Net-Leased Portfolio 14 DST

Consistently Delivering Diversified portfolios of long-term

TOTAL OFFERING PRICE: $55,230,000

Equity Offering Amount : $27,120,000

- Non-Recourse Debt: $28,110,000

- offering loan to value (ltv): 50.90%

- minimum purchase: $100,000

- year 1 investor cash flow: 6.57%

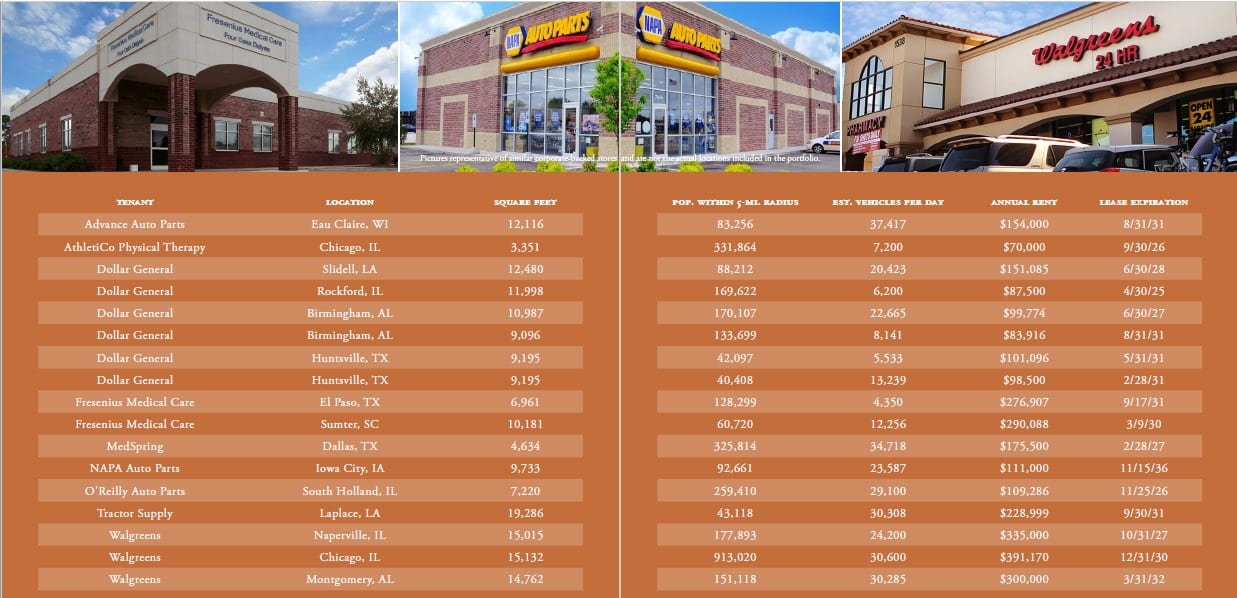

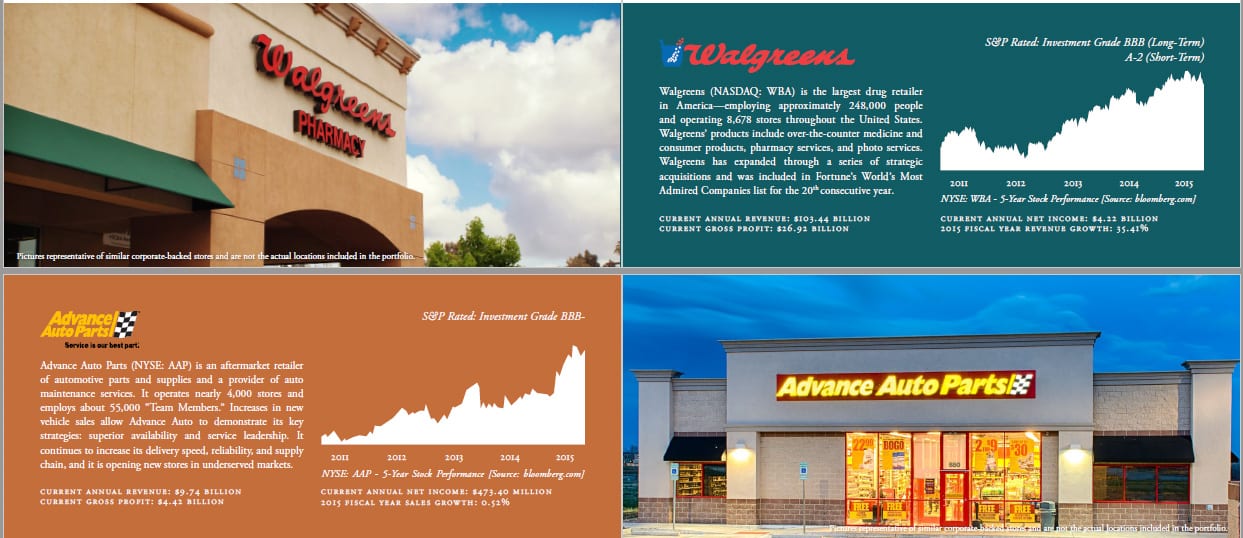

ExchangeRight Net-Leased Portfolio 14 DST is a portfolio of 17 single-tenant, long-term net-leased retail assets that are 100% occupied and operated by Advance Auto Parts, AthletiCo Physical Therapy, Dollar General, Fresenius Medical Care, MedSpring, NAPA Auto Parts, O’Reilly Auto Parts, Tractor Supply, and Walgreens.

