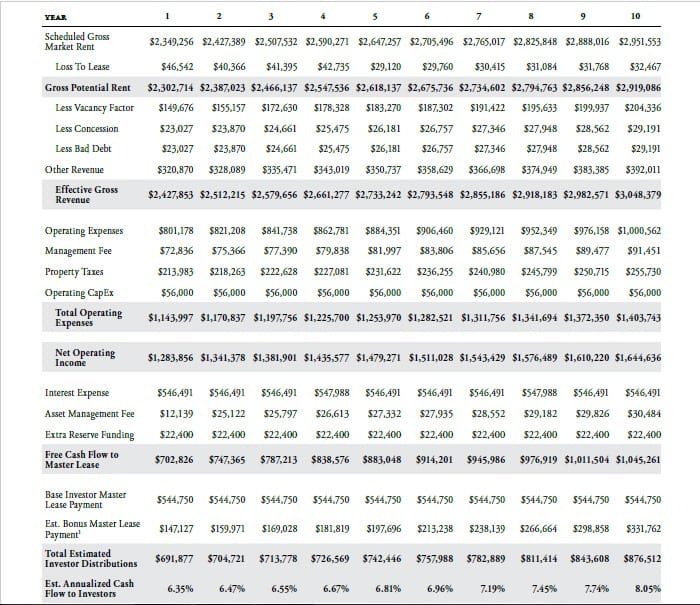

Crystal Lake Florida Apartments, DST is a 224-unit Class B Multifamily property that is projected to provide year-1 investor cash flow of 6.35% and the potential to add value through capital improvements and full unit upgrades on approximately half of the units.

Value-Add Class B Multifamily Portfolio

ExchangeRight and its affiliates are currently managing over $700 million of assets including 22 apartment communities consisting of over 4,000 units in Alabama, Louisiana, North Carolina, South Carolina, Texas, Georgia, and Florida and 216 single-tenant retail properties located across 27 states.

Underwriting Highlights

- Initial cash flow projected to be 6.35%, growing to 8.0%+ over a 10-year period and averaging 7.0% over the hold period.

- Hold-period physical occupancy underwritten at approximately 93.1% though the property is currently 99.5% and the market occupancy for Class B is 96.0%.

- Year 1 Net Operating Income (NOI) conservatively underwritten to have no growth in year 1 of operations when compared to historical financials.

- Offering Loan to Value anticipated to be 53.5% with a Debt Service Coverage Ratio average of 2.71x per annum over a 10-year hold.

- $1.5 million of accountable reserves are being funded by the lender and investors to execute the property upgrades and to provide an operating reserve cushion, with over $1.0 million in excess reserves above identified replacements projected over the next 10 years:

- $542,000 for unit interior renovations

- $235,000 for capital improvement upgrades and amenities

- $700,000 for upfront replacement and operations reserves and contingency

- $72,558 for net tax and insurance reserves

- The DST will also reserve $250 per unit per year for replacement reserves with the lender and an additional $100 per unit per year in excess of lender’s requirements for the benefit of the investors.

Bonus Master Lease Payments are estimated payments that would be paid to investors if the property produces revenues in excess of annual effective gross revenue benchmarks. There is no guarantee that the property will produce the necessary effective gross revenue to earn bonus rent payments.

Investing in real estate in general, including this offering, involves risk. Please review the Private Placement Memorandum in its entirety, including especially the section that outlines the risks of this offering, before making any investment decision.

property Details

Community Amenities

- Dog Park/Dog Run

- Emergency Maintenance

- Extra Storage

- Grilling/Picnic Area(s)

- Laundry Facility

- Nature Trail

- Pet Friendly

- Community Playground

- Resident Car Wash

- Sand Volleyball Court

- Stocked Lake

- Swimming Pool

Property Summary

- Year Built 1997

- Year Renovated 2015

- No. of Units 224 units

- Net Rentable Area 219,680 sq ft

- Avg. SqFt/Unit 981 sq ft

- Occupancy/Leased 99.5% (as of 1/20/17)

- Land Area 24.09 acres

ABOUT Crystal Lake Florida Apartments

Growing Investor Returns

Projected initial cash flow of 6.35% to investors with an expectation to grow to over 8.0% by year 10.

Property Value-Add Potential

We anticipate investing $230,000 in upgrading the property common area and amenities. There is also potential to fully renovate approximately half of the property’s units over a 4-year period, and we anticipate generating $70 in additional monthly rent per unit on full renovations.

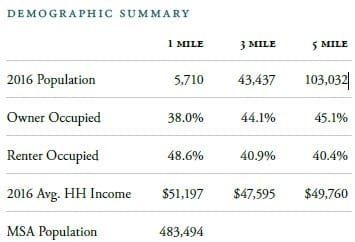

Stable and Growing Market

Rents have grown over 13% over the last 5 years in Pensacola, and occupancy has averaged 96% for Class A and B assets.2 Pensacola is forecasted to have a 12% population increase by 2020.

Conservative Underwriting Assumptions

Year 1 revenue has been conservatively underwritten, with revenues projected to be equal to trailing performances despite anticipated value creation through renovations and management improvements.

Excess Upfront and Ongoing Reserves

The DST has been capitalized with nearly $1.5 million of upfront reserves to complete renovations, perform common area improvements, and provide extra cushion for maintenance items and ongoing replacement reserves. We forecast that we will have set aside over $1.0 million more in replacement reserves than is required by third-party reports over a 10-year period.

ABOUT Exchange Right

ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 and 1033 investors. Our goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. We target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

ExchangeRight launched its 1031-exchangeable DST multifamily platform in 2015 targeting Class B apartments with stable income and value-added upside potential. Our multifamily offerings feature strong cash flow, high debt coverage ratios, conservative underwriting, long-term fixed-rate financing, and the potential to enhance return with value-added strategies.

ExchangeRight also raises limited preferred equity capital that allows accredited investors to participate in the cash flow and profits of our 1031 platform. This preferred equity is used alongside ExchangeRight’s capital to invest in the acquisition and inventorying of individual net-leased assets prior to their being structured in DST portfolios for offering to exchange investors. These preferred equity funds can provide investors with enhanced liquidity and short-term returns, and exit options with each DST portfolio disposition.