CSRA NY MOB, DST

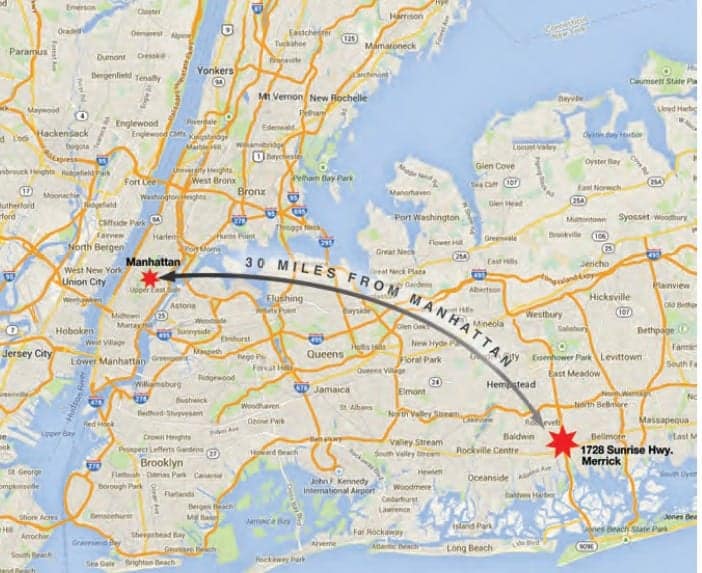

Location: 1728 Sunrise Highway, Merrick, NY 11566

OFFERING PRICE: $8,020,000

EQUITY RAISE: $3,120,000

- CASH ON CASH RETURN YR 1: 6.25%

- LOADED LTV: 61.10%

- SENIOR LOAN: $4,900,000

- INTEREST RATE: 4.87%

Nassau County is home to four of the most affluent neighborhoods in America, and is ranked as the 12th wealthiest county in the nation, according to the U.S. Census Bureau’s 2012 American Community Survey.

Sunrise Highway, Merrick, NY

The medical office building is located in Southern Nassau County, featuring a growing population of 1.3 million regionally and 416,816 in a five-mile radius.

INVESTMENT HIGHLIGHTS

- $3.2 Million Capital Investment: The property was completely renovated for the tenant in 2009 with a new roof, building mechanical systems, walls, bathrooms, floors and parking lot.

- Stabilized Long-Term Cash Flow: The building is 100 percent leased to Orlin & Cohen Orthopedic Group through 2029, with a 5-year option and 3% yearly increases.

- Central Location to Area Hospitals: The property is strategically located near nine area hospitals, including South Nassau Communities Hospital, a 435-bed facility, Mercy Medical Center, a 375-bed facility, and Winthrop University Hospital, a 591-bed facility.

- Demographics: The New York Metropolitan Statistical Area, encompassing New York City, Long Island, Northern New Jersey, Westchester County and Southern Connecticut, is the economic engine of the Northeast. Long Island has a high population density and strong demographics. Orlin & Cohen is well positioned to support the residents’ medical needs.

- Established Tenancy: Orlin & Cohen Orthopedic Group leases 100% of the property. They are New York State’s largest private orthopedic practice.

PROPERTY DETAILS

- LEASE: 15-year lease, with one 5-year renewal option

- STRUCTURE: Absolute net lease – expires in 2029

- RENT BUMPS: 3% annual rent increases

ORLIN & COHEN ORTHOPEDIC GROUP

Orlin & Cohen Orthopedic Group is the largest private orthopedic practice in New York State. The practice operates orthopedic, pain management, diagnostic physical therapy and occupational therapy in seven facilities throughout Long Island. The Group’s physicians are subspecialists in sports medicine, knee, foot and ankle, shoulder, joint replacement, spine and hand practices.

The team of orthopedic specialists features board-certified, fellowship-trained physicians from some of America’s most prestigious medical programs, including Cornell, Johns Hopkins and Columbia Presbyterian. The physicians also hold leadership positions with South Nassau Communities Hospital, South Shore Ambulatory Surgery Center and North Shore-LIJ Health System.

MARKET OVERVIEW

The medical office building is located in Southern Nassau County, featuring a growing population of 1.3 million regionally and 416,816 in a five-mile radius.

Situated within the New York Metropolitan Statistical Area, the area has a strong medical and corporate business environment, recreational venues, educational institutions and surrounding middle- and high-income residential neighborhoods.

ABOUT CAPITAL SQUARE

Capital Square 1031, LLC specializes in the creation and management of real estate investment programs for Section 1031 exchange investors and other investors using the Delaware Statutory Trust structure. Louis J. Rogers, founder and chief executive offi cer of Capital Square, has been involved in the creation and management of more than 100 investment offerings totaling over $3 billion, including DSTs, tenant-in-common offerings, numerous real estate funds, and multiple publicly registered non-traded real estate investment trusts.