Consistently Delivering Diversified portfolios of long-term

The portfolio is composed of high-quality tenants with strong credit and provides the investor with access to a diversified portfolio. First year net operating income is diversified as follows: 34% pharmaceutical (Walgreens)

highlights

ExchangeRight Net-Leased Portfolio 14 DST is a portfolio of 17 single-tenant, long-term net-leased retail assets that are 100% occupied and operated by Advance Auto Parts, AthletiCo Physical Therapy, Dollar General, Fresenius Medical Care, MedSpring, NAPA Auto Parts, O’Reilly Auto Parts, Tractor Supply, and Walgreens.

The portfolio is composed of high-quality tenants with strong credit and provides the investor with access to a diversified portfolio. First year net operating income is diversified as follows:

- 34% pharmaceutical (Walgreens)

- 12% discount automotive (Advance Auto, NAPA Auto, and O’Reilly Auto Parts)

- 27% necessity health care (Fresenius Medical Care, MedSpring, and AthletiCo Physical Therapy)

- 20% discount necessity retail (Dollar General)

- 7% other (Tractor Supply)

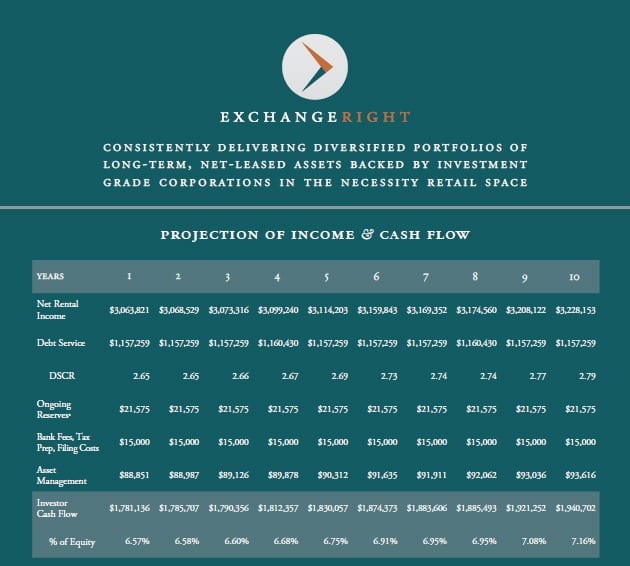

Annual Income Forecast

The Offering’s projected cash flow as a percentage of equity for each year throughout the hold period is as follows: 6.57%, 6.58%, 6.60%, 6.68%, 6.75%, 6.91%, 6.95%, 6.95%, 7.08%, and 7.16%.

Exit Strategy

We designed our exit strategy with the goal of providing investors stable cash flow and value-added returns. We believe this is best achieved by aggregating our net-leased portfolios together to be sold, acquired, or listed in the public markets. Combining portfolios helps mitigate lease and debt rollover risk through scale and diversification. Bringing the larger, aggregated portfolio to the public markets aims to capitalize on the premium typically paid for liquidity, diversification, and convenience. This strategy is anticipated to provide investors with the opportunity to sell and perform another 1031 exchange or exchange their DST interests for ownership in a REIT under IRC section 721 in a REIT sale, merger, IPO, or public listing.

$488,934 of initial tax and insurance reserves and reserves for operations and repairs were funded at the loan closing. The DST is additionally reserving $9,000 per year in years one through five and $21,575 per year in years six through ten in addition to the lender requirement to provide additional operational reserves for the benefit of the trust, which is reflected in the ongoing reserve figures presented above.

The Dollar General, Fresenius Medical Care, and MedSpring leases are guaranteed by the full faith and credit of the respective Tenants’ parent corporations (Dollar General Corporation and Fresenius Medical Care, Inc., respectively). The Advance Auto Parts, AthletiCo Physical Therapy, Motor Parts and Equipment Corporation (“NAPA”), O’Reilly Auto Parts, Tractor Supply, and Walgreens leases are entered into directly with, or with nexus to, the respective parent corporations. ExchangeRight NLP14 Master Lessee, LLC is entirely dependent upon the ongoing contractual rent payments of the above-listed tenants to make Master Lease payments and meet its obligations under the Master Lease. Though it is not anticipated, if any of these corporations materially defaulted, it would have a materially adverse impact on cash f low and operations.

ABOUT Exchange Right

ExchangeRight is committed to providing long-term, stable income and asset preservation to accredited 1031 and 1033 investors. Our goal is to consistently deliver 1031-exchangeable DST portfolios of long-term, net-leased properties backed by investment grade corporations. We target corporate tenants that successfully operate in the necessity retail space to provide investors with stable and predictable income. ExchangeRight’s long-term exit strategy is to provide greater diversification and value to investors by combining multiple portfolios of investment grade, net-leased assets in a portfolio sale or 721 exchange roll-up.

ExchangeRight launched its 1031-exchangeable DST multifamily platform in 2015 targeting Class B apartments with stable income and value-added upside potential. Our multifamily offerings feature strong cash flow, high debt coverage ratios, conservative underwriting, long-term fixed-rate financing, and the potential to enhance return with value-added strategies.

ExchangeRight also raises limited preferred equity capital that allows accredited investors to participate in the cash flow and profits of our 1031 platform. This preferred equity is used alongside ExchangeRight’s capital to invest in the acquisition and inventorying of individual net-leased assets prior to their being structured in DST portfolios for offering to exchange investors. These preferred equity funds can provide investors with enhanced liquidity and short-term returns, and exit options with each DST portfolio disposition